- Solana network activity cooled as market fear spiked, but signs point to sentiment-driven slowdown rather than structural weakness.

- Whales increased accumulation below $120, repeating past behavior that previously led to profitable exits.

- Spot Solana ETFs posted inflows during the dip, helping absorb selling pressure as technical momentum began to stabilize.

Even with volatility shaking the broader crypto market, stronger networks have continued to pull in capital. Retail participation has thinned out noticeably as fear took over, dragging down usage metrics across chains. Still, Solana has held up better than most Layer-1s, even as risk appetite keeps fading.

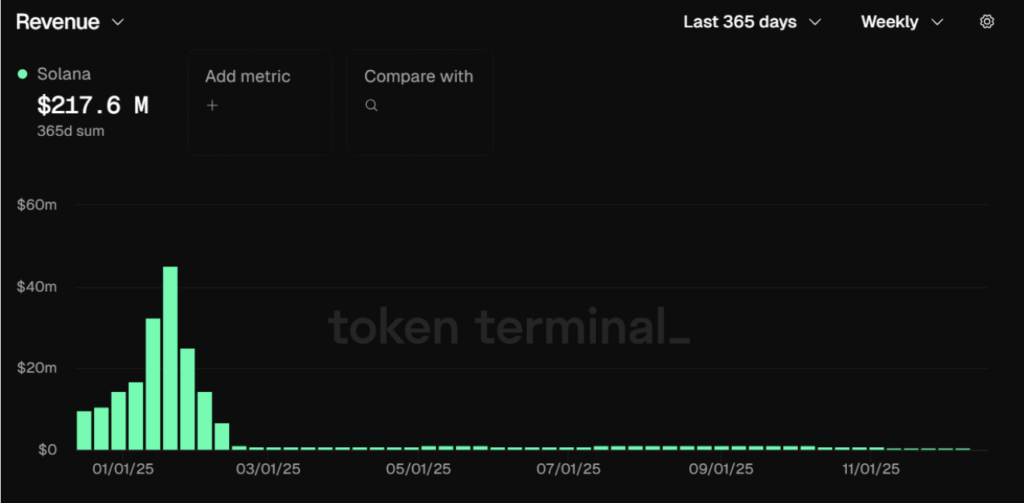

On-chain data shows that Solana’s network revenue spiked hard back in January, then slowly slid to yearly lows as activity cooled off. That drop erased earlier gains, but the timing matters. It lined up with extreme fear across the market, not with any obvious breakdown in the network itself. In other words, this looks more like sentiment-driven contraction than structural damage.

Network Activity Slows, But the Core Stays Intact

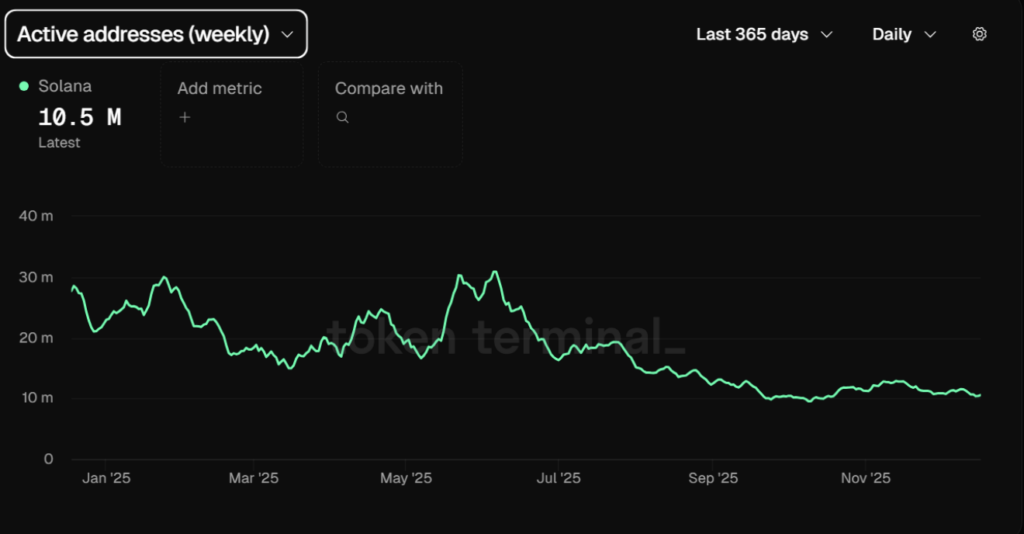

Weekly active addresses followed a similar path. As volatility picked up and traders backed away, usage dropped across the board. That decline mirrors what’s happening across crypto, not something unique to Solana.

What stands out is that activity has begun to stabilize near recent lows. The bleeding hasn’t accelerated, and that usually hints the worst of the panic might already be priced in. It’s quiet, yes, but not collapsing.

Whales Step In Below $120

When SOL slipped under $120 on December 18, larger players didn’t run. They leaned in.

One wallet, labeled G6gemN, scooped up around 41,000 SOL, roughly $5 million worth, right into the weakness. That kind of buying doesn’t look reactive, it looks planned.

There’s history here too. About eight months earlier, the same wallet accumulated just under 25,000 SOL near $122, then later sold near $175 for a healthy profit. Seeing that wallet reload around similar levels suggests confidence, not fear. Price dips are attracting capital rather than forcing exits, which says a lot about underlying conviction.

ETF Inflows Quietly Absorb Supply

While spot markets looked shaky, institutional flows told a different story. Solana spot ETFs pulled in roughly $11 million in net inflows on the same day price dipped.

That demand helped offset spot selling pressure and added a layer of support underneath the market. Institutions appear comfortable accumulating during fear-driven pullbacks, not chasing strength. This kind of flow doesn’t usually show up at market tops.

Support Holds as Momentum Begins to Turn

Technically, Solana traded near $124 at press time after briefly dipping as low as $117. Buyers defended that zone and pushed price back into the broader $122–$145 accumulation range.

Momentum indicators are starting to cooperate. MACD is hinting at a developing bullish crossover, and RSI printed a bullish divergence as selling pressure faded near the lows. Nothing explosive yet, but the tone has shifted slightly.

For now, Solana remains range-bound, absorbing supply rather than breaking down. The next move likely depends on whether broader sentiment stabilizes, but the structure suggests this pullback is being met with patience, not panic.