- SHIB is down sharply from recent highs, with many newer investors facing heavy losses after the 2021 bull run.

- Despite the decline, Shiba Inu remains one of crypto’s top long-term performers due to its historic 12.9 million percent rally from all-time lows.

- Optimism persists around regulatory clarity and potential ETF developments, though risks remain high and outcomes are far from guaranteed.

Shiba Inu’s price history hasn’t been kind to recent buyers. Over the past few months, SHIB holders have sat through a brutal drawdown, watching portfolio values shrink as the token slid lower and lower. Anyone who bought around March 2024, near $0.000045, is now staring at losses of roughly 84%, with SHIB trading closer to $0.00000728. Even investors who entered earlier in the year, when prices hovered around $0.000021, are still down more than 65%.

It’s been uncomfortable, no doubt. The kind of downturn that tests patience and forces people to rethink conviction.

A Historic Rally That Still Defines SHIB’s Reputation

And yet, despite all that damage, Shiba Inu continues to be labeled one of crypto’s most successful performers. That sounds odd at first, until you zoom way out. SHIB’s reputation is anchored to one thing above all else, its absurd rise from the very bottom.

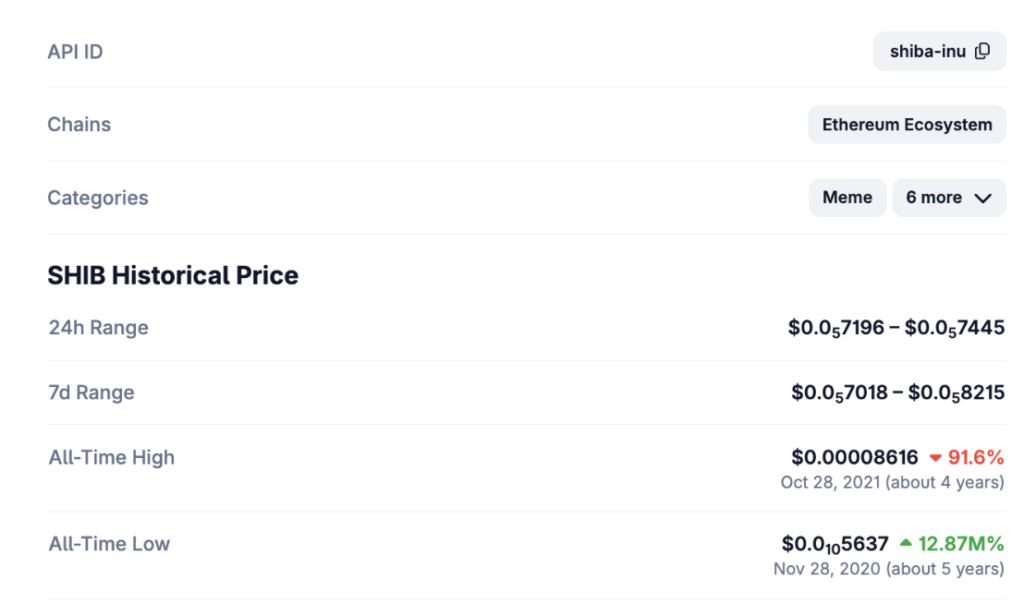

Back in November 2020, just months after launch, SHIB traded at an almost invisible price of $0.00000000005637. From that level, the token has climbed more than 12.9 million percent, according to CoinGecko data. It’s the kind of number that barely feels real. A $100 investment near those lows would be worth roughly $12.9 million today, even after all the recent pain.

That early explosion still shapes how many investors think about SHIB, even if the current chart looks ugly.

Newer Holders Feel the Weight of the Downtrend

For those who arrived after the 2021 frenzy, the story is very different. SHIB is now down more than 91% from its all-time high, and many newer holders are deep in the red. The long, grinding decline has erased enthusiasm and turned what once felt like easy upside into a test of endurance.

To be fair, Shiba Inu isn’t alone here. Bitcoin and Ethereum have also suffered major pullbacks in recent cycles, though their losses have been far less severe. Still, the contrast highlights how unforgiving meme-driven assets can be once momentum fades.

Why Some Investors Still Believe a Rebound Is Possible

Even with all the damage, optimism hasn’t disappeared. A portion of the SHIB community continues to believe another comeback is possible, largely because of what the token has already done once before. History doesn’t repeat perfectly, but it tends to shape expectations.

Broader market developments are adding fuel to that hope. Regulatory clarity, especially around the proposed CLARITY Act, has investors betting that institutional capital could finally flow more freely into crypto. If that happens, speculative assets like SHIB could benefit disproportionately.

There’s also growing chatter around ETFs. While Shiba Inu already secured a SEK-denominated ETP in Europe, a U.S. spot ETF remains the bigger prize. SHIB has been mentioned as a potential component in future ETF products, including speculation around T. Rowe Price and Grayscale frameworks. None of this is guaranteed, but the narrative is there, and markets tend to move on narratives long before confirmations arrive.

Caution Still Matters, Even for Believers

At the end of the day, Shiba Inu’s story is a mix of extremes. Massive early gains, crushing drawdowns, and persistent hope layered on top. The token’s past proves what’s possible, but it doesn’t promise a repeat.

For investors, optimism should probably be balanced with realism. Crypto has a habit of surprising everyone, sometimes to the upside, sometimes not. SHIB’s future may include another rally, or it may simply continue to drift. Either way, certainty is the one thing this market never offers.