- Long-term XRP holders believe sustained adoption could dramatically reshape portfolio value over time

- Many analysts see 1,000 to 10,000 XRP as meaningful exposure for future growth

- Institutional interest and ETF inflows continue to support XRP’s long-term investment narrative

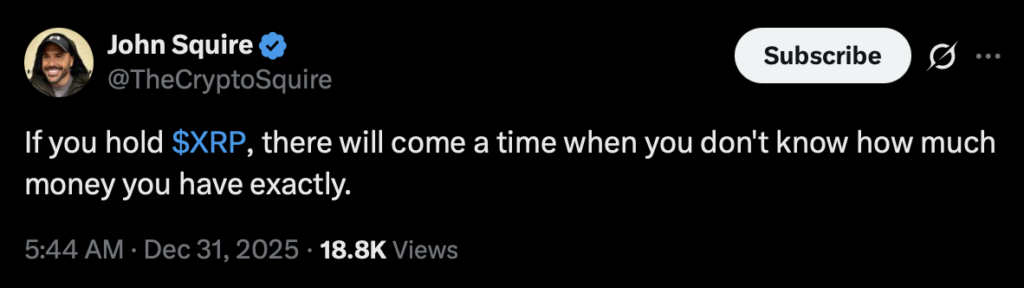

Finance commentator and long-time XRP advocate John Squire recently stirred discussion by pointing to the long-term impact of simply holding XRP. According to him, investors who stay positioned for years may eventually reach a point where tracking the exact value of their holdings becomes surprisingly difficult. The idea sounds bold, but it reflects a wider optimism inside the XRP community about where the asset could land if adoption keeps unfolding as expected.

His comments aren’t framed as a precise prediction, but more as a reflection of scale. If XRP becomes deeply embedded in global financial infrastructure, even early assumptions about value could feel outdated. For supporters, that possibility alone keeps long-term conviction alive, even during slower market periods.

Growing Expectations Around XRP Wealth Potential

Across the XRP ecosystem, many investors believe time is the most important variable. Institutional adoption, ongoing ETF developments, and gradual integration into real-world payment rails are often cited as the main drivers behind this optimism. The thinking is simple, if XRP keeps finding utility, price appreciation tends to follow, even if it’s uneven along the way.

Bark, founder of an XRP-focused NFT project, has echoed this sentiment, suggesting that XRP could eventually support retirement-level financial security for disciplined long-term holders. It’s not about overnight gains, he argues, but about letting the asset mature while remaining patient, even when markets cool or sentiment drifts.

How Much XRP Is Considered Meaningful Exposure

The question of how many tokens are “enough” remains a regular topic of debate. While opinions vary, many analysts point to holdings between 1,000 and 10,000 XRP as offering meaningful long-term exposure without requiring extreme capital. Edoardo Farina, for example, has previously suggested that 1,000 XRP represents a reasonable minimum for investors who are serious about future upside.

At current prices near $1.85, 1,000 XRP costs roughly $1,850, while 5,000 XRP comes in around $9,250. A 10,000 XRP position sits closer to $18,500, a figure many community members view as manageable compared to the potential long-term outcomes they envision.

Long-Term Price Forecasts Fuel the Narrative

Forecasts for XRP stretch across a wide range, depending on who you ask. Telegaon projects XRP could trade between $80 and $120 by the 2035–2040 window, which would place 1,000 XRP near $100,000 and 10,000 XRP around $1 million. More aggressive outlooks, like those from Changelly, suggest prices between $150 and $200 in the same timeframe, pushing a 10,000 XRP holding toward $2 million.

Some analysts, including Jake Claver, have floated even higher scenarios, proposing four-digit XRP prices if the asset becomes a foundational layer in global finance. Those projections are clearly speculative, and would require massive adoption and market expansion, but they continue to shape long-term holder psychology.

Institutional Interest Adds Weight to the Thesis

Recent institutional activity has added fresh fuel to XRP’s long-term story. Spot ETF launches tied to firms such as Franklin Templeton, Grayscale, Bitwise, and Canary Capital reportedly absorbed around $1.25 billion worth of XRP in a short period. While ETF flows can fluctuate, analysts note that sustained inflows tend to tighten supply over time.

Beyond ETFs, XRP’s use in corporate treasury management and cross-border settlement continues to grow quietly. Squire’s remarks ultimately point back to patience rather than price targets. If adoption keeps expanding, today’s valuations may look small in hindsight, even if the path there isn’t smooth or predictable.