- Dogecoin remains under short-term selling pressure, but rising volume suggests active positioning rather than capitulation.

- A potential double bottom is forming, though price must reclaim the $0.132–$0.138 zone to confirm any reversal.

- Failure to hold the $0.1205 support level could expose DOGE to another leg lower toward the $0.108 area.

Dogecoin (DOGE) is trading around $0.123 after slipping roughly 2.7% over the past 24 hours. The session leaned heavy on the sell side, with brief intraday bounces failing to gain any real traction. Momentum indicators stayed soft, and sentiment never really flipped positive.

What stood out, though, was participation. Trading volume climbed more than 13% to about $858 million, showing that traders are still very active, even as price drifts lower. Over the last week, DOGE is down just over 5%, keeping the short-term trend tilted firmly to the downside.

Double Bottom Takes Shape, But Confirmation Is Missing

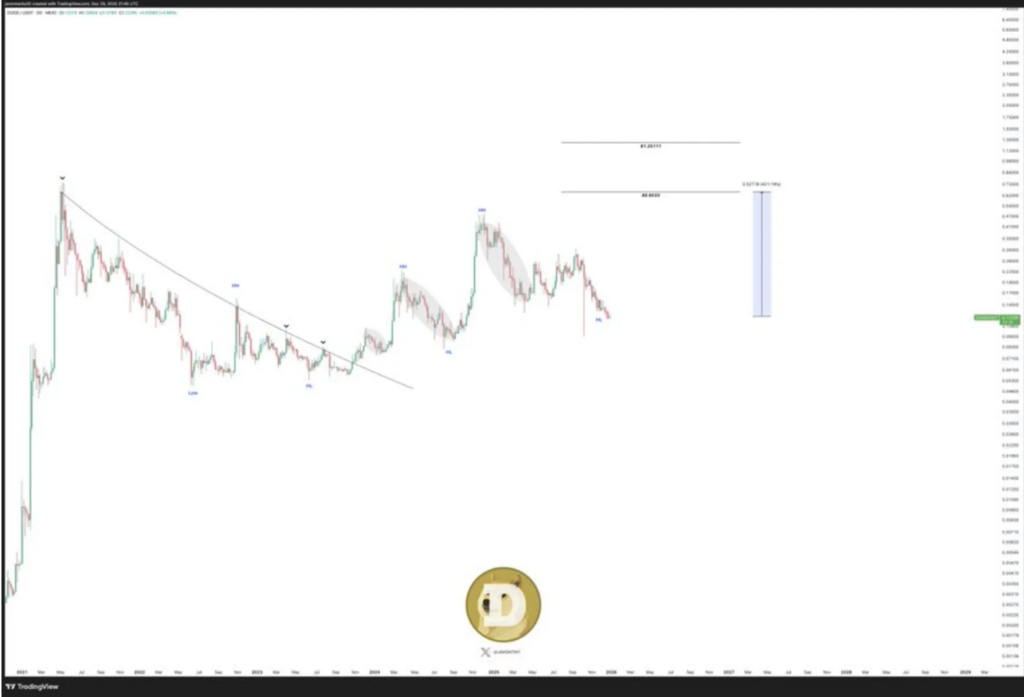

According to analyst CryptoPulse, DOGE’s daily chart is beginning to hint at a potential double bottom. In theory, this type of structure can mark seller exhaustion. In practice, it means very little until price confirms it.

Right now, the formation is fragile. The key resistance band sits between $0.132 and $0.138. A clean daily close above that zone would be the first sign that short-term bias is shifting. Without it, every bounce risks turning into another rejection.

If DOGE does manage to break above that neckline, the next upside area appears near $0.147. That level would act as an early follow-through target. Still, without stronger volume and consistent closes, upside attempts remain vulnerable, and traders are treating rallies with caution rather than confidence.

Bigger Targets Exist, But They’re Long-Term Stories

Zooming out, longer-term projections tell a very different story. Analyst Javon Marks has pointed out that DOGE’s broader structure still supports a much higher breakout scenario. His primary target sits near $0.653, more than 400% above current price.

Marks also outlined a secondary extension toward $1.25 if DOGE can clear that first major resistance. These levels are not meant for short-term positioning, though. They reflect a wider-cycle thesis that assumes sustained trend strength over time, not the choppy conditions seen today.

In the near term, DOGE remains very much a technical trade, driven by support and resistance rather than long-range optimism.

$0.1205 Support Remains the Line in the Sand

From a risk perspective, CoinLore data highlights $0.1205 as the level that matters most right now. Holding above it keeps recovery attempts alive and opens the door for another test of resistance near $0.134.

If that resistance gives way, price could work higher toward $0.149 and potentially $0.165. On the flip side, a decisive loss of $0.1205 would weaken the structure quickly. In that case, the next meaningful support sits closer to $0.109.

Until one of those levels breaks with conviction, Dogecoin remains stuck in a waiting game, moving sideways within a tightening range as traders look for confirmation rather than guessing the next move.