- XRP has fallen nearly 15% since January 6, but long-term holders are accumulating at the fastest pace since September

- The 20-day EMA and dense on-chain supply clusters near $2.00 are acting as key defense zones

- Targeted dip buying is supporting price, even as momentum remains weak and larger whales stay cautious

XRP has been sliding hard since its January 6 peak, and the move hasn’t been subtle. In less than a week, price is down close to 15%, with several support levels already breaking along the way. Momentum looks weak, sentiment feels heavy, and the chart hasn’t offered much comfort to late buyers.

But under the surface, something different is happening. Conviction buyers are stepping in aggressively, at a pace XRP hasn’t seen since early September. That disconnect between falling price and rising long-term demand is creating a rare tension, one that usually doesn’t last very long.

One Trend Line Is Quietly Deciding XRP’s Fate

The sell-off really picked up after XRP failed to reclaim its 200-day EMA at the January 6 high. That rejection mattered. EMAs, especially longer ones, often act like trend gatekeepers, and staying below them tends to keep sellers in control.

From there, XRP lost the 100-day EMA, then the 50-day, one after another. Now price is hovering near the 20-day EMA, which has become the final short-term line holding the structure together. This level often separates a controlled pullback from something more painful.

There’s precedent here. In early December, XRP lost the 20-day EMA on December 4 and proceeded to drop roughly 15% in the days that followed. That memory is why this level feels heavy now. Holding it keeps the structure alive, barely. Losing it on a daily close likely extends the freefall.

Dip Buying Is Surging, but It’s Not Everyone

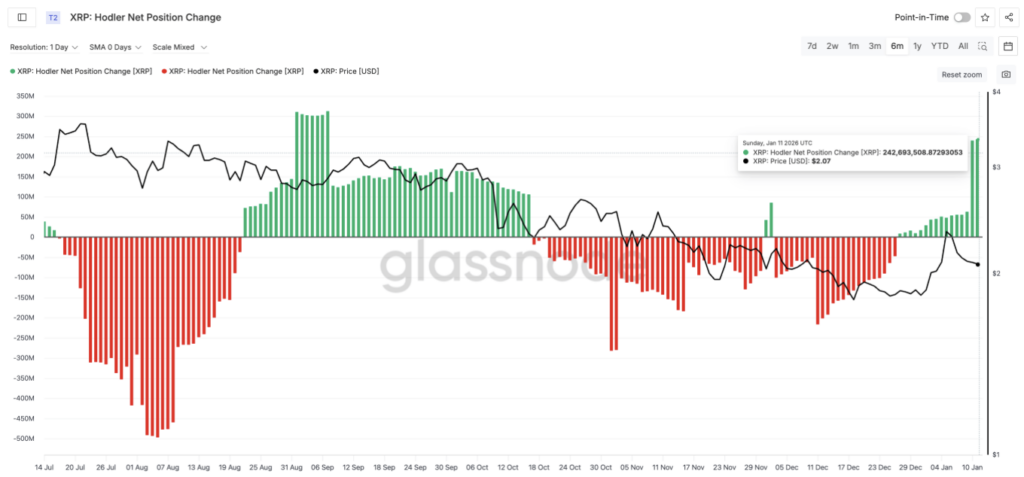

Despite the technical damage, long-term holders are buying into the weakness, and they’re doing it with conviction. This shows up clearly in the HODLer net position change metric, which tracks whether long-term wallets are adding or reducing their balances.

On January 9, these holders added around 62 million XRP. Over the next two days, that number exploded. Roughly 239 million XRP was absorbed on January 10, followed by another 243 million on January 11, even as price continued to fall. That makes it the strongest two-day accumulation streak since September 7.

What’s notable is who isn’t buying. Large whales remain mostly sidelined. Only smaller whales, those holding between 1 million and 10 million XRP, have shown activity. Their combined balances increased by about 10 million XRP, roughly $20.5 million at current prices.

This isn’t broad-based accumulation. It’s targeted, defensive buying. Smaller players are stepping in near key levels, while bigger money waits for clarity. That imbalance explains why XRP is holding support but failing to bounce with strength.

Supply Clusters Explain Why Buyers Aren’t Panicking

The conviction from long-term holders lines up almost perfectly with XRP’s on-chain cost structure. Large supply clusters sit just below the current price, acting like pressure pads rather than trap doors.

One major cluster sits between $2.00 and $2.01, where roughly 1.9 billion XRP were accumulated. Another lies just below, between $1.96 and $1.97, with about 1.8 billion XRP bought. Holders near these levels are close to breakeven, which often encourages dip buying instead of panic selling.

That’s why selling pressure has slowed, even as momentum remains weak. As long as these clusters hold, XRP can print long lower wicks and attempt to stabilize. A reclaim of the 20-day EMA near $2.04 would be the first real signal that this defense is working.

Above that, XRP needs to reclaim $2.21 and then $2.41, the January 6 peak. Clearing $2.41 would reopen $2.69 and flip the structure bullish again, but that’s a longer road.

Downside risk hasn’t disappeared. A clean break below $2.01 exposes $1.97, then $1.77 after that. Notably, those levels also line up with visible support on the price chart, reinforcing how closely structure and on-chain data are aligned right now.

XRP’s current strength isn’t coming from momentum or headline-driven hype. It’s coming from structure. As long as the 20-day trend line holds and dense supply clusters sit beneath price, conviction buyers are willing to absorb the pressure, quietly, patiently, and without much noise.