- Trevor Flipper argues HYPE still has upside, but says most traders take unnecessary risk by using naked long positions.

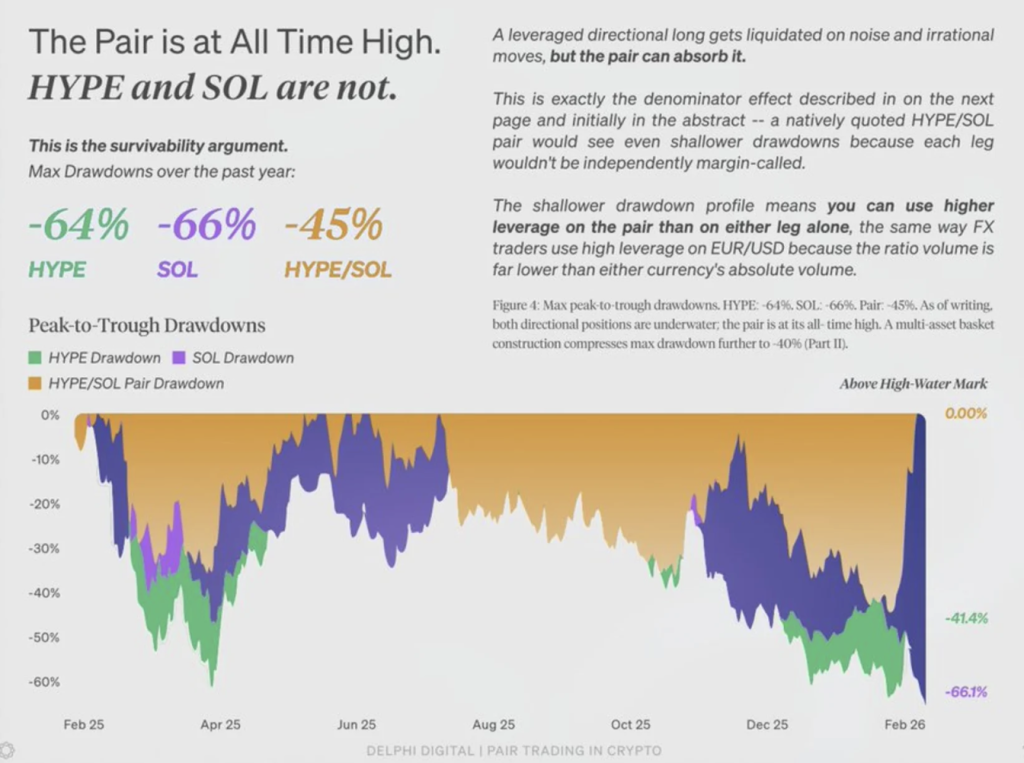

- The HYPE/SOL pair hit an all-time high even while both assets remain below their peaks, showing cleaner relative strength performance.

- Pair trading improved Sharpe ratio and reduced drawdowns, with basket trades potentially lowering volatility even further.

Crypto analyst Trevor Flipper recently shared a pretty strong take: he still thinks HYPE has room to run. But the interesting part wasn’t the bullish call itself. It was the way he framed the bigger problem, which is that most traders structure their positions in a way that quietly stacks risk against them, even when their thesis is correct.

And yeah… that stings, because it’s true more often than people want to admit.

The Real Problem Isn’t Timing, It’s Trade Structure

Flipper’s argument is simple. On Crypto Twitter, traders constantly talk about relative strength. They’ll say things like, “Asset A will outperform Asset B,” or “This coin is clearly stronger than that one.” But instead of actually trading the difference, most people just buy the asset they like and hope the market cooperates.

That’s where things get messy.

A naked long position exposes you to the full market. Bitcoin dumps? You feel it. Liquidity dries up? You feel it. Random wick on a Sunday night? Yep, you feel that too. Even if your core idea was correct (that one asset is stronger than another), you can still get chopped up by volatility that has nothing to do with your thesis.

Flipper’s point was that the issue isn’t always leverage, or entry timing, or even bad risk management. Sometimes the trade is just built wrong from the start.

