- A BlackRock-linked wallet sent $101M in BTC and $22M in ETH to Coinbase Prime

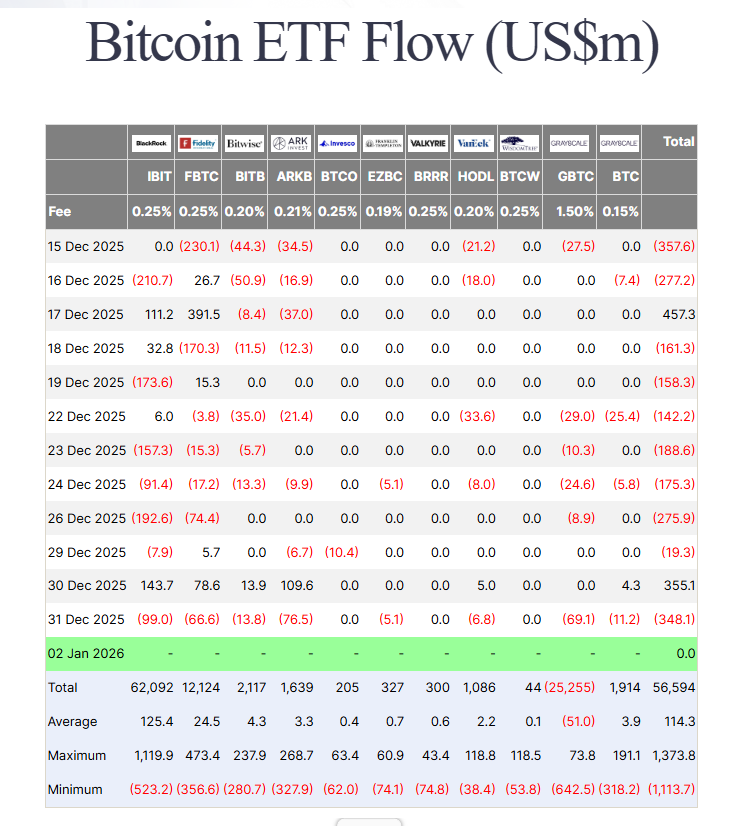

- U.S. spot Bitcoin ETFs saw $348M in net outflows on Dec. 31

- BlackRock’s IBIT led the withdrawals but still holds over $67B in BTC

A wallet labeled as belonging to BlackRock transferred 1,134 Bitcoin worth roughly $101 million and 7,255 Ethereum valued at about $22 million to Coinbase Prime on Wednesday, according to on-chain data from Arkham Intelligence. Coinbase Prime serves as the institutional custody and trading arm of the exchange, commonly used by large asset managers and ETF issuers.

The timing of the transfers has drawn attention as they coincide with renewed outflows across U.S.-listed crypto exchange-traded products.

Bitcoin and Ethereum ETF Outflows Pick Up Into Year-End

According to data from Farside Investors, U.S. spot Bitcoin ETFs returned to net outflows on December 31, shedding a combined $348 million as markets wrapped up 2025. BlackRock’s iShares Bitcoin Trust (IBIT) accounted for $99 million of that total, leading withdrawals for the day.

Despite the outflows, IBIT remains the dominant spot Bitcoin ETF. The fund currently holds 770,791 BTC, valued at approximately $67.4 billion, giving it a commanding lead over competitors in both assets under management and market share.

What These Transfers May Signal

Transfers to Coinbase Prime do not necessarily indicate immediate selling. Institutional flows often reflect portfolio rebalancing, ETF share redemptions, or internal custody movements tied to creation and redemption activity. Still, the scale of the transfers highlights how actively large managers are managing exposure amid shifting market conditions.

With ETF flows turning negative into year-end, traders will be watching closely to see whether institutional demand stabilizes or continues to soften in early 2026.