- Solana’s network activity has fallen nearly 97% from its 2024 peak, dragging SOL sharply lower.

- The collapse of memecoin trading exposed how reliant recent growth had become on speculative demand.

- Institutional interest remains, but SOL’s next move depends on whether real usage replaces lost activity.

Solana’s on-chain activity has taken a sharp hit in Q4 2025, and the price didn’t escape the fallout. Network usage is down roughly 97% from its peak, and SOL followed with a heavy drawdown of its own.

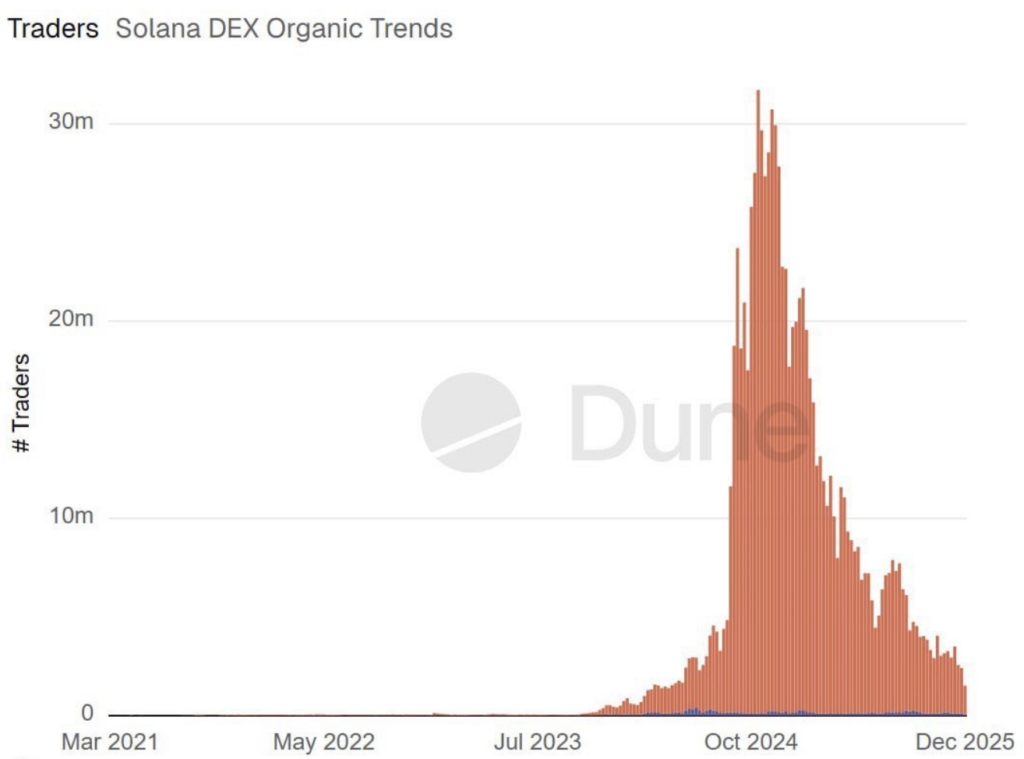

At its height in late 2024, Solana was buzzing with more than 30 million active traders. Fast forward to 2025 and that number has collapsed to under 1 million monthly users. It’s no surprise some analysts are starting to ask the uncomfortable question out loud — is this just a cooldown, or something deeper breaking underneath?

To be fair, late-2025 hasn’t been kind to crypto overall. Bitcoin dropped more than 30% during the same stretch. But Solana’s situation feels a bit more specific, and that’s what has people watching closely.

Memecoins: Stress Test or Structural Risk?

Solana and Hyperliquid were two of the biggest winners of this cycle. SOL itself surged from around $8 to nearly $300, a massive 35x move from the depths of the 2022 bear market.

A big part of that growth came from memecoins. They drove traffic, fees, and attention, even as the network improved stability and cut down on outages. When markets turned risk-off in 2025, memecoins were the first domino to fall. Activity vanished fast.