The HYPE/SOL Pair Trade Shows a Cleaner Way to Express the Thesis

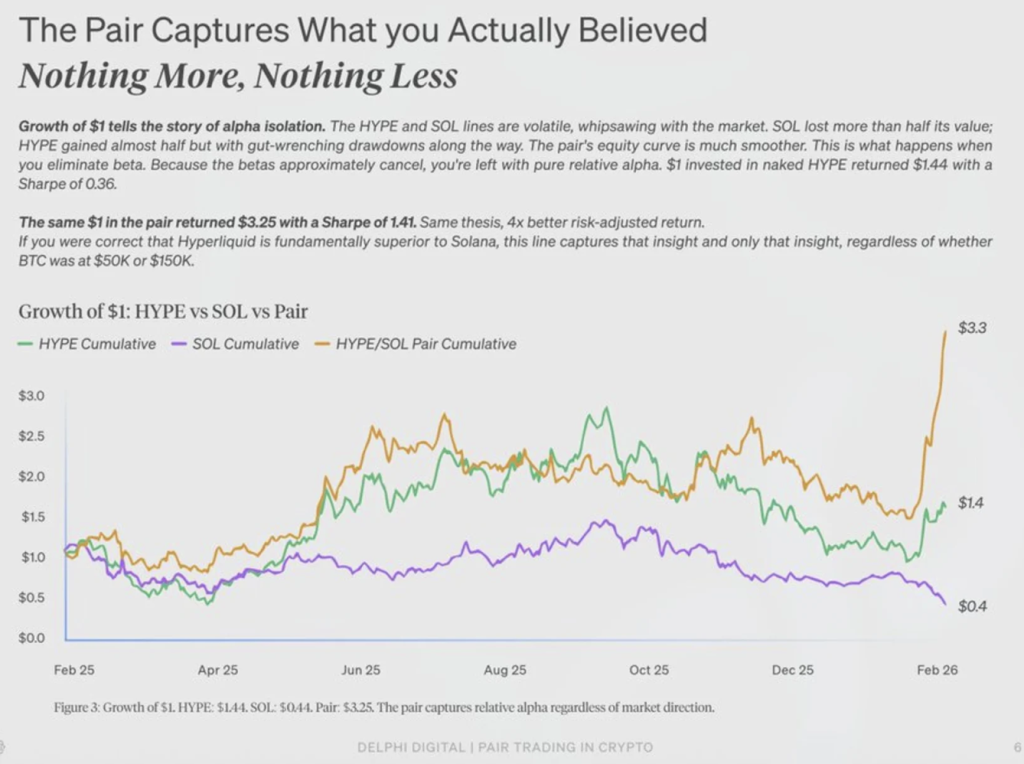

To demonstrate this, Flipper used a case study comparing HYPE against Solana, specifically through the HYPE/SOL trading pair. This relative trade has been popular in some form for most of the past year, and the results were pretty telling.

Even though HYPE is still around 40% below its all-time high, the HYPE/SOL pair is currently sitting at an all-time high. Solana is also below its peak, but that doesn’t matter to the pair in the same way. The pair only tracks the relative performance between the two assets, which is the entire point.

That’s the key advantage: the trade doesn’t care if Bitcoin is at $60,000 or $120,000. It doesn’t care if the whole market is euphoric or miserable. It only cares whether Hyperliquid is outperforming Solana. If your thesis is “HYPE beats SOL,” the pair trade expresses that directly, without dragging you through the full market rollercoaster.

Flipper explained that if the underlying assumption is correct, the pair position rewards it cleanly. You don’t need the whole market to go up. You just need your stronger asset to keep being stronger.

Risk-Adjusted Returns Look Dramatically Better

Over nearly a year, Flipper noted that the HYPE/SOL pair achieved a Sharpe ratio of 1.45, which he described as “institutional quality.” In contrast, a trader who simply went long HYPE (even with the correct idea) would have posted a Sharpe ratio of just 0.35.

That’s not a small difference. That’s a completely different trade.

The pair setup also reduced maximum drawdown from -64% to -45%, and cut volatility by about 21%. And the wild part is that it didn’t require complicated derivatives or fancy timing. It just required adding one short leg on Solana to neutralize broader market swings. With that one adjustment, the risk-adjusted returns were nearly four times better.

Flipper said this framework came from frustration. Being right fundamentally but still getting wrecked during downturns is one of the most common experiences in crypto. Pair trading, in his view, strips out market noise and lets the alpha show through.

Why This Could Matter More as Crypto Grows Up

Flipper also suggested that this type of positioning could become even more valuable as crypto matures. As the market evolves, weaker projects tend to get weeded out, while the strongest players expand and potentially grow into trillion-dollar companies. In that environment, relative strength strategies may become a more consistent way to capture upside without needing to gamble on overall market direction.

Looking ahead, Flipper’s broader goal is to expand this approach into multi-asset basket trades. Early data, according to him, suggests volatility could drop even further, from around 104% in naked trades to 82% in pairs, and down to 57% in basket-style structures. At the same time, Sharpe ratios could climb toward 1.80, which is the kind of profile traditional funds actually look for.

It’s not a magic trick, and it doesn’t remove risk entirely. But it’s a reminder that in crypto, how you express the idea can matter just as much as the idea itself.