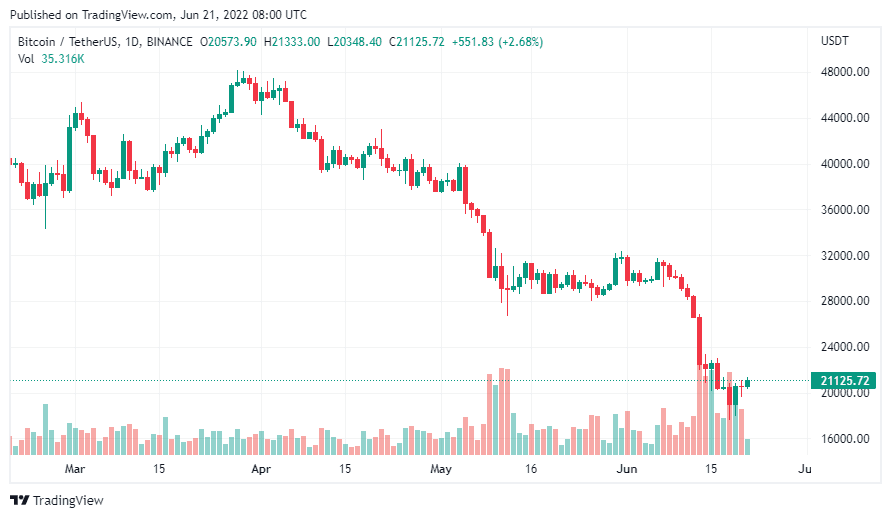

The crypto industry was fearful this Monday as Bitcoin struggled to maintain its value above a key level. This is joined by investor fears that if major assets like Bitcoin continue to struggle further, it could negatively affect the entire crypto market.

Bitcoin, the OG and most popular coin in crypto, traded below an already dangerously low $20,000 earlier this morning.

The coin even dropped as low as $17,592, which is the most drastic dip since its value of $20,000 in December of 2020. This year it fell nearly 60% of its value and over 37% just this month alone.

Its fall follows problems at several major industry players. Further declines, market players said, could have a knock-on effect as other crypto investors are forced to sell their holdings to meet margin calls and cover losses.

Three Arrows Capital, a cryptocurrency hedge fund, is said to be exploring new options that include the liquidation of assets and a bailout by another firm. This announcement came on the same day that the crypto lender Babel Finance announced it would suspend withdrawals.

Even crypto lender company Celsius Network said earlier this month that they would do the same and suspend customer withdrawals. Although the company did elaborate by saying they are working closely with regulators and officials to do it in a legal and sustainable manner.

Adam Farthing, chief risk office for Japan at crypto liquidity provider B2C2, said, “There is a lot of credit being withdrawn from the system and if lenders have to absorb losses from Celsius and Three Arrows, they will reduce the size of their future loan books which means that the entire amount of credit available in the crypto ecosystem is much reduced.”

“It feels very like 2008 to me in terms of how there could be a domino effect of bankruptcies and liquidations,” Farthing continued.

Smaller tokens correlated with Bitcoin’s price fall, with the number 2 most popular coin, Ethereum, dropping below $1000 briefly.

The fall in crypto markets has coincided with a slide for equities, as US stocks suffered their biggest weekly percentage decline in two years on fears of rising interest rates and the growing likelihood of recession.

Bitcoin and all cryptos are theoretically supposed to exist independently of stock market but lately have proven to be closely correlating.

The overall crypto market capitalisation is roughly $877 billion, according to price site Coinmarketcap, down from a peak of $2.9 trillion in November 2021.

A fall in stablecoins — a type of crypto designed to hold a steady value — is also suggesting investors are pulling money from the sector as a whole.