- Dogecoin jumped after a Senate crypto bill hinted at favorable regulatory treatment

- The move appears driven by speculation, not long-term structural change

- DOGE’s lack of utility and ecosystem growth remain its biggest challenges

Dogecoin caught a sudden bid in mid-January, and for once, it wasn’t sparked by memes or a celebrity post. Instead, the move came from Washington. A provision buried inside a newly released Senate draft crypto bill gave DOGE a regulatory tailwind, at least on paper, and the market reacted quickly.

Why Dogecoin Spiked After the Senate Draft Bill

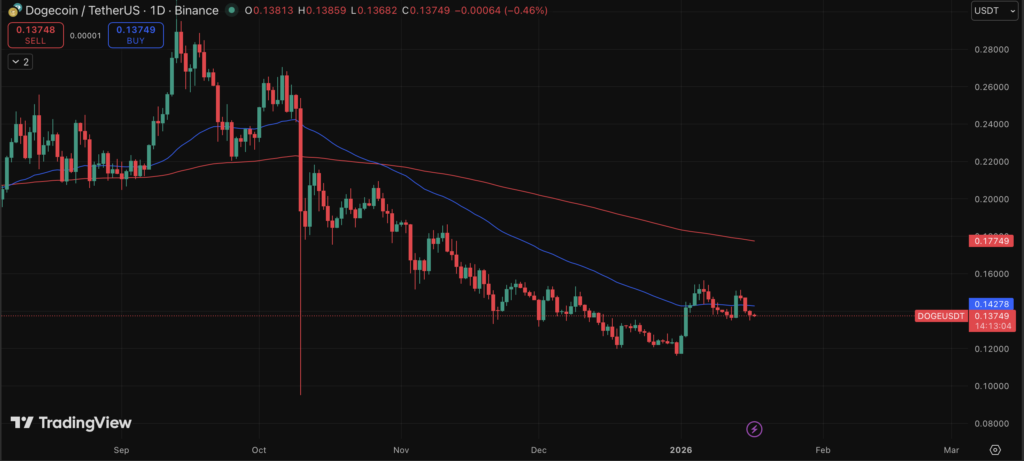

DOGE climbed roughly 8% on January 13, briefly pushing toward the $0.15 level. The timing lined up almost perfectly with the release of a 278-page Senate draft crypto bill, which builds on the Clarity Act passed by the House last year. The goal of the bill is to finally sort digital assets into clearer regulatory buckets, something the industry has been waiting on for years.

The framework introduces a split between “ancillary assets” and “digital commodities.” Ancillary assets wouldn’t be treated as securities, but they would still fall under SEC oversight and face stricter disclosure and trading rules. Digital commodities, on the other hand, would live in a lighter regulatory lane. The SEC would largely decide which assets land where, which is where things get interesting for Dogecoin.

How the Bill Quietly Favors DOGE

There’s a specific clause in the draft that caught traders’ attention. It states that any crypto already serving as the primary asset in an existing exchange-traded product would not be classified as an ancillary asset. Dogecoin qualifies under that definition, thanks to three spot Dogecoin ETFs already on the market, the first approved back in September 2025.

That effectively places DOGE in the same regulatory category as Bitcoin, at least under the current draft language. Once that detail started circulating, price followed. XRP and Solana were also mentioned in a similar context, but DOGE’s move stood out given its usual reliance on sentiment rather than policy.

This Looks Like a Speculative Pop, Not a Structural Shift

As nice as the green candles may look, this rally feels more speculative than foundational. The bill is still a draft, and there’s no guarantee it ever becomes law in its current form. In fact, reports suggest more than 75 amendments are already being discussed. By the time anything passes, the language could look very different.

Even if the provision survives, the advantage it gives Dogecoin is fairly narrow. Easier ETF inclusion helps, sure. It lowers friction for both retail and institutional investors who prefer exposure without dealing with wallets or custody. But over the long run, cutting regulatory red tape doesn’t fix deeper issues.

Dogecoin’s Bigger Problem Hasn’t Changed

Outside of regulation, Dogecoin still struggles with relevance. It lacks meaningful utility, developer momentum is thin, and the ecosystem appears largely stagnant. DOGE is down more than 55% over the past year and nearly 80% from its 2021 peak. A glance at its official site tells a similar story, with minimal updates and limited signs of active development.

Meanwhile, the crypto industry is moving toward stablecoins, tokenization, and infrastructure-driven use cases. None of those trends meaningfully involve Dogecoin. In fact, wider stablecoin adoption could chip away at DOGE’s already limited role as a medium of exchange.

The community and brand remain Dogecoin’s strongest assets, no question. But without a clear path to convert that attention into sustained utility, regulatory classification alone won’t move the needle much. The Senate bill gave DOGE a moment. It didn’t solve its fundamentals.