- Litecoin lost the critical $80–$84 support zone, reinforcing a broader bearish market structure.

- Liquidation data suggests a short-term bounce is possible, but momentum remains weak.

- Unless LTC reclaims key resistance, sellers are likely to target $66 and potentially $59 next.

Litecoin saw a sharp jolt of volatility on Thursday, April 18, tracking Bitcoin’s sudden swings almost tick for tick. BTC briefly pushed toward $89.5k before rolling over hard and printing a new local low near $84.5k. That move rippled quickly into the altcoin market, and LTC didn’t escape the damage. In just five hours, Litecoin dropped roughly 7.5%, tagging a fresh lower low at $72.64 before stabilizing slightly around $75.89.

What made this move more concerning wasn’t just the speed of the drop, but where it happened. Over the past two weeks, Litecoin bulls quietly lost control of the $80–$84 zone, a level that had acted as long-term structural support. Earlier analysis already warned that buyers were losing strength there, and the latest breakdown seems to confirm that concern. Even Litecoin’s inclusion in Bitwise’s 10 Crypto Index ETF failed to spark any meaningful reaction on the chart, which says a lot about current sentiment.

Daily Structure Shows Sellers Still in Charge

Looking at the daily chart, the broader picture hasn’t improved much. Using the Fixed Range Volume Profile for 2025, Litecoin’s Value Area High and Low sit around $120 and $83. Back in early October, LTC was trading comfortably above that upper value zone, until the sharp October 10 crash flipped the structure entirely.

Since then, selling pressure has dominated. The On-Balance Volume shows that the balance between buyers and sellers tilted heavily toward distribution, not accumulation. Litecoin did attempt to defend the $80 region during November’s choppy price action, but those efforts were thin and short-lived. Once that floor gave way, the trend resumed lower without much resistance.

With $80 now lost, the chart exposes several deeper levels that bears are likely watching next. Long-term support zones come in around $73.4, followed by $66.5, and then much lower near $59.6 if pressure accelerates.

Liquidation Data Hints at a Short-Term Bounce

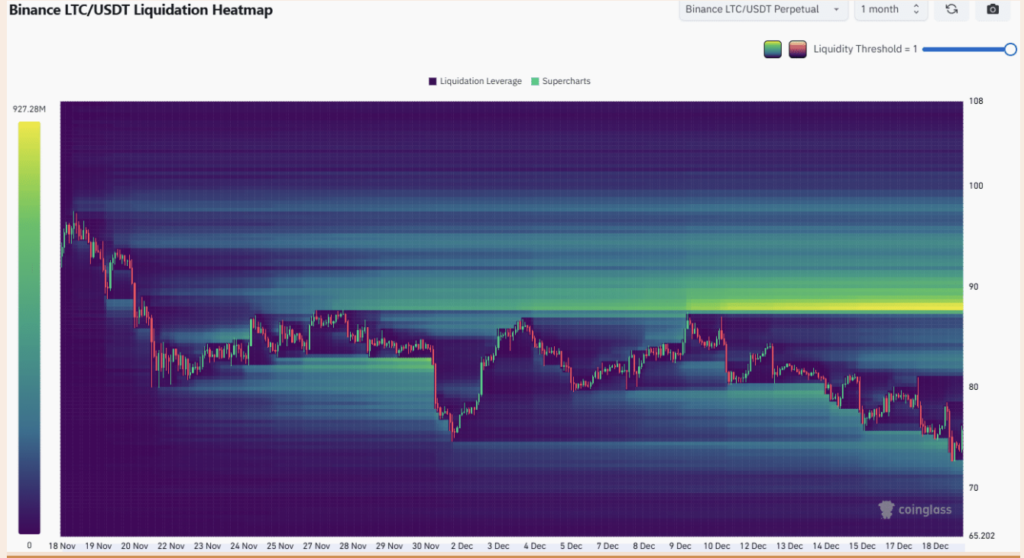

Zooming into derivatives data adds a bit of nuance. The one-month liquidation heatmap shows that liquidity clustered around the $73 area has already been cleared. That sweep often leads to a relief bounce, and Litecoin appears to be doing exactly that right now.

If this bounce extends, price could drift back toward the $82–$83 region, which lines up with a nearby magnetic liquidity zone. This wouldn’t be unusual behavior. Markets often retrace after flushing stops, especially when price moves quickly into thin liquidity.

Still, it’s important to keep expectations in check. A bounce doesn’t automatically mean a reversal. It can just as easily be a setup for sellers to re-enter at better levels.

The Bullish Scenario Remains a Long Shot

There is, technically, a more optimistic path on the chart, though it requires several things to go right. Above current levels, the $88 zone is packed with short liquidations. In a scenario where broader market sentiment flips risk-on and shorts start getting squeezed, Litecoin could be pulled toward that area.

In a best-case outcome, a liquidation cascade could even push LTC back above $90, forcing a trend reassessment. But right now, that scenario looks more like an outlier than a base case. It would need help from Bitcoin and a noticeable shift in market psychology.

Traders’ Bias Stays Bearish After the Breakdown

For now, the dominant takeaway is simple. Litecoin has lost an important long-term support zone, and the higher-timeframe structure remains bearish. There’s no clear evidence of strong buying interest stepping in yet, just reactive bounces.

If price revisits the $80–$84 area, that region is likely to act as heavy resistance rather than support. From a trading perspective, many will view rallies into that zone as potential short opportunities, with downside targets sitting near $66 and, if momentum builds, closer to $59.

Until Litecoin can reclaim lost structure and show sustained demand, the path of least resistance still points lower, even if short-term relief moves pop up along the way.