- Solana remains capped below the $142–$145 resistance zone despite rising trading volume and active price testing

- On-chain data shows slowing network growth, which could limit upside unless new wallet activity rebounds

- Analysts see potential upside toward $165–$200 if momentum holds, with $131 acting as key downside support

Solana has cooled off a bit after its recent push higher. At the time of writing, SOL was trading around $140.28, down roughly 1.3% over the past 24 hours, and still struggling to reclaim a stubborn resistance zone between $142 and $145. The session itself was choppy. Price opened near $142, briefly pushed above $143, then slid back toward the $138.50–$139.00 area before finding its footing and drifting back toward $140.

Volume tells a slightly different story. Over the same 24-hour window, trading activity jumped to about $5.6 billion, up more than 11%. Market capitalization sits near $79.3 billion, with roughly 565 million SOL circulating out of a total supply just above 618 million. There’s interest here, even if price hasn’t followed through yet.

Network Growth Lags as SOL Presses Against Resistance

On-chain data adds an important layer. Santiment noted that Solana recently traded as high as $144 while actively testing the $145 resistance level. Whether that ceiling breaks, they argue, may hinge on one thing, network growth.

The numbers aren’t encouraging, at least not yet. Weekly new wallet creation on Solana peaked around 30.2 million back in November 2024. The most recent reading? Just 7.3 million. That’s a steep drop, and Santiment’s chart labels the trend plainly as “still falling.”

Historically, Solana’s stronger breakouts have lined up with rising address activity and broader on-chain participation. Periods where network growth stalled, on the other hand, often coincided with softer price action and longer corrections. Right now, SOL’s rebound attempt is happening while new wallet growth continues to shrink, which makes this resistance test more delicate than it looks on the surface.

Analysts See Bigger Targets if Momentum Holds

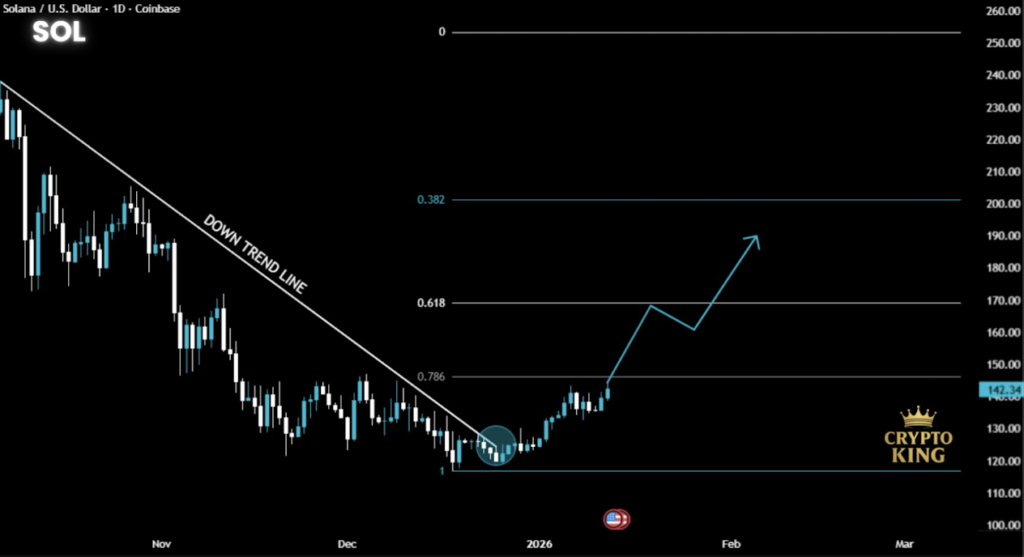

Despite that caution, several analysts remain constructive on the broader setup. Crypto analyst NekoZ highlighted a potential trend reversal on the daily chart after months of downside pressure. According to his view, SOL finally broke above a descending trend line that had capped rallies since November.

That breakout followed the formation of a rounded base near the $120 area, with price stabilizing into early January before pushing higher. Using Fibonacci retracement levels, NekoZ pointed out that SOL is now consolidating near the 0.786 level, right around the $142–$145 zone. If momentum holds, the next upside markers sit near the 0.618 level around $165, with a more ambitious target near the 0.382 level, roughly $200.

Another analyst, Crypto King, echoed a similar view, noting that the previously broken trend line is now acting as confirmed support. In his words, bulls appear to be in control, positioning SOL for a potential move toward $170, though he stressed the need for continued confirmation. NekoZ went even further, describing the structure as a rounding bottom followed by a “massive breakout,” with a next target zone above $190 if conditions stay favorable.

Short-Term Structure Watches $131 and $150

Zooming into lower timeframes, the picture tightens. Crypto Tony shared a chart showing SOL climbing from the mid-$120s into the $137–$140 range, printing a series of higher lows along the way. That pattern suggests improving short-term structure, even if resistance overhead remains firm.

In his analysis, immediate support sits just above $130, with $131 acting as a key level to watch. On the upside, the broader resistance band stretches from the high $140s into the $150 area. Crypto Tony outlined an “ideal scenario” where price rejects near $143, pulls back toward $131 to reset, and then makes a stronger push toward the $150 zone.

For now, Solana is stuck between growing optimism on the charts and a slowdown in on-chain expansion. Whether price can break decisively above $145 may depend less on technicals alone, and more on whether network activity starts to wake up again.