Still, long-time Solana supporters argue this wasn’t wasted growth. Commentators like Marty Party have framed memecoins as a kind of “liveness test” for the chain. In that view, gamblers stress the system, then leave, making room for more serious users later on. Equity traders, stablecoin flows, and real-world use cases are supposed to follow.

The problem is timing. As memecoin activity dried up, SOL slid from nearly $300 down to the $120 support zone, a painful 58% drop. That exposed how dependent near-term demand had become on speculative traffic.

Institutional Interest vs. Usage Reality

There are signs Solana isn’t being written off entirely. Visa’s involvement in stablecoin settlements is often cited as proof the chain still matters at an institutional level. If network usage gradually shifts away from pure speculation, Solana could stabilize in a healthier way.

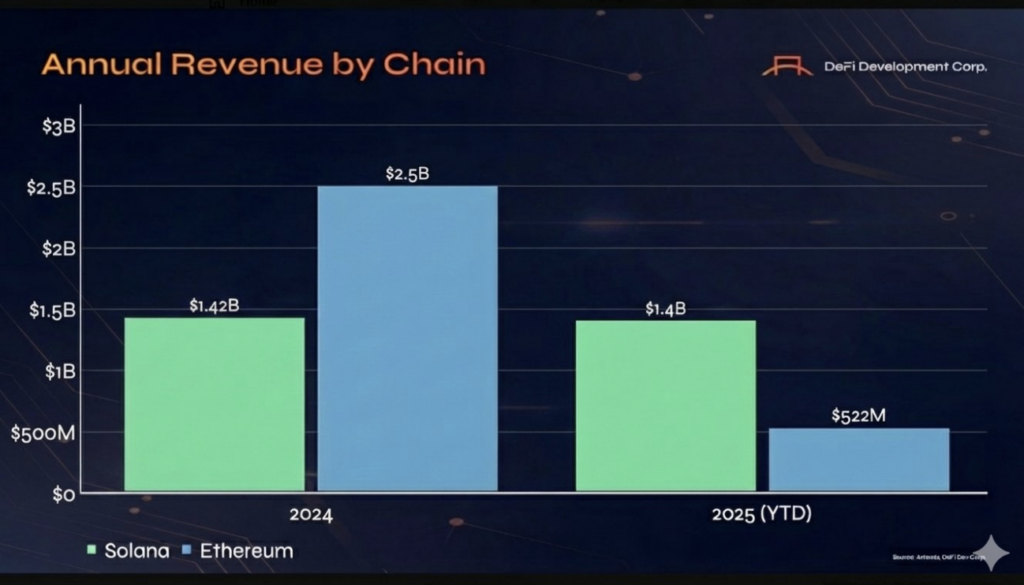

That shift also matters when comparing Solana to Ethereum. ETH remains the clear leader in institutional adoption and revenue. In 2025 alone, Ethereum generated more than $1.4 billion, while Solana brought in roughly $502 million — about a threefold gap.

What’s more concerning is the trend. In 2024, Solana reportedly generated around $2.5 billion in revenue. That implies a steep, almost fivefold drop this year. Even Solana co-founder Anatoly Yakovenko admitted it’s been a strange ride, noting that whether permissionless protocols can grow and sustain revenue is still very much an open question.

Price Performance and What Comes Next

From an investor perspective, the story hasn’t been pretty. SOL has underperformed ETH by about 56% this year, a sharp reversal from 2024 when Solana outpaced Ethereum by more than 24%.

Some forecasts are blunt. Fundstrat has suggested SOL could revisit the $50–$75 range in the first half of 2026 if weakness persists. Others are less pessimistic. Analyst Ted Pillows sees a higher chance of a short-term rebound, pointing to nearly $1 billion in upside liquidity tied to leveraged short positions. In that scenario, a 15% move toward the $134–$140 range wouldn’t be shocking.

For now, Solana sits at a crossroads. The memecoin wave is gone, activity is quiet, and price has corrected hard. Whether the next chapter brings real adoption or further erosion will likely depend on what fills the gap left behind.