- XRP’s 2014 low created a rare “early entry” window that most traders miss

- A $1,000 buy at the bottom could’ve reached about $1.35M at the 2025 peak

- The bigger lesson is how crypto rewards patience more than timing perfection

Ripple’s XRP has been around since 2012, which makes it one of the few crypto assets that has lived through multiple full cycles. It also means XRP has had long stretches of boredom, controversy, and pain, especially after the SEC sued Ripple in 2020. But after Ripple’s 2025 settlement, the asset regained momentum and printed one of its most explosive runs in years.

And yes, the math checks out. If someone had bought XRP at the right moment, they could’ve turned a small investment into life-changing money. The part people forget is that “the right moment” almost never feels right in real time.

How $1,000 Could’ve Become Over $1 Million

According to CoinGecko data, XRP’s lowest recorded price was around $0.002686 in May 2014. If you had put $1,000 into XRP at that exact low, you would’ve received roughly 372,300 XRP. That’s an absurd amount of coins by today’s standards, and it shows how different early crypto pricing was.

Fast forward to July 2025, when XRP hit its all-time high of $3.65. At that peak, those 372,300 XRP would’ve been worth around $1.35 million. That’s a gain of roughly 135,790%, which is the kind of return traditional markets basically don’t offer outside of freak once-in-a-generation stories.

The Hard Part Wasn’t Buying, It Was Holding

The part that gets left out of these “what if” stories is the psychological cost. Anyone who bought in 2014 would’ve had to survive years of sideways trading, multiple crashes, and constant doubt. Then the SEC lawsuit hit in 2020, and XRP became one of the most publicly attacked large-cap assets in the market.

Most people would’ve sold long before 2025. Not because they were stupid, but because the market is designed to wear you down. Crypto doesn’t just test your portfolio. It tests your patience, your ego, and your ability to sit still while nothing happens.

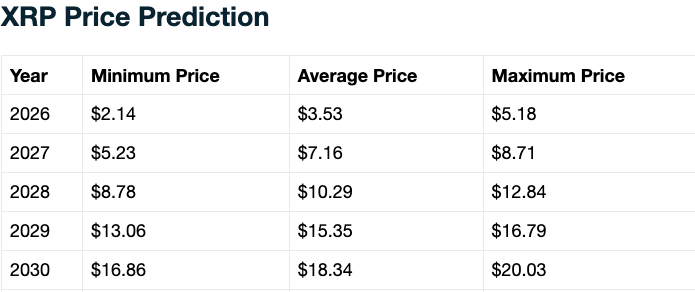

Can XRP Still Create New Millionaires?

XRP has dropped sharply since its July 2025 high, and it’s been dragged down further by broader market weakness, macro uncertainty, and the 2026 liquidity crunch. But that doesn’t automatically make the story “over.” In fact, this is where a lot of crypto narratives quietly reset.

Supporters argue XRP is still early in the adoption curve, especially now that spot XRP ETFs launched last year. ETFs have become one of the most important engines in crypto’s modern market structure. When institutional flows return, they don’t just boost price, they reshape legitimacy.

The Bigger Lesson Isn’t XRP, It’s the Cycle

Whether XRP hits new highs or not, the bigger takeaway is what this story shows about crypto cycles. The biggest wealth creation usually happens when the asset is hated, boring, or written off. The gains come later, after the market has already convinced most people it’s dead.

That doesn’t mean XRP is guaranteed to repeat history. Nothing is. But it does mean the market still runs on the same emotional pattern: despair creates opportunity, and euphoria creates exits. People just pretend they don’t see it while it’s happening.