- Bitcoin and Ethereum funds saw heavy outflows last week.

- XRP and Solana products attracted notable inflows despite the broader pullback.

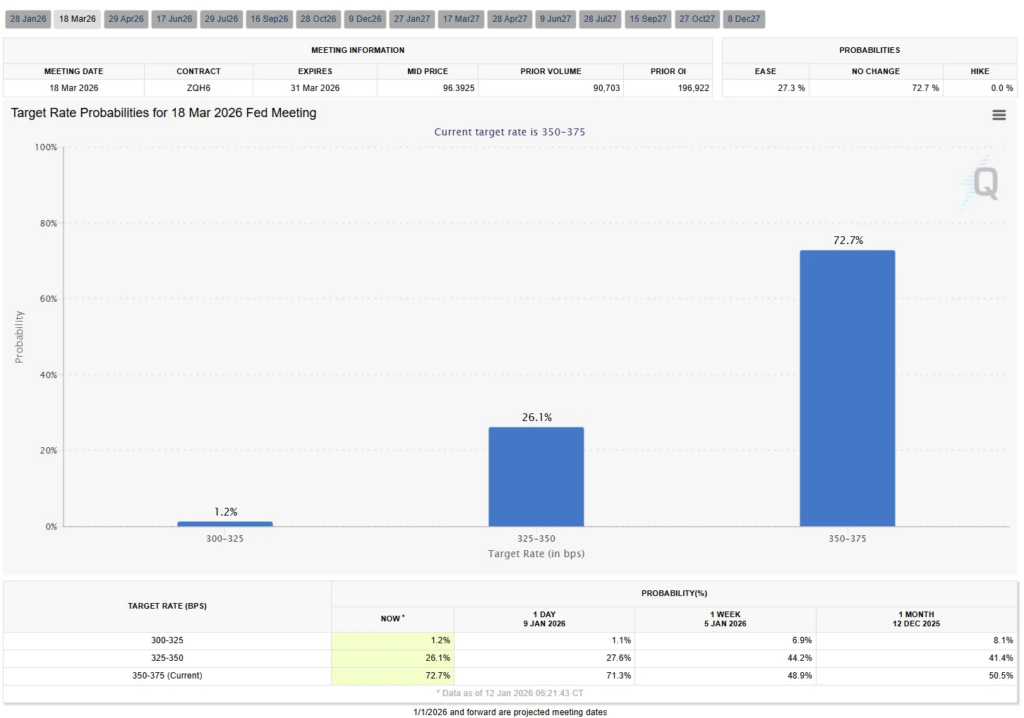

- Waning expectations of a March Fed rate cut weighed on overall sentiment.

