- Litecoin sentiment is weakening as FUD spikes during low volatility

- Price remains capped by heavy supply zones and a descending structure

- Extended consolidation or gradual downside looks more likely than a sharp breakout

Litecoin has carried the “undervalued OG” label for years now. It was one of the earliest altcoins to prove it could function at scale, yet price has never really followed through in the way many expected. Even today, its all-time high still sits well below the psychological $500 mark, and that gap feels more obvious as Bitcoin flirts with the $100K narrative while LTC struggles to hold ground near $100. The contrast is hard to ignore.

Litecoin’s Market Tone Is Quietly Shifting

What’s changed lately isn’t price alone, but the tone underneath it. Volatility has compressed, and price swings have become smaller and less decisive. That usually happens when participation thins out and traders start rotating capital elsewhere. In environments like this, rallies tend to feel fragile, and bounces lose follow-through quickly.

This leaves a fairly simple, but uncomfortable question on the table. Is Litecoin just pausing before another directional move, or is the rally losing energy altogether?

Sentiment Weakens as Fear Creeps Back In

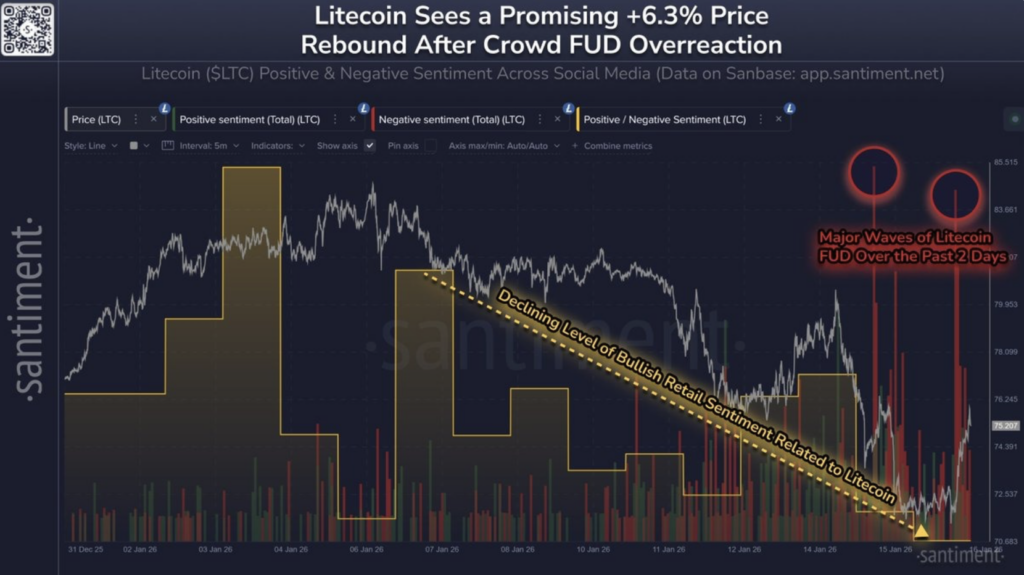

Recent sentiment data leans toward the latter. Social metrics show optimism fading while fear-driven commentary spikes, a combination that often shows up when conviction starts to crack. On the Santiment chart, Litecoin’s price attempts to stabilize, but bullish sentiment continues trending lower. That divergence isn’t great.

Over the last couple of days, sudden FUD spikes have appeared, which usually reflects nervous positioning rather than confident accumulation. In a healthy consolidation, sentiment tends to flatten or slowly improve. Here, it doesn’t. That’s why the latest bounce looks more like a short-term relief move after panic selling, not the start of a fresh, demand-led rally.

Litecoin Price Structure Remains Under Pressure

From a technical standpoint, Litecoin is still deep in a cooldown phase. Price is trading around the mid-$70s and remains below several key resistance zones. Multiple overhead supply blocks and a falling trendline continue to cap upside attempts, while buyers have struggled to defend higher lows.

The chart shows a clear descending structure, with lower highs and price pressing toward the lower boundary of a falling channel or wedge. Supply remains stacked between roughly $82 and $90, and again from $95 up toward $110. Meanwhile, demand near current levels looks thin, which suggests dip buyers aren’t stepping in with much conviction. Capital flows back this up too, with CMF sitting slightly negative, pointing to ongoing outflows rather than accumulation.

If pressure continues, downside levels around $72 come into focus first, followed by the $68 to $65 zone. On the upside, Litecoin would need to reclaim $82 to $85 with real volume to shift momentum, then push through $90. The $100 level remains a much larger ceiling for now.

Does Litecoin Have a Path Back to $100?

At the moment, it doesn’t look like Litecoin has the strength to reclaim $100 cleanly. Each bounce attempt runs into selling pressure fairly quickly, and the lack of aggressive buyers is noticeable. That said, the charts don’t really point to an imminent collapse toward $50 either.

Instead, the more likely outcome is extended weakness. A slow grind lower or sideways, with LTC stuck inside a broader bearish trend for longer than many would like. It’s not dramatic, but it’s not inspiring either.