NFT collector accidentally burns a $135K CryptoPunk while trying to borrow money through wrapping, sparking discussions on confusing user interfaces and wash trading in NFT markets.

- While trying to borrow money against it to purchase another NFT, a CryptoPunk #685 was unintentionally sent to a burn address by an NFT collector.

- The investor’s loss was attributed to confusing user interfaces and difficult instructions, and the community as a whole concluded that the front-end procedures for crypto ecosystems needed to be updated.

Background

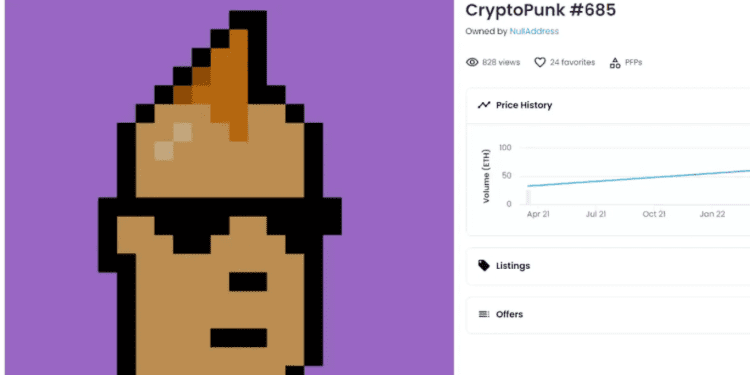

Non-fungible tokens, or NFTs, have swept the cryptocurrency industry. These digital assets signify ownership of distinctive digital goods, including original music, artwork, and other creative content. With 10,000 different 8-bit characters, CryptoPunks is one of the most well-known NFT collections. With some selling for millions of dollars, CryptoPunks are renowned for their tremendous value. Regrettably, a collector accidentally destroyed a CryptoPunk valued at 77 Ether, or $135,372.16.

The Accident

On March 13, Brandon Riley, a seasoned NFT investor, paid 77 ETH for CryptoPunk #685. Despite his long-term holding intentions, he had to borrow money to purchase another NFT. He tried wrapping the NFT, which entails locking an NFT into a smart contract to produce a new token that can be used in other applications. Riley unintentionally sent the NFT to a burn address while wrapping it, which removed it from circulation forever.

Riley had followed the directions precisely, but the new procedure of wrapping NFTs led him to make an expensive error. He didn’t want to sell the CryptoPunk on Blur, a well-known NFT marketplace, because it was a “forever punk” and had special meaning to him. Riley claimed that, contrary to expectations that he must have possessed “huge resources,” he had borrowed money to buy the CryptoPunk.

Lessons Learned

Riley’s experience shows how the crypto ecosystem needs improved front-end procedures and user interfaces. Making the processes as simple and user-friendly as possible is vital as the cryptocurrency industry expands and more people enter the market. Complex user interfaces and unclear instructions can result in expensive errors, which deters potential investors from entering the market. The incident has also highlighted how critical it is to comprehend the procedures involved in dealing with NFTs. Before undertaking the functions on their own, investors must take the time to become familiar with them, especially when dealing with high-value NFTs.

NFT Wash Trading

Riley’s CryptoPunk incident is one of many problems the NFT market is dealing with. In the NFT market, wash trading—the activity of traders buying and selling assets to manipulate prices—has gained much attention. Wash trading in the NFT market grew by 126% in February, with a $580 million total volume, according to a CoinGecko analysis.

According to the study, Magic Eden, OpenSea, Blur, X2Y2, CryptoPunks, and LooksRare are the top six NFT marketplaces. Wash trade increased for the fourth consecutive month for X2Y2, Blur, and LooksRare. Wash trading has become more prevalent due to the murky restrictions around NFTs. Well-defined limits must be created to stop wash trading and other fraudulent practices as the NFT sector expands.

Conclusion

Although NFTs have added a new level of excitement to the cryptocurrency industry, they also provide unique difficulties. Riley’s CryptoPunk event serves as a reminder of the value of comprehending the procedures involved in working with NFTs and the necessity for improved front-end procedures and user interfaces in the crypto ecosystem. Another problem that calls for clear restrictions is the rise of wash trading in the NFT market. Creating a solid framework to safeguard investors and stop fraudulent actions as the NFT sector develops is crucial.