- Bieber’s BAYC #3001 fell from 500 ETH to roughly $12,000 in value

- NFT floor prices remain far below 2022 speculative highs

- The sector has shifted from hype-driven art to utility-focused crypto use cases

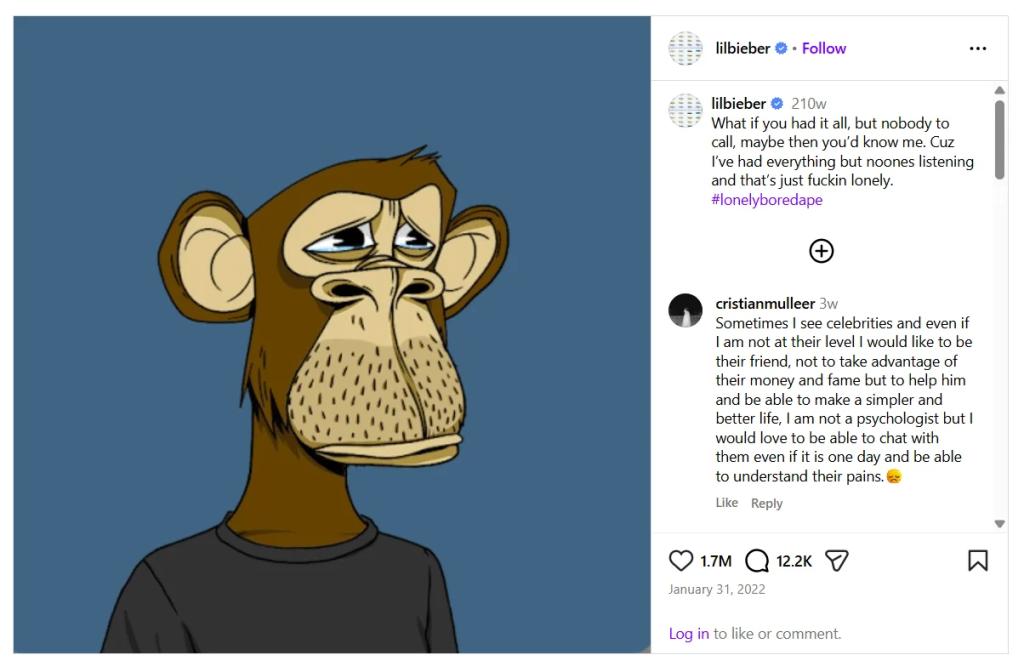

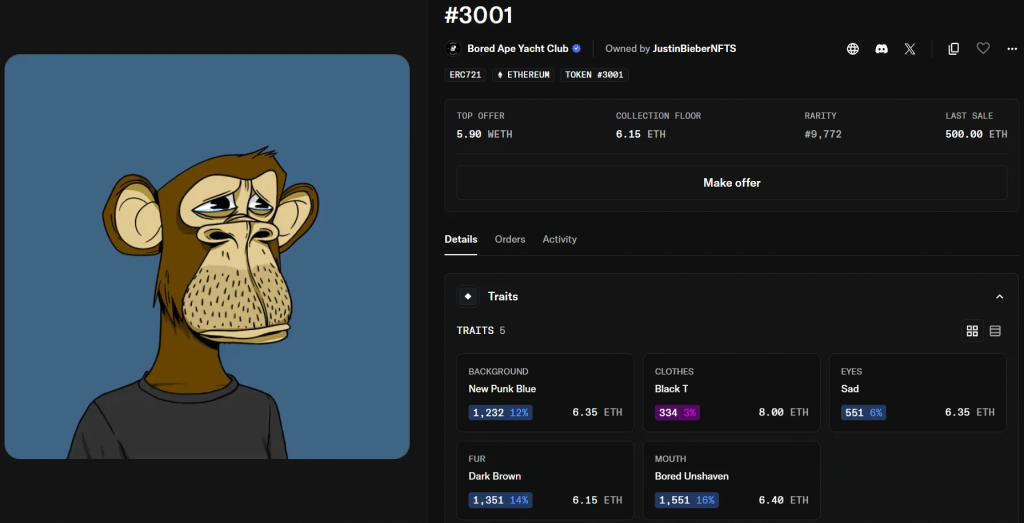

Justin Bieber’s Bored Ape #3001 has become one of the most visible examples of the NFT cycle’s extreme boom-and-bust pattern. Purchased in early 2022 for 500 ETH — then worth roughly $1.3 million — the asset is now valued near $12,000. With the highest bid around 5.9 ETH and the BAYC floor hovering near 6.15 ETH, the collapse reflects a near-total wipeout in dollar terms.

At the time of purchase, analysts noted Bieber paid well above comparable listings, which were trading between $200,000 and $300,000. The acquisition came at peak enthusiasm, when celebrity participation and social media status signaling were driving valuations higher almost daily.

The BAYC Peak and the Collapse

Bored Ape Yacht Club launched in April 2021 with a mint price of just 0.08 ETH and sold out within hours. By May 2022, floor prices surged to between 128 and 145 ETH, translating to roughly $350,000 to $420,000 depending on Ethereum’s price.

When broader crypto markets reversed, NFT liquidity evaporated quickly. Trading volumes fell sharply, and floor prices retraced in tandem with Ethereum’s decline and fading speculative appetite. Bieber also holds ape #3850, purchased for roughly $470,000, which has seen a similar drawdown.

The losses are not isolated. Many collectors who entered during the 2022 rally are facing steep ETH-denominated and even steeper dollar-denominated declines.

What This Says About NFT Crypto Cycles

The wipeout underscores how tightly NFTs were tied to crypto liquidity cycles. As Ethereum soared and capital flooded into digital assets, profile-picture NFTs became status assets. When liquidity tightened, they became illiquid risk exposures.

Still, NFTs did not disappear. The speculative art frenzy cooled, but development shifted toward more functional applications. Projects are now emphasizing in-game assets, digital identity, tokenized real-world items, and gated-access systems rather than pure collectible hype.

Ethereum’s Role and the Road Ahead

Ethereum remains the dominant chain for high-value NFTs despite price compression. Meanwhile, Solana and Polygon have gained traction by offering lower fees and faster settlement, making them attractive for gaming and utility-driven use cases.

Bieber’s Bored Ape is less about one celebrity’s loss and more about how fast crypto narratives can inflate and deflate. NFTs were once positioned as cultural blue chips. Today, they’re being rebuilt as infrastructure tools. Whether that second phase proves durable will determine if this was a permanent collapse or simply an early cycle reset.