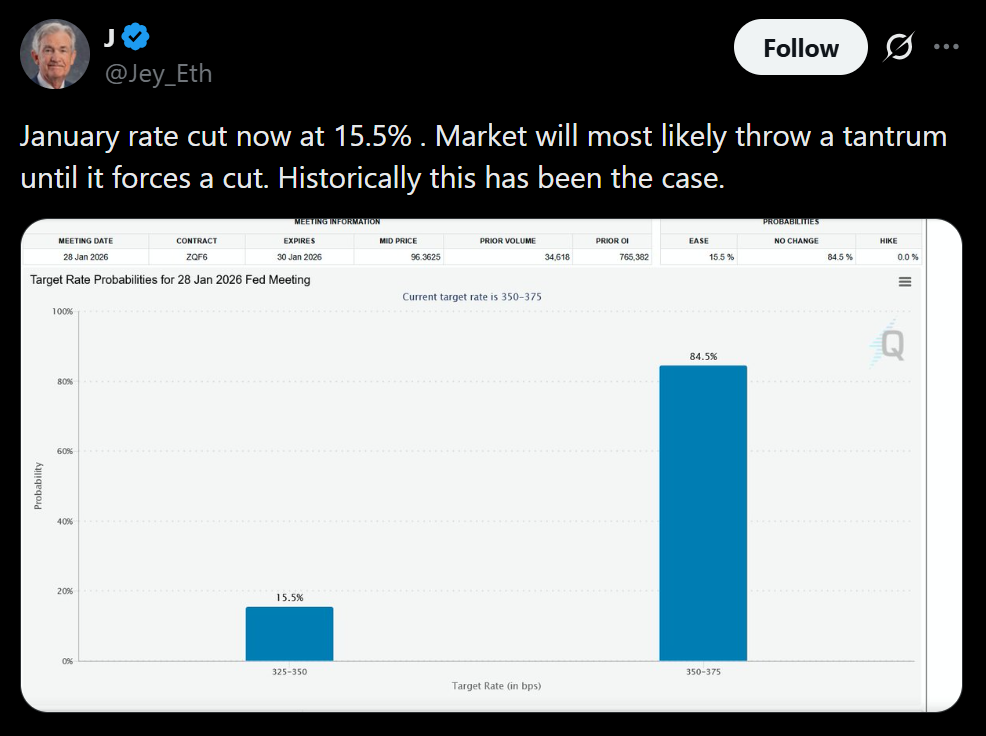

- Polymarket shows January Fed rate cut odds at an all-time low of 13%.

- Strong GDP data has erased expectations for near-term easing.

- Crypto markets may face tighter liquidity until at least April or 2026.

Market participants, including crypto traders, have sharply reduced expectations for a January Federal Reserve rate cut following the release of stronger-than-expected U.S. GDP data. The shift is notable for crypto markets, especially Bitcoin, which benefited heavily from rate cuts earlier this year and is now facing a year-end liquidity squeeze.

Strong GDP Pushes Rate Cut Odds to Record Lows

The latest U.S. GDP report showed the economy growing at a 4.3% pace in the third quarter, beating expectations of 3.3% and accelerating from 3.8% in Q2. That resilience has changed the policy outlook, with markets increasingly convinced the Fed has little reason to ease again in January.

On Polymarket, odds of a January rate cut have now dropped to an all-time low of 13%, with traders assigning roughly an 86% probability that the Fed keeps rates unchanged. The collapse in odds highlights how decisively sentiment has turned against near-term easing.

Crypto Traders Pull Back Aggressively

The move lower in rate cut expectations comes after the Fed already delivered three cuts this year, actions that helped fuel Bitcoin’s rally to new highs. With growth holding firm and inflation still a concern, traders now expect the Fed to pause and reassess rather than push further stimulus into the system.

New York Fed President John Williams echoed that view, noting that policymakers are in a solid position after this year’s cuts and see no urgency to move again without clearer justification.

Focus Shifts to April and 2026

With January increasingly ruled out, attention has shifted toward April as the earliest potential window for another cut. Even then, uncertainty remains high, with markets split on whether easing will materialize that soon.

Further out, crypto traders on Polymarket are betting that the bulk of rate cuts will come in 2026, not early 2025. Several Fed officials, including Austan Goolsbee, have suggested additional cuts are possible next year, but only if inflation shows meaningful progress lower.

What This Means for Crypto Markets

For crypto, the all-time low odds of a January rate cut signal tighter liquidity conditions ahead. Bitcoin’s explosive moves earlier this year were closely tied to monetary easing, and the fading prospects of near-term cuts help explain the market’s current hesitation. Until growth slows or inflation cools more decisively, risk assets may remain under pressure.