- XRP trades near $1.91, roughly 50% below its July 2025 peak.

- Bulls argue regulation and institutional adoption are being ignored by the market.

- ETF launches and Ripple’s expansion continue to strengthen the long-term case.

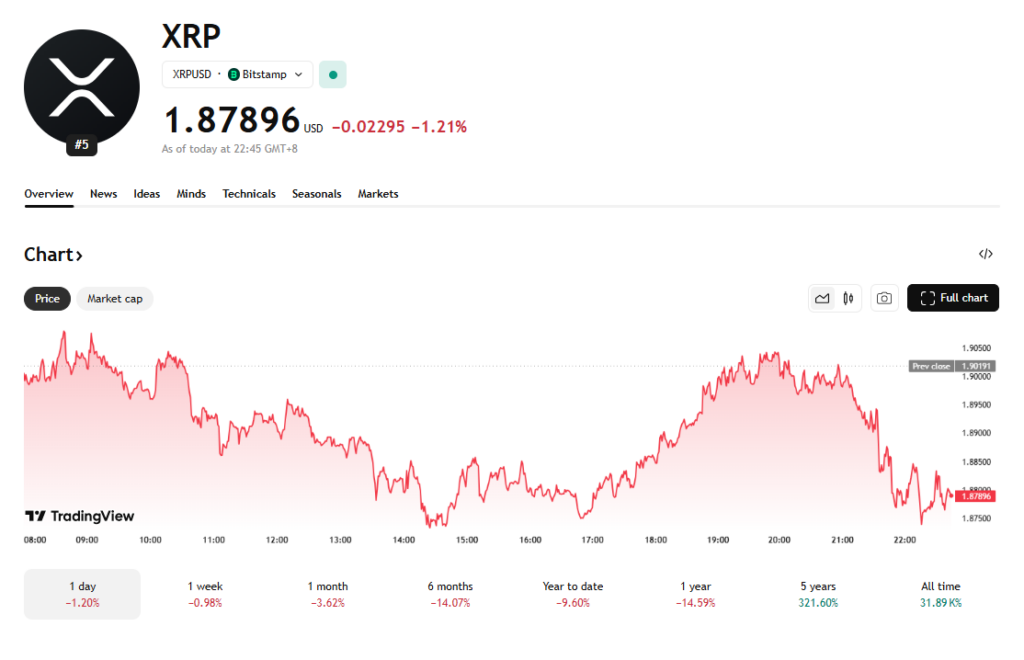

XRP is once again at the center of a growing debate as it trades around $1.91, nearly 50% below its July 2025 peak of $3.66. The price weakness has sparked frustration among long-term holders, but it has also intensified claims that XRP could become one of the biggest missed investment opportunities of this generation. Commentators like Coach JV argue that current prices fail to reflect the scale of structural changes taking place behind the scenes.

Price Weakness Masks a Changing Foundation

Despite little movement over the past 24 hours and a roughly 4% dip on the weekly timeframe, some analysts believe XRP’s current valuation is misleading. Price action remains stuck below key psychological levels, raising doubts among short-term traders. Still, supporters of the XRP bull case point out that today’s environment is materially different from the one that fueled the previous rally to $3.66.

Regulatory clarity is improving, and institutional pathways that once didn’t exist are now forming. The CLARITY Act, expected to move toward markup in January 2026, is increasingly viewed as a potential unlock for broader institutional participation. That backdrop, bulls argue, is not yet reflected in XRP’s market price.

Coach JV summed up the sentiment bluntly, saying that people often prioritize short-term status purchases over long-term wealth opportunities, framing XRP as a classic case of misplaced priorities rather than a lack of capital.

Institutional Adoption Continues to Build

Beyond regulation, Ripple’s institutional footprint has expanded steadily. The company’s $1 billion acquisition of GTreasury positioned Ripple closer to the $120 trillion corporate treasury market, opening potential use cases for XRP in payments, liquidity, and treasury operations. RippleNet now counts more than 300 banking partners globally, including major names like Santander, SBI Holdings, and Standard Chartered.

On-Demand Liquidity continues to process billions in cross-border transactions, reinforcing XRP’s role as a functional asset rather than a purely speculative token. In November 2025, the launch of three XRP ETFs from Canary Capital, Franklin Templeton, and Grayscale further integrated XRP into traditional investment channels, echoing the early stages of Bitcoin’s ETF-driven adoption cycle.

Aggressive Price Targets Fuel the Investment Alert

XRP price predictions remain wide-ranging, but the most optimistic forecasts are driving renewed attention. Analysts like Alex Cobb argue that XRP trading below $2 represents a rare accumulation zone. Others have gone much further, with YoungHoon Kim suggesting XRP could reach triple-digit prices by the end of the decade if adoption and regulation align.

Under those assumptions, even modest holdings could translate into life-changing outcomes, a narrative that continues to resonate with long-term believers. Whether those projections materialize or not, the growing disconnect between price and fundamentals is what keeps the missed opportunity debate alive.

A Market Still Deciding

For now, XRP remains caught between skepticism and conviction. The price reflects caution, but the underlying ecosystem is expanding in ways that were absent during previous cycles. If regulatory progress and institutional adoption continue on their current path, today’s prices may eventually look very different in hindsight.