- Early PEPE investor James Wynn has closed all of his long positions.

- His move comes despite predicting a $69B market cap for PEPE in 2026.

- Weak market sentiment and bearish forecasts are fueling correction fears.

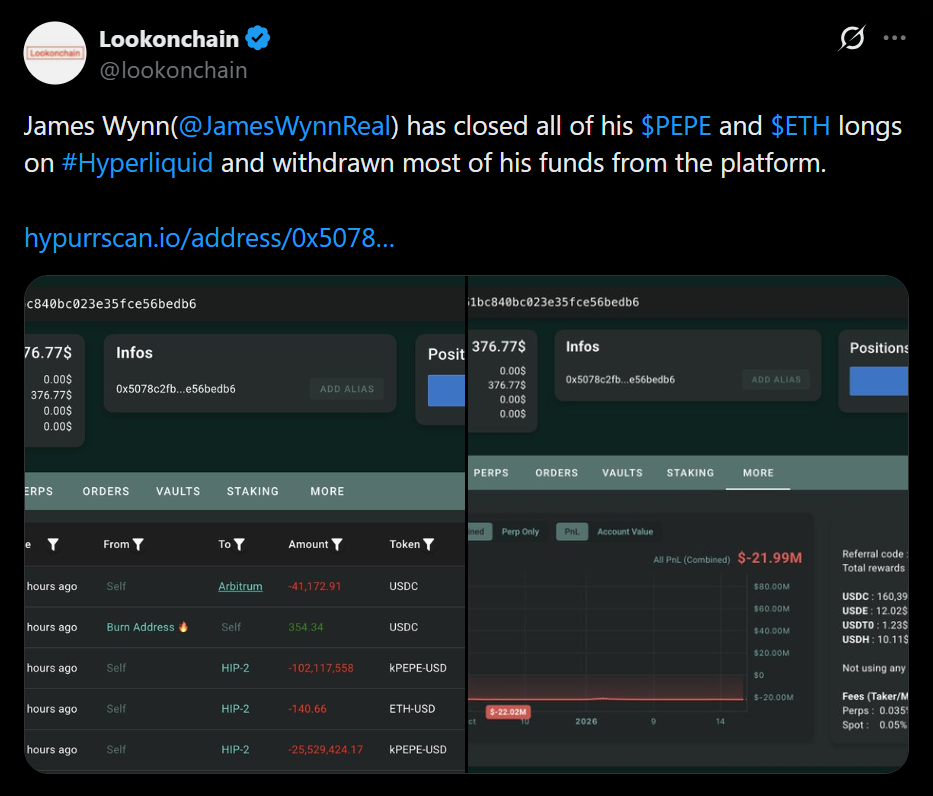

James Wynn, one of PEPE’s earliest and most vocal supporters, is back in the spotlight — but this time for what he did, not what he said. Wynn previously predicted that PEPE’s market cap could reach an eye-catching $69 billion in 2026, a call that helped fuel attention and inflows during the memecoin’s early run. Now, data from LookOnChain shows that Wynn has closed all of his PEPE and Ethereum long positions on Hyperliquid and withdrawn most of his funds from the platform. That move has sparked fresh debate about whether he’s bracing for a deeper correction.

From Bold Predictions to Closed Positions

Wynn’s influence inside the PEPE community grew rapidly after his early market cap predictions proved directionally correct, attracting significant speculative interest. His calls became part of the broader PEPE narrative, especially after he publicly said he would delete his account if the token failed to reach the $69 billion target. Against that backdrop, closing his long positions has raised eyebrows. For many traders, it looks less like routine risk management and more like a signal that expectations may be shifting.

Market Conditions Add Extra Pressure

The timing matters. Crypto markets are still stabilizing after the late-2025 downturn, and risk appetite remains fragile. Gold and silver hitting multiple all-time highs suggest many investors are still leaning defensive. In that environment, memecoins like PEPE — already among the most volatile assets in the market — tend to feel pressure faster than larger-cap tokens. Wynn stepping aside during this phase naturally feeds speculation that he expects turbulence ahead.

Price Action Tells a Mixed Story

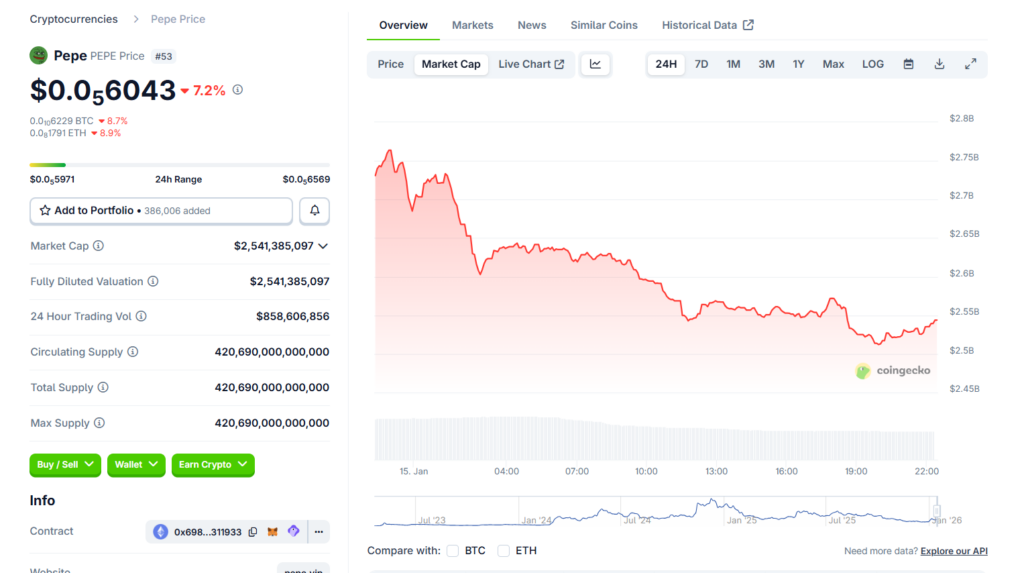

PEPE rallied sharply earlier this month, but momentum has faded. According to CoinGecko data, the token is down 8.2% in the last 24 hours and 3.4% over the past week, while sitting nearly 65% below its January 2025 levels. At the same time, it remains up close to 50% on the 14-day chart and more than 53% over the past month. That split highlights the current tension — strong short-term rebounds layered on top of a much larger drawdown.

Bearish Forecasts Add to Uncertainty

Some analysts are leaning cautious. CoinCodex projections suggest PEPE could fall toward $0.000004471 by January 26, 2026, implying a potential correction of nearly 27% from current levels. While forecasts aren’t guarantees, they reinforce the idea that volatility is far from over. Wynn’s exit doesn’t confirm a crash is coming, but it does remove a symbolic layer of confidence that many traders had leaned on.

For now, PEPE sits at a crossroads. Community optimism, recent gains, and bold long-term narratives are colliding with fragile market conditions and visible risk reduction by a high-profile investor. Whether that leads to consolidation or a sharper pullback is still unclear — but the questions are getting louder.