- Bitcoin price weakness has pushed fundamentals back into focus this cycle

- MicroStrategy continues to accumulate BTC despite market volatility

- Tokenized Bitcoin growth is strengthening long-term institutional adoption signals

This cycle has quietly shifted the focus back to fundamentals, and it’s starting to show. Price action across crypto has been messy, sharp drops followed by fast rebounds, with no real sense of stability sticking around for long. That kind of movement tends to mess with sentiment, and it did.

The Fear and Greed Index reflected exactly that. Confidence kept flipping between extreme fear and plain old fear, almost week to week, as traders struggled to find solid footing.

Bitcoin diverges from risk assets

What stood out this time was the divergence. On the charts, Bitcoin began losing relative strength against traditional risk-on assets and even legacy markets. The S&P 500, for example, climbed roughly 2.18% quarter-to-date, while BTC slid around 22%, sitting just 7% away from wiping out the prior quarter’s gains entirely.

That gap matters. It signals that price isn’t telling the whole story right now, and that’s where fundamentals start creeping back into the conversation, whether the market likes it or not.

Saylor doubles down on the long game

This is where Michael Saylor’s recent comments start to land. In a recent interview, he argued that Bitcoin’s fundamentals remain strong this year, despite the ugly price action. According to AMBCrypto, that statement carries weight, mostly because the big players seem to agree.

MicroStrategy didn’t slow down. The company added roughly 31,000 BTC this quarter, sticking firmly to its thesis and ignoring short-term volatility. That kind of conviction suggests something bigger, a possible shift in how the market processes fear, uncertainty, and doubt, with fundamentals doing more of the heavy lifting.

Bitcoin as the next-generation store of value

Looking ahead, MicroStrategy’s roadmap is clearly built for the long haul. Saylor has pointed to AI-driven financial modeling, an expanded digital gold narrative, regulatory easing, and even quantum-related fears as catalysts that could reshape Bitcoin’s role. In his view, MSTR could end up holding 5–7% of Bitcoin’s total supply over the coming years.

At the heart of that confidence are two trends: growing Bitcoin tokenization and improving regulatory clarity. Together, they form the backbone of what Saylor believes will unlock the next wave of institutional adoption.

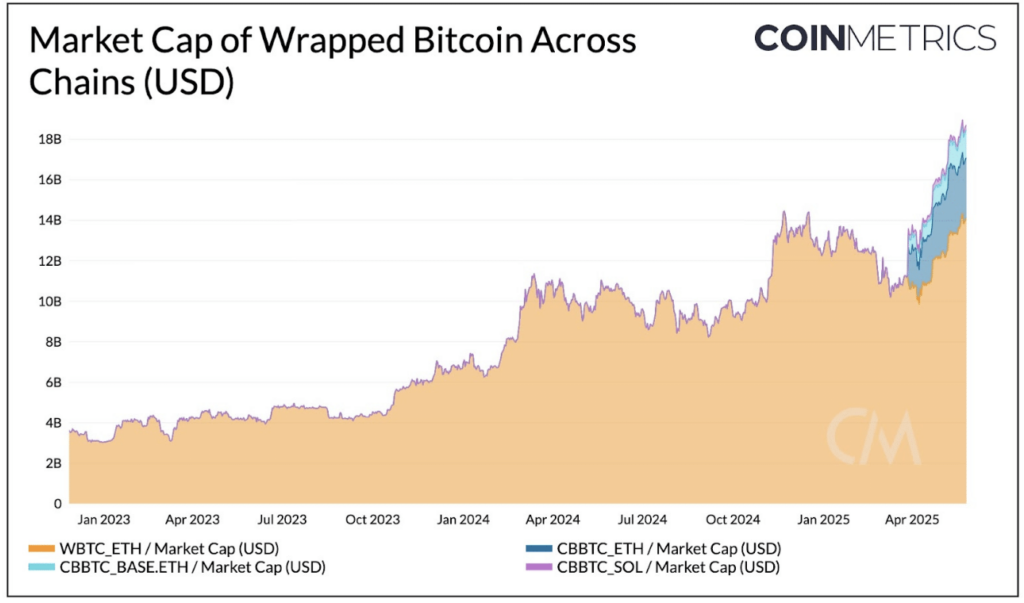

Tokenized Bitcoin strengthens the thesis

Data backs this up. The 2025 Coin Metrics report shows that the market cap of wrapped Bitcoin across multiple chains has grown fivefold since January 2023. The two largest versions, WBTC and cbBTC, now represent a combined 172,130 BTC.

That surge highlights how Bitcoin is expanding beyond its base layer, quietly deepening its DeFi presence by tapping into other Layer 1 ecosystems. Viewed through that lens, MicroStrategy’s strategy feels less aggressive and more… inevitable.

With fundamentals strengthening and tokenization accelerating, institutional interest in Bitcoin may only be getting started. If so, MicroStrategy’s moves could end up setting the pace for the rest of the market, whether they’re ready or not.