- AAVE fell nearly 10% in hours after a whale sold over 230K tokens, triggering heavy sell-side volume.

- Price is now testing a critical higher-timeframe trendline around the $160–$162 zone.

- Holding this level could spark stabilization, while failure may open downside toward $140–$130.

AAVE saw a sharp change in tone after price slipped hard from the $175–$176 zone and tumbled into the mid-$150s in a matter of hours. The move wasn’t slow or hesitant. It was fast, heavy, and backed by a surge in volume of more than 220%, which usually points to aggressive selling rather than casual profit-taking.

At that point, the narrative shifted. Traders stopped asking what caused the drop and started focusing on what happens next. With AAVE now trading below its recent value area, the pressure is on buyers to show up. If they don’t, the market may not be done moving lower just yet.

Whale Selling Sparks The Move Lower

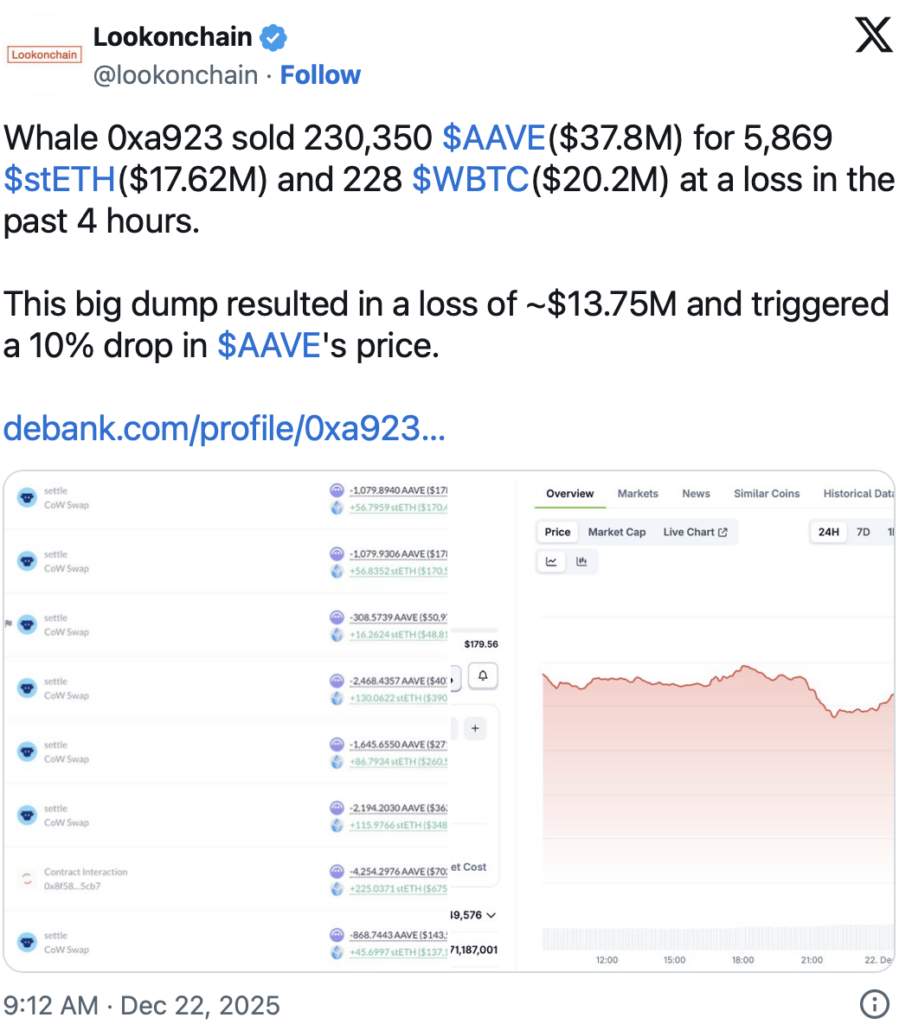

Not long after AAVE cracked below intraday support, on-chain data began to tell a clearer story. A large holder stepped in and unloaded a sizable position right as sell volume exploded. The timing lined up almost too perfectly, suggesting this wasn’t broad market panic but a concentrated supply event.

According to Lookonchain, the whale dumped more than 230,000 AAVE within a short window. What stands out is that the selling happened at a loss, likely influenced by already weak retail sentiment across the market. That wave of supply dragged AAVE down nearly 10%, briefly tagging the $155 area before a modest bounce back toward $160.

The speed of the move matters here. This didn’t look like rotation or sloppy execution. It looked like intentional risk reduction, fast and decisive, with little regard for short-term price impact.

Where AAVE Stands Now On Higher Timeframes

After the drop, AAVE is now sitting at a much more important level. On the weekly chart, price is pulling back toward an ascending trendline that has held multiple times since mid-2023. Right now, the $160–$162 zone is acting as a decision area rather than a clear support or resistance.

If AAVE manages to hold this trendline and attract steady bids, a bounce back toward the $180–$200 region isn’t out of the question. That would look more like a mean reversion than a full trend restart, but it would still matter. On the other hand, a weekly close below this structure could open the door toward the $140–$130 range, where stronger historical support sits.

Momentum indicators are already showing fatigue. OBV has started to roll over, and upside follow-through has been lacking. That doesn’t doom the structure, but it does mean buyers can’t afford to stay passive here.

So, Was This Just A Shock Or Something Bigger?

The sell-off clearly damaged AAVE’s short-term momentum, there’s no sugarcoating that. Still, the broader structure hasn’t completely fallen apart yet. Price is sitting right on a higher-timeframe level where the market has to make a choice.

If buyers defend this area and AAVE can reclaim its prior value zone, it would suggest the market has absorbed the whale selling and is ready to stabilize. If not, the recent losses may need more time to settle, and downside risk remains very real.

For now, it’s less about predictions and more about reactions. Watching how price behaves around this support will tell the real story. Patience, as usual, is doing most of the heavy lifting here.