- Anthony Scaramucci believes Solana could flip Ethereum through faster growth, not ETH decline.

- Solana generated nearly $1.5 billion in network revenue over the past year.

- The flippening remains uncertain, but momentum is clearly building into 2026.

Crypto markets took their fair share of bruises in 2025, leaving investors cautious as 2026 approaches. Still, fresh narratives are starting to surface, and one of the loudest comes from SkyBridge Capital founder Anthony Scaramucci. His claim that Solana could eventually flip Ethereum has reignited a long-running debate about speed, scale, and real-world usage. The question now is whether this idea is just talk, or something that could actually materialize in the year ahead.

Why Scaramucci Thinks Solana Has the Edge

In a recent interview, Scaramucci laid out his case for Solana without dismissing Ethereum outright. He argued that Solana’s explosive activity growth, low fees, and developer-friendly environment give it a structural advantage. According to him, Solana already processes more activity than dozens of other chains combined, all while keeping costs minimal and performance high.

Importantly, Scaramucci framed the flippening not as Ethereum failing, but Solana growing faster. He pointed to staking incentives, strong tokenomics, and products like liquid staking ETFs as additional reasons Solana continues to attract long-term capital.

Network Usage and Revenue Are Backing the Narrative

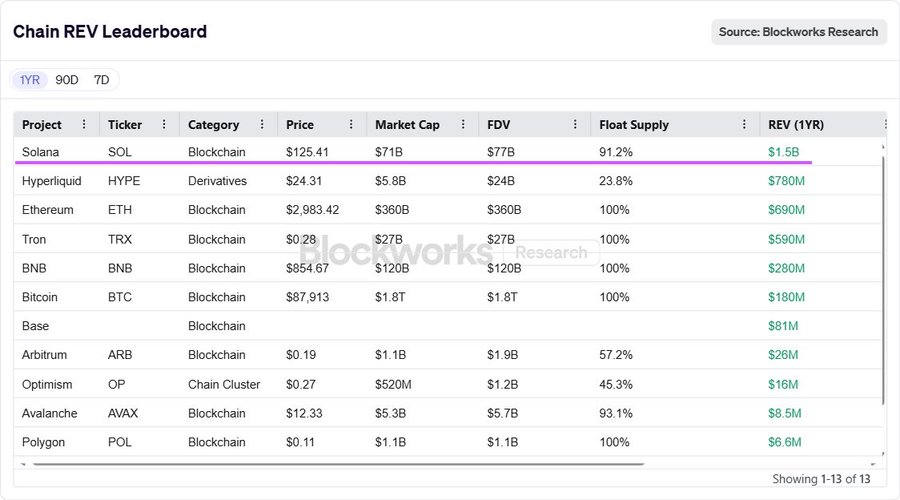

Beyond opinions, Solana’s onchain data is starting to turn heads. According to figures shared by CryptoRUs, Solana generated nearly $1.5 billion in network revenue over the past year. That total reportedly exceeded the combined revenue of Ethereum and other major competitors during the same period, a notable shift in how value is being captured onchain.

The revenue surge reinforces the idea that Solana’s “low fees, high throughput” model isn’t just about user experience. At scale, constant activity can still translate into meaningful top-line numbers, even without expensive transaction costs.

What This Means for 2026

Flipping Ethereum remains a tall order. Ethereum still dominates DeFi, developer mindshare, and institutional integration. But Solana’s momentum, particularly in usage and revenue, suggests it’s no longer just an alternative chain riding hype cycles. If current trends persist, 2026 could see the gap narrow further, even if a full flip doesn’t happen immediately.

For now, the Solana-versus-Ethereum debate looks less like speculation and more like a question of execution. Whether Solana can sustain growth through volatile markets will likely decide how realistic this narrative becomes.