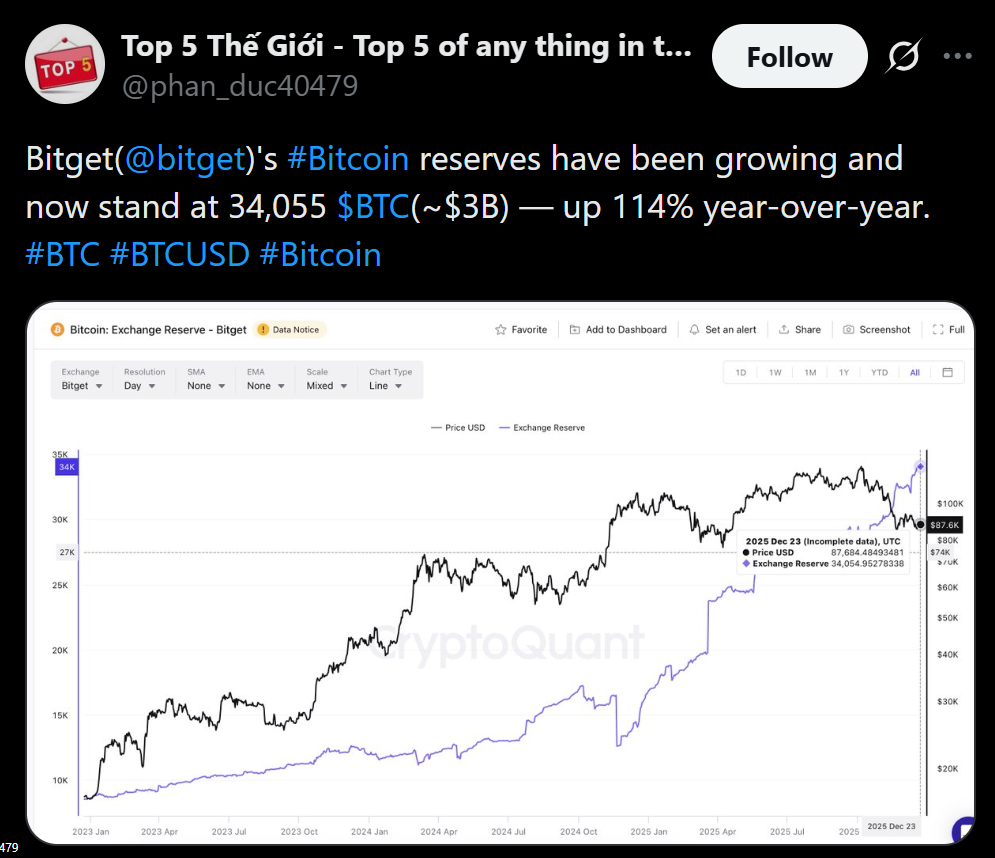

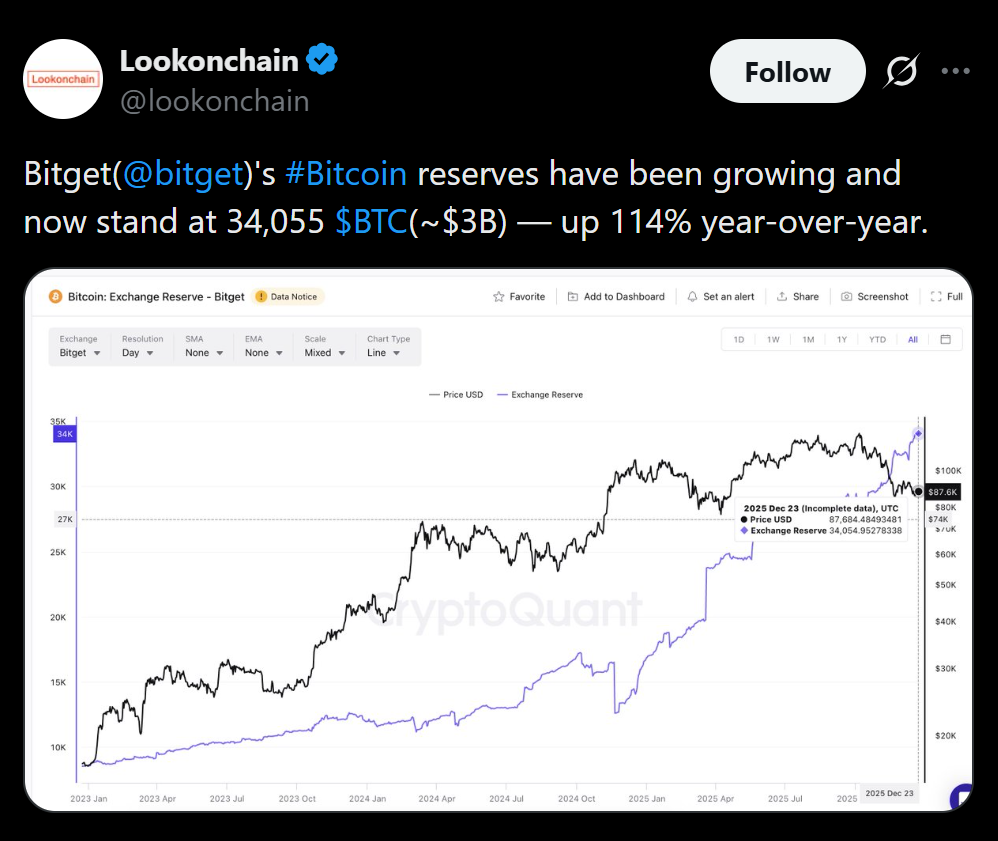

- Bitget now holds 34,055 BTC worth about $3 billion.

- Bitcoin reserves grew 114% year-over-year through steady accumulation.

- The exchange reports surplus coverage across BTC, ETH, USDC, and USDT.

Bitget has quietly but aggressively expanded its Bitcoin holdings over the past year, more than doubling its reserves as institutional interest in crypto continues to rise. As of December 2025, the exchange holds 34,055 BTC worth roughly $3 billion, representing a 114% year-over-year increase. The buildup signals a clear focus on balance sheet resilience at a time when transparency and solvency matter more than ever.

Bitcoin Accumulation Picked Up Speed in 2025

Bitget’s reserve growth accelerated steadily throughout the year rather than arriving in a single burst. The exchange held 28,022 BTC in August, increased that figure to 30,300 BTC by October, and added roughly another 4,000 BTC by December. The pace of accumulation suggests growing confidence and a deliberate strategy rather than reactive positioning.

A Broader Push for Over-Collateralization

Bitcoin isn’t the only asset where Bitget is running with a surplus. According to the exchange’s December reserves report, Bitget maintains full backing across all major assets. Coverage currently stands at 300% for Bitcoin, 183% for Ethereum, 129% for USDC, and 100% for USDT. That level of over-collateralization is designed to reassure users amid heightened scrutiny of centralized exchanges.

Why This Matters for the Market

As institutional participation increases, exchanges are under pressure to demonstrate financial strength and risk discipline. Bitget’s expanding reserves point to a strategy centered on credibility and long-term positioning rather than short-term optics. In an environment where proof-of-reserves has become table stakes, excess coverage may increasingly separate trusted platforms from the rest.