- The Altcoin Season Index has dropped to 35, signaling a transition phase rather than full altcoin season

- Ethereum is holding key ETH/BTC support and acting as the main driver of altcoin sentiment

- Select altcoins, especially privacy-focused assets, are already showing strong momentum

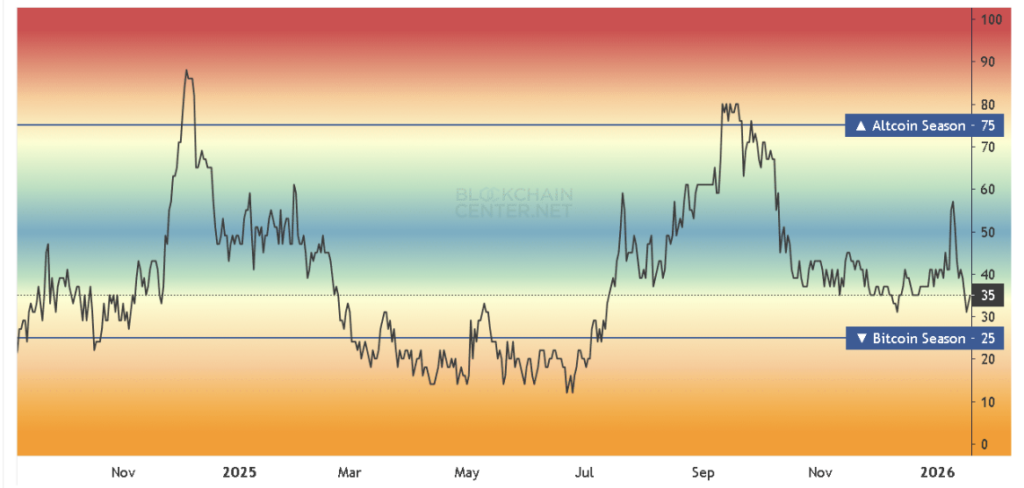

The altcoin market has quietly slipped into a more delicate phase. The Altcoin Season Index has dropped to 35, a level that doesn’t scream panic, but definitely signals transition. Bitcoin dominance has softened a bit, and that shift is encouraging capital to rotate into alternative assets, even if the move still feels selective rather than explosive.

Under the surface, market structure suggests altcoins may be preparing for an expansion phase. Ethereum, once again, is doing most of the heavy lifting when it comes to sentiment.

Ethereum Holds Firm as Bitcoin Dominance Eases

Ethereum has shown notable resilience against Bitcoin during recent volatility. At the time of writing, ETH/BTC was trading near 0.03484, holding above its 2025 lows and a well-defined support zone. That alone matters. In moments where the broader market feels shaky, relative strength tends to stand out more clearly.

On the longer-term chart, Ethereum is still pressing up against its descending trendline that has been in place since 2017. It hasn’t broken through yet, but it’s testing it again. Momentum indicators are starting to stir too. The MACD is flashing early signs of a potential bullish crossover, which could hint that Ethereum’s relative strength is building as Bitcoin dominance continues to fade, slowly.

Total Altcoin Market Structure Looks Constructive

Zooming out, the total crypto market cap excluding Bitcoin has been holding steady around $1.29 trillion. On the weekly timeframe, the structure looks like an ascending triangle, a pattern that usually reflects consistent accumulation pressure rather than distribution.

This kind of setup often precedes a breakout that draws more capital into altcoins. That said, it’s not guaranteed. If the rising support trendline fails to hold, short-term downside pressure could still show up before any broader move higher takes shape. For now, though, the structure leans constructive.

Altcoin Season Index Signals Transition, Not Euphoria

With the Altcoin Season Index sitting at 35, the market is clearly not in full altcoin season territory. Bitcoin is still outperforming most assets overall. However, this level has historically marked periods where select altcoins begin to gain traction ahead of broader participation.

In past cycles, similar readings often came before more widespread altcoin strength. It’s usually a slow handoff, not a sudden switch, and that seems to be what’s unfolding again.

Select Altcoins Are Already Moving

As attention shifts, several altcoins have already posted outsized gains. Monero surged more than 85%, Chiliz climbed roughly 85% as well, and MYX jumped over 82%. Dash advanced around 70%, Zcash gained about 60%, and Bitcoin Cash moved up close to 24%.

A clear theme has emerged here. Privacy-focused assets are showing notable strength, suggesting that capital is rotating with intent, not randomly.

Where the Market Goes From Here

As Bitcoin dominance continues to ease, the market appears more open to altcoin leadership, at least at the margins. Ethereum remains central to that narrative. Its ability to hold support on the ETH/BTC pair could end up shaping how far and how fast this rotation develops.

If altcoins can keep building momentum without Bitcoin reasserting full control, Ethereum’s role as a leader becomes even more important. For now, the market feels balanced on a knife’s edge. Whether this turns into a broader altcoin expansion or stays selective depends on what happens next, and who steps up to lead.