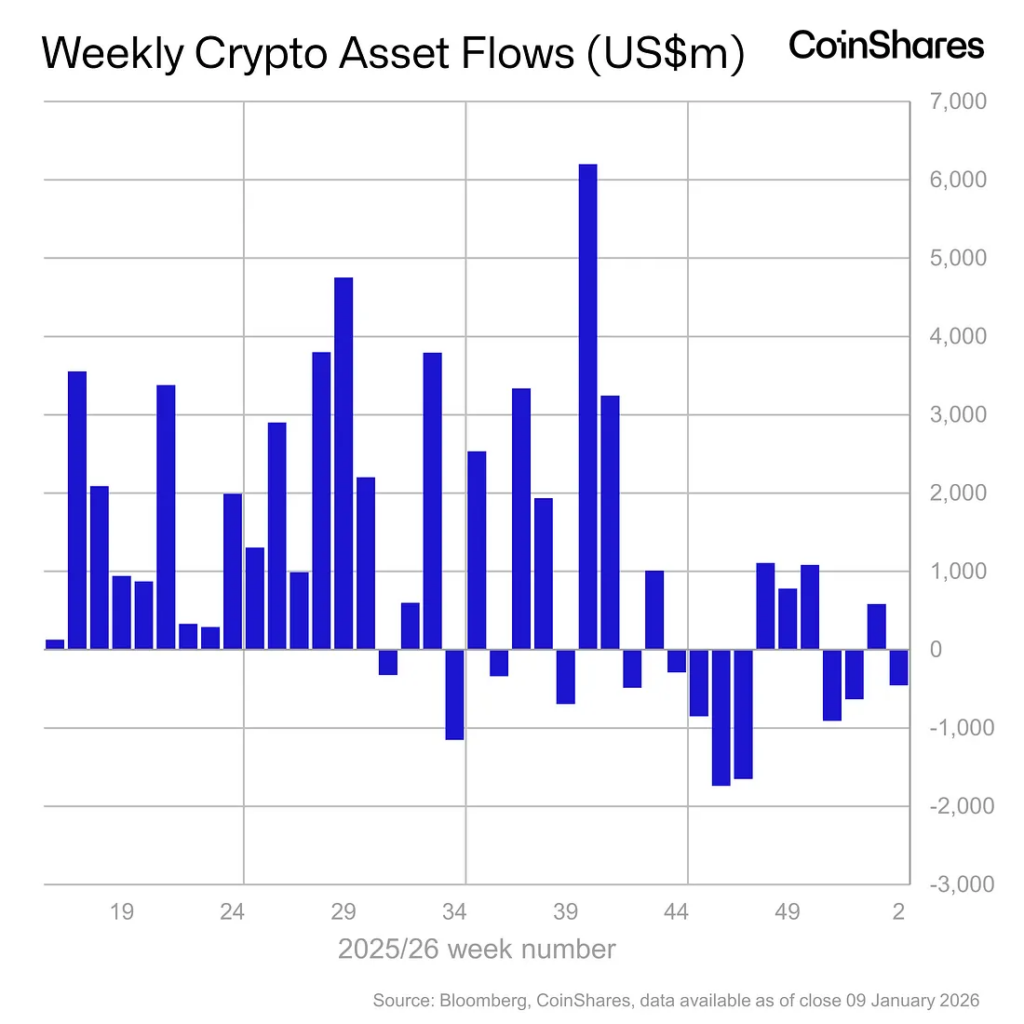

Last week’s fund flows drew a sharp line through crypto markets. While exchange-traded crypto products broadly saw outflows, capital quietly rotated into a few specific names. According to the latest CoinShares data, funds tied to XRP and Solana posted solid inflows even as Bitcoin and Ethereum led a wave of redemptions. That divergence says more about sentiment than the headline numbers alone.

Bitcoin and Ethereum Take the Hit

Bitcoin products recorded roughly $405 million in outflows for the week, with Ethereum close behind at $116 million. Together, they erased a large portion of the $1.5 billion that flowed into crypto funds earlier in the year. The pullback wasn’t chaotic, but it was decisive, particularly among U.S.-based investors who accounted for the bulk of the selling pressure.

Where the Money Actually Went

While majors were seeing red, XRP-linked funds attracted about $46 million in inflows, and Solana products pulled in roughly $33 million. Sui and Chainlink also managed to close the week in positive territory, albeit with smaller allocations. This wasn’t a broad altcoin rush. It was targeted, suggesting investors are picking narratives rather than chasing the entire market.

Geography and Providers Tell a Story

On the provider side, Grayscale and Fidelity saw most of the weekly redemptions, while iShares and ProFunds managed to bring in fresh capital. Regionally, U.S. funds experienced the largest outflows, while Germany, Canada, and Switzerland recorded net inflows. That split highlights how sentiment isn’t moving in lockstep globally, even when macro pressures are shared.

The Fed Shadow Still Looms

CoinShares analysts pointed to shifting expectations around U.S. monetary policy as a key driver. Recent macro data has dampened hopes for a March rate cut, with markets now pricing only a 27% probability. As those odds faded, risk appetite softened, pushing some investors to reduce exposure while others rotated into assets they see as better positioned.

Conclusion

This wasn’t a simple risk-off week. It was a reshuffling. Bitcoin and Ethereum took the brunt of outflows, but capital didn’t leave crypto entirely. It moved selectively. XRP and Solana benefiting in that environment suggests investors are still engaged, just far more discriminating than they were a few weeks ago.