- Standard Chartered predicts Ethereum could reach $7,500 in 2026.

- Longer-term forecasts place ETH at $30,000 by 2029 and $40,000 by 2030.

- Macro uncertainty and risk aversion continue to suppress near-term price action.

Ethereum could be gearing up for a major breakout in 2026, according to a new report from Standard Chartered. The bank’s digital assets research head, Geoffrey Kendrick, believes ETH is on track to reach a fresh all-time high of $7,500 this year, implying a rally of roughly 140% from current levels. Kendrick framed the outlook boldly, saying 2026 could become Ethereum’s defining year, much like 2021 was during the last major cycle.

Bigger Targets Stretch Into the Next Decade

The optimism doesn’t stop at 2026. Standard Chartered’s longer-term projections suggest Ethereum could climb as high as $30,000 by 2029 and potentially reach $40,000 by 2030. A move to $30,000 would represent an increase of more than 860%, while $40,000 would imply gains exceeding 1,100%. That said, the bank has actually trimmed its earlier forecasts, making the current outlook bullish but slightly more conservative than previous estimates.

Ethereum’s Bullish Phase Already Began

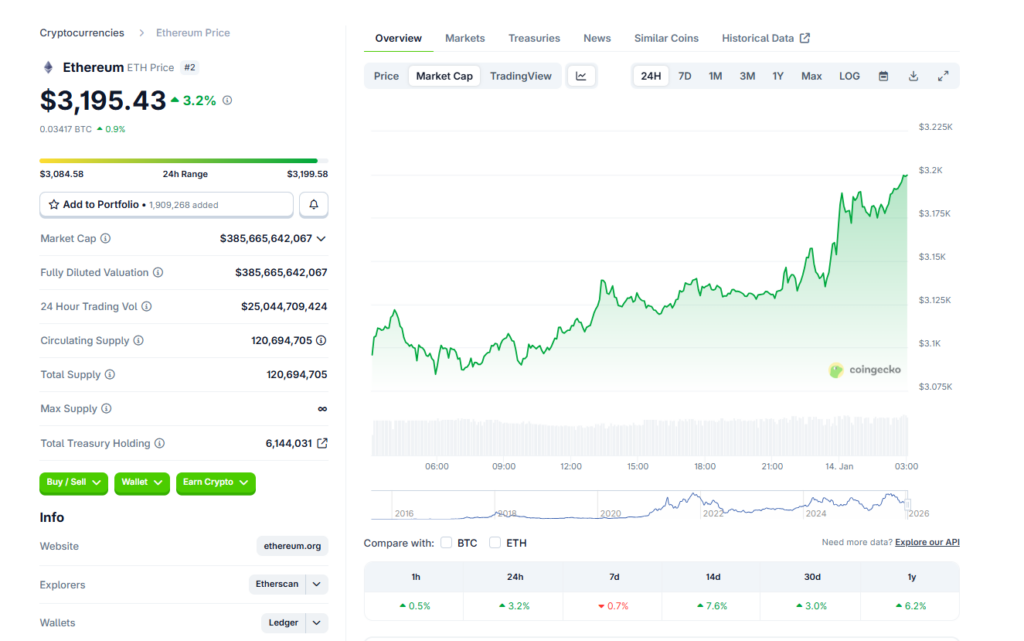

Ethereum entered a bullish phase back in mid-2025 before running into a sharp correction toward the end of the year. The asset reached a peak of $4,946.05 in August 2025 but has since pulled back by nearly 37%. According to CoinGecko, ETH has shown modest recovery signs recently, rising over 6% in the past two weeks and edging higher on the monthly chart, though short-term weakness still lingers.

Macro Pressure Continues to Weigh on ETH

For now, Ethereum remains tied to broader market sentiment, which is still fragile. Investors have increasingly shifted toward perceived safe-haven assets like gold and silver, both of which have printed multiple all-time highs in recent months. That rotation away from risk assets has limited upside across crypto, including ETH. If economic conditions stabilize and risk appetite returns, Ethereum’s momentum could strengthen quickly, aligning more closely with Standard Chartered’s long-term thesis.