- The Fed is exploring limited “payment accounts” as a lighter alternative to master accounts.

- The proposal would allow clearing and settlement access without full Fed services.

- Internal debate highlights concerns around oversight and financial crime safeguards.

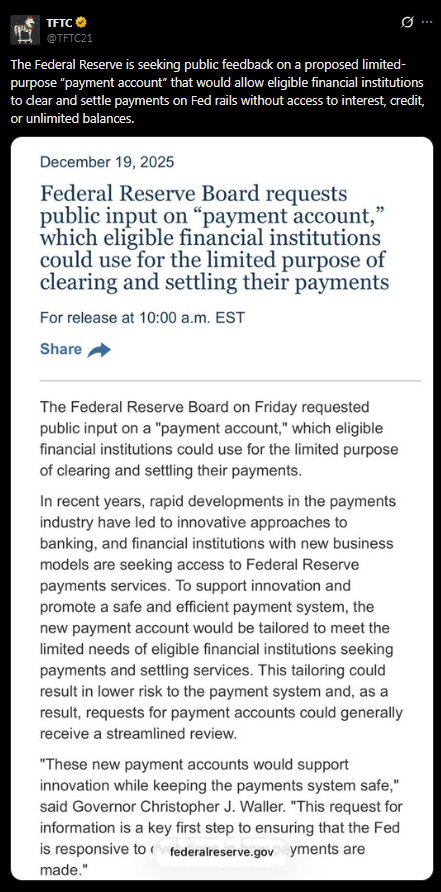

The U.S. Federal Reserve has taken an early step toward reshaping access to its payment infrastructure, signaling openness to a narrower version of its highly sought-after master accounts. In a statement released Friday, the Fed said it is seeking public input on the creation of so-called “payment accounts,” a lighter alternative designed to give firms access to payment rails without unlocking the full suite of central bank services.

A Slimmed-Down Path to Fed Payment Rails

Master accounts act as a direct gateway into the Fed’s payment systems, but they are notoriously difficult to obtain. That barrier has been especially frustrating for crypto and fintech firms relying on newer technologies to clear and settle transactions. The proposed payment accounts would focus narrowly on clearing and settlement functions, avoiding the broader privileges that come with traditional master accounts.

According to a Fed board memo, the request for information aims to address growing demand from institutions seeking streamlined access for payment activity only. The public comment period will remain open for 45 days, giving industry participants a chance to weigh in.

What These Accounts Would — and Wouldn’t — Do

Under the initial concept, payment accounts would come with clear limits. They would not pay interest, would not provide access to Fed credit facilities, and would likely include caps on balances. Fed Governor Christopher Waller described the proposal as a way to encourage innovation while maintaining system safety, calling it a necessary response to how payment technologies are evolving.

Waller has previously floated the idea as a “skinny” master account, and Friday’s announcement formalizes that concept into a public policy discussion.

Internal Pushback Highlights Risk Concerns

Not everyone at the Fed is on board. Governor Michael Barr, who served as the central bank’s top regulatory official until the Trump administration took office, opposed the move. Barr argued that the proposal lacks sufficient detail around safeguards to prevent money laundering and terrorist financing, particularly if accounts are granted to institutions the Fed does not directly supervise.

That tension reflects a broader debate inside the central bank: how to modernize payment access without compromising oversight or financial integrity.

Why This Matters for Crypto and Fintech

If implemented, payment accounts could mark a meaningful shift for crypto-native firms that have struggled to connect to core payment infrastructure. While far from a green light, the Fed’s request for input suggests growing recognition that existing frameworks may not fit the next generation of financial systems. Whether the final version strikes the right balance remains an open question.