- Aave’s DAO-Labs dispute triggered a sharp sentiment shock, but the worst fear now appears priced in

- On-chain activity stayed resilient during the sell-off, with signs of accumulation near local lows

- Strong TVL and fee generation suggest Aave’s core fundamentals were never truly damaged

Aave has been back in the spotlight lately, though not because of a clean price breakout or some flashy new upgrade. Instead, attention shifted after a very public disagreement between the DAO and Aave Labs rattled confidence and sent the token lower. At first glance, it looked messy. But once the noise fades, the picture underneath feels a bit more nuanced.

A Sentiment Shake, Then a Reset

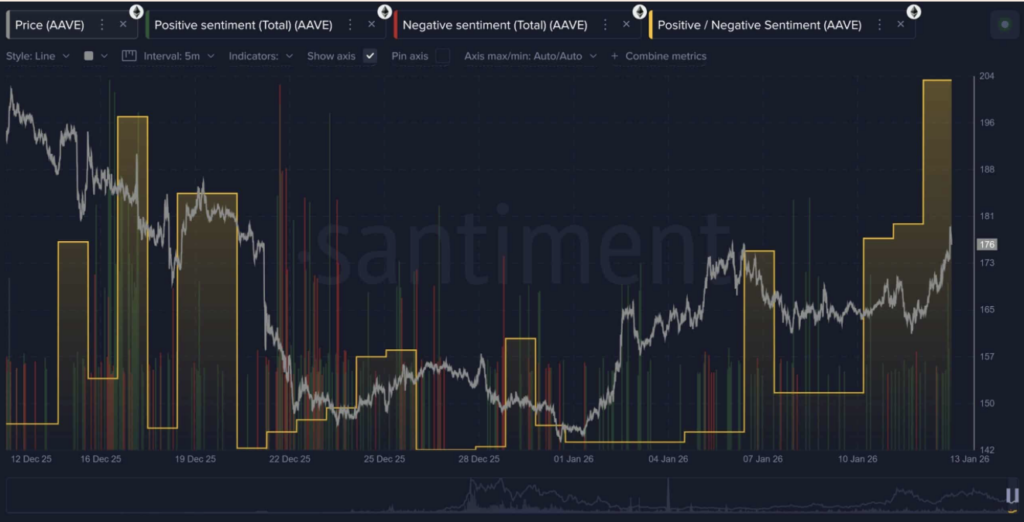

December was rough for AAVE. As the DAO-Labs dispute played out in public, sentiment soured quickly and the price followed. Roughly $500 million in market value was erased, according to Santiment data, as traders reacted to uncertainty rather than fundamentals. Fear tends to move faster than facts.

What’s interesting is how short-lived that mood turned out to be. As January rolled in, negative chatter began to cool, replaced by a more balanced tone. Positive mentions started to outpace the negative ones just as the price stopped printing lower lows. It felt less like blind optimism and more like acceptance that the worst-case scenarios were unlikely. The market, in typical fashion, may have overreacted first and asked questions later.

On-Chain Activity Told a Different Story

While headlines focused on governance drama, on-chain data was quietly sending another signal. Daily active addresses picked up around AAVE’s local lows in late December, with short bursts of network growth appearing right when price looked weakest. That kind of timing usually isn’t random.

Token circulation also increased during the dips, suggesting repositioning rather than panic exits. In simple terms, coins were moving, but not fleeing the ecosystem. Since early January, price action has slowly leaned higher, supported by steady buying beneath the surface. The protocol itself never missed a beat, even while sentiment swung wildly.

The Core Didn’t Crack

This is the part that matters most. Despite the noise, Aave’s fundamentals stayed intact. Total value locked is still hovering around $36 billion, only slightly off its highs and comfortably above mid-year levels. That kind of stability is hard to fake.

Revenue has held up too, with annualized protocol fees sitting near $700 million. Users didn’t vanish, liquidity didn’t evaporate, and capital didn’t rush for the exits. In other words, the system kept doing what it’s supposed to do.

That resilience helps explain why both sentiment and price are starting to recover. If the DAO and Aave Labs manage to resolve their differences without dragging things out, the damage may end up being more psychological than structural. Sometimes the market just needs a reminder that strong foundations don’t disappear overnight.