- XRP briefly reclaimed $1.64 before facing renewed selling pressure

- South Korean volume spiked as Bitcoin touched $70K

- Key resistance and macro sentiment now shape the next move

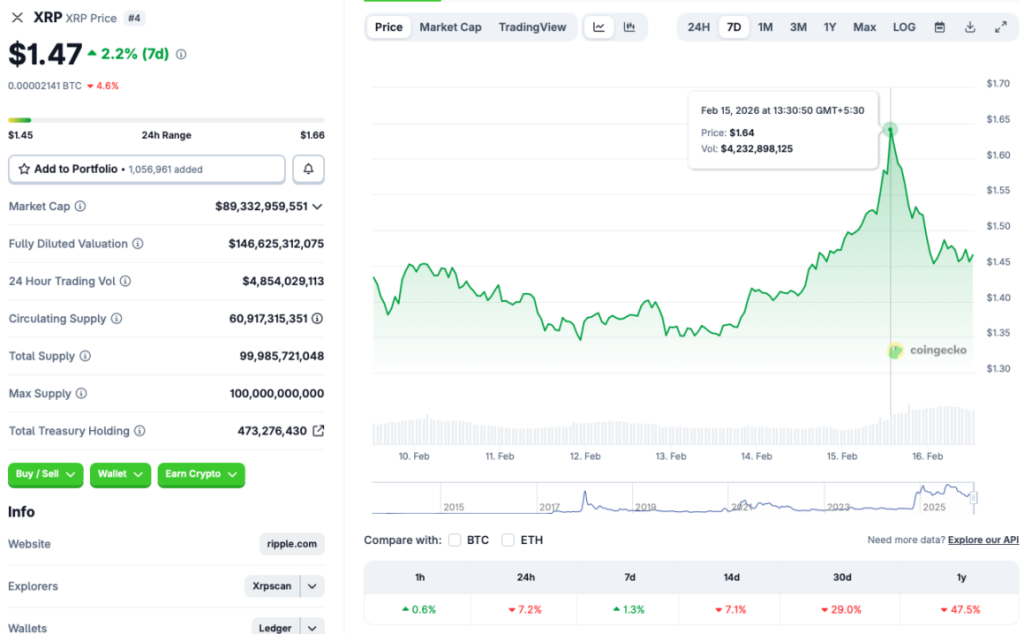

Ripple’s XRP managed to reclaim the $1.64 level during the weekend rally, riding the same momentum that pushed Bitcoin to $70,000. That bounce felt constructive at first. But as BTC slipped back toward $68,000, XRP followed almost immediately.

According to CoinGecko data, XRP is now down 7.2% in the last 24 hours, 7.1% over two weeks, and nearly 29% in the past month. The weekly chart still shows a modest 1.3% gain, which suggests buyers haven’t fully stepped away. Still, the rejection near $1.65 shows that conviction remains fragile.

$1.65 Is the Line That Matters

Technically, $1.65 is acting as a clear resistance ceiling. XRP has attempted to push through but hasn’t managed to hold above it. On the downside, the $1.40 zone appears to be the immediate support area where buyers are stepping in.

If XRP breaks cleanly above $1.65 with sustained volume, the path toward $1.90 opens up quickly. But failure to hold $1.40 could invite another leg down, especially if Bitcoin weakens further. For now, the asset is boxed between those levels.

South Korea’s Volume Spike

One notable catalyst behind the weekend rally was a surge in South Korean trading activity. Upbit and Bithumb reportedly processed around $1.20 billion in XRP volume within 24 hours. That kind of regional participation often adds short-term momentum.

However, volume-driven rallies can fade just as fast if broader sentiment cools. Without sustained global inflows, regional spikes tend to create volatility rather than long-term trend shifts.

ETFs and Institutional Angle

The post-SEC settlement environment has clearly strengthened XRP’s institutional narrative. Spot XRP ETFs launched in late 2025, and firms like Goldman Sachs reportedly hold significant exposure, including around $152 million in XRP-linked ETF positions.

That institutional presence adds structural credibility. Still, ETF inflows tend to accelerate in bullish conditions and slow during risk-off phases. Macro sentiment and broader crypto flows will likely determine how quickly capital returns.

Conclusion

XRP’s ability to reclaim $1.65 will define the short-term outlook. A breakout could unlock momentum toward $1.90, while failure to hold support near $1.40 increases downside risk. The broader crypto market, particularly Bitcoin’s stability, remains the dominant influence. For now, XRP is waiting on macro clarity as much as technical confirmation.