- Coinbase says it cannot support the Senate crypto bill as currently written.

- Concerns center on user privacy, stablecoin rewards, and SEC authority.

- The exchange’s opposition could significantly impact the bill’s outcome.

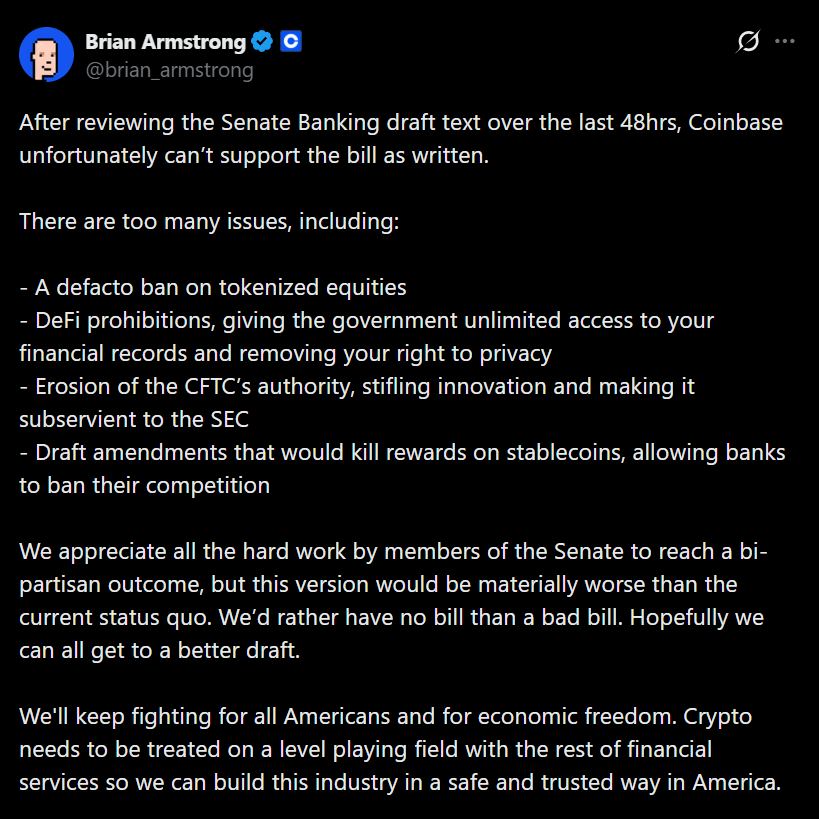

Coinbase has taken a firm stance against the Senate Banking Committee’s sweeping cryptocurrency legislation just hours before the panel is set to vote. In a public post on X, CEO Brian Armstrong said the exchange cannot support the bill in its current form, despite acknowledging the bipartisan effort behind it. His message was blunt: Coinbase would rather see no bill at all than one that leaves the industry worse off than it is today.

Why Coinbase Says the Bill Falls Short

According to Armstrong, the proposal raises serious concerns around decentralized finance, stablecoin rewards, and user privacy. He warned that parts of the bill could grant the government what he described as “unlimited access” to users’ financial records, a line that immediately set off alarms across crypto circles. He also criticized amendments he believes would effectively eliminate rewards tied to stablecoins, a feature many platforms rely on to attract users.

The bill itself is designed to clarify regulatory jurisdiction between the SEC and the CFTC, define when digital assets qualify as securities or commodities, and introduce new disclosure standards. While those goals have broad support in theory, Coinbase argues the execution misses the mark.

Stablecoin Rewards Become a Flashpoint

One of the biggest sticking points is how stablecoin rewards are treated. Banking groups have already pushed back against a separate stablecoin law known as GENIUS, which passed last summer. That law prevents issuers from paying direct interest to stablecoin holders but allows third-party platforms like Coinbase to offer rewards. Critics now argue that the new bill could close that loophole, while crypto firms say the issue was already settled and accuse banks of trying to curb competition.

SEC Authority Raises Old Fears

Armstrong also took issue with what he sees as an expansion of SEC authority at the expense of the CFTC. He described it as an erosion of the CFTC’s role that could stifle innovation and place too much power in the SEC’s hands. That concern runs deep in the industry, especially after former SEC Chair Gary Gensler’s tenure, which many crypto firms associate with regulation by enforcement rather than clear rulemaking.

Title I of the bill, focused on “Responsible Securities Innovation,” has drawn particular scrutiny for giving the SEC the first say in classifying certain digital assets. For many companies, that structure revives fears of unpredictable enforcement rather than collaborative oversight.

Why This Could Change the Bill’s Fate

People close to the discussions say Coinbase’s opposition is a big deal. When the largest US-based crypto exchange publicly rejects a bill, it sends a signal to lawmakers that industry support is far from unified. With the Senate Banking Committee preparing to amend and vote on the legislation, Coinbase’s stance could force changes, delay the process, or even derail the bill altogether.

For now, the message from Armstrong is clear. Progress matters, but not at any cost. In Coinbase’s view, regulatory clarity only works if it actually improves the landscape rather than tightening controls in ways that slow innovation and erode trust.