- XRP fell below $2 amid a broader crypto market correction.

- Heavy liquidations and geopolitical tensions fueled risk-off behavior.

- Short-term pressure remains, but longer-term expectations are still intact.

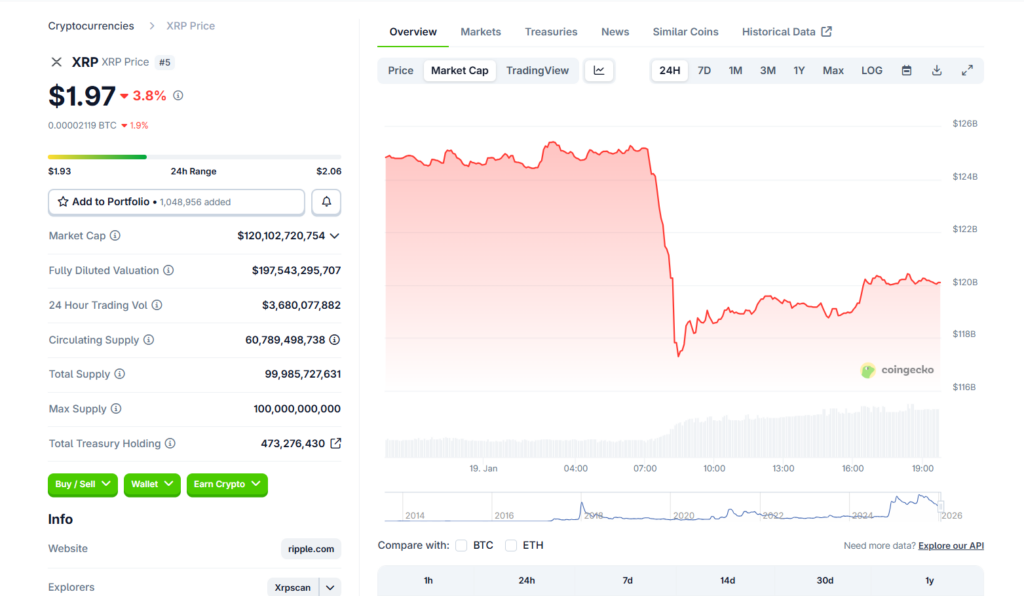

XRP saw a sharp pullback today, sliding from around $2.06 to $1.97 and wiping out recent gains. According to CoinGecko, the token is down 4.1% over the last 24 hours, 6.2% on the week, and more than 8% across the past two weeks. Zooming out further, XRP remains nearly 40% below its January 2025 levels, though it has still managed to hold a modest 3.8% gain on the monthly chart. The move has reignited debate over whether XRP’s recent bounce was a genuine recovery or simply a dead cat bounce.

A Market-Wide Reset Is Driving the Move

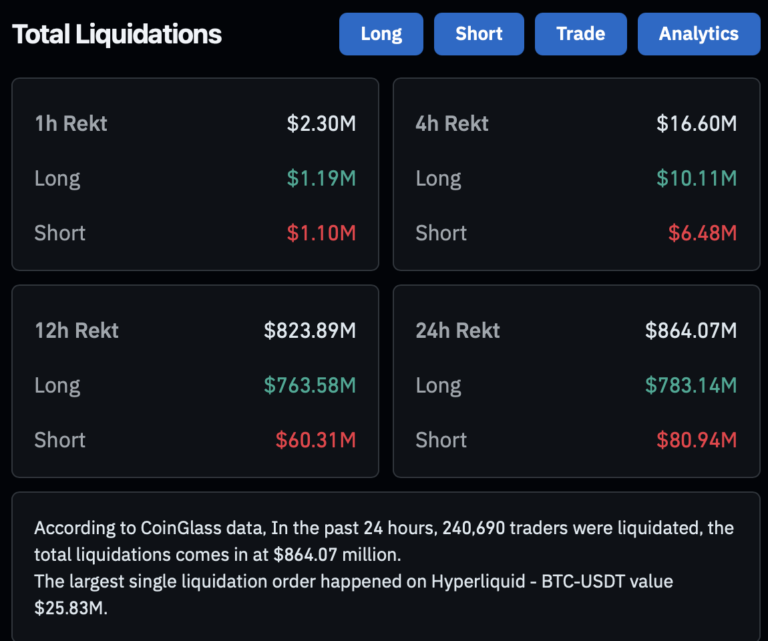

XRP’s decline didn’t happen in isolation. The broader crypto market is undergoing a correction after Bitcoin failed to hold above $97,000 and slid back toward $92,000. As often happens, altcoins followed BTC lower. According to CoinGlass data, more than $864 million in leveraged positions were liquidated across the crypto market in the past 24 hours, adding forced selling pressure and accelerating downside moves.

Geopolitical Risk Adds Another Layer

Beyond technical factors, rising geopolitical tension appears to be weighing on sentiment. Recent developments surrounding the US and Greenland have introduced fresh uncertainty, with President Trump signaling an aggressive stance based on national security concerns. Opposition from NATO allies and talk of military support for Denmark have added to investor anxiety. In risk-sensitive markets like crypto, those headlines tend to push participants toward de-risking rather than adding exposure.

Why XRP Still Looks Vulnerable Short-Term

The October 2025 market crash left lasting scars, and confidence has yet to fully recover. Many investors are still leaning defensive, rotating into assets like gold and silver rather than high-volatility tokens. In that context, XRP could remain under pressure in the coming weeks, especially if Bitcoin struggles to reclaim key levels and macro uncertainty persists.

Why the Longer-Term Case Isn’t Dead

Despite the current weakness, XRP’s broader narrative hasn’t disappeared. The asset had a strong run in 2025, and expectations for 2026 remain elevated. CNBC recently labeled XRP the “hottest crypto trade of 2026,” reflecting continued institutional and retail interest. If market conditions stabilize and risk appetite returns later in the year, XRP could still find room to regain momentum.

For now, though, the market is sending a clear message. Caution is in control, and rallies will need stronger confirmation before confidence returns.