- Solana is down over 50% from September highs, with key support levels broken.

- TVL, network fees, and memecoin activity have all declined sharply.

- A bearish chart pattern points to a potential move toward the $90–$100 zone.

Solana’s native token has taken a heavy hit over the past few months, with SOL down roughly 52% between Sept. 18 and Nov. 21. The drop followed a broader altcoin selloff that also dragged Bitcoin to a seven-month low near $80,000. As a result, SOL has lost several key long-term support levels, and both onchain metrics and technical patterns are pointing toward the risk of a deeper correction, potentially below the $100 mark.

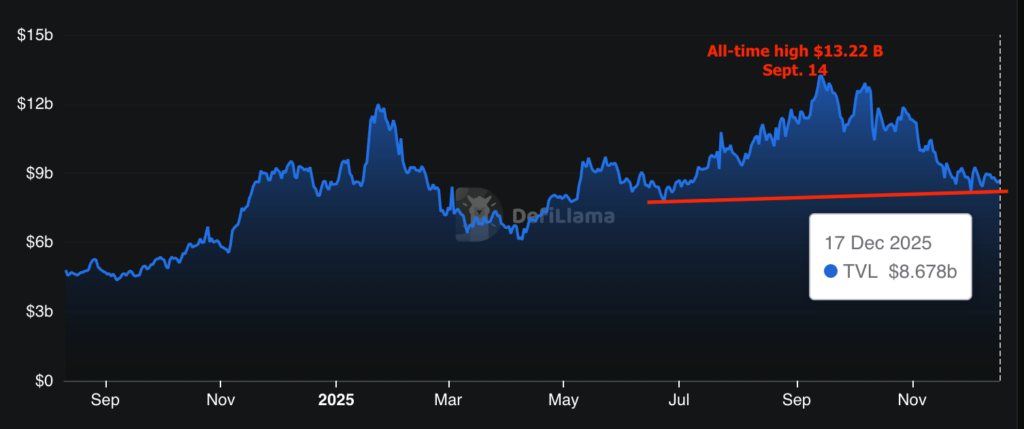

Solana’s TVL Falls Back to Mid-Year Levels

One of the clearest warning signs is the sharp decline in Solana’s total value locked. TVL has fallen more than 34% from its September peak of $13.22 billion to about $8.67 billion, marking a six-month low. Over the past 30 days, TVL has remained stuck below $10 billion, signaling persistent capital outflows from the ecosystem.

Data from DefiLlama shows that the decline has been led by Jito liquid staking, which is down 53% since mid-September. Other major protocols haven’t been spared either. Jupiter DEX, Raydium, and Sanctum have each seen drops ranging from roughly 30% to nearly 46%, reinforcing the view that activity is slowing across the board.

Network Activity Continues to Cool

The pressure on SOL is also reflected in falling network usage. Solana’s chain fees totaled around $3.43 million over the past week, down 11% from the previous week and 23% compared to last month. At the same time, active addresses declined by nearly 8% over seven days, while transaction counts fell more than 6%.

Together, lower fees, fewer users, and declining transaction volume point to reduced onchain demand. That lack of activity adds overhead pressure on SOL’s price and makes it harder for bulls to regain control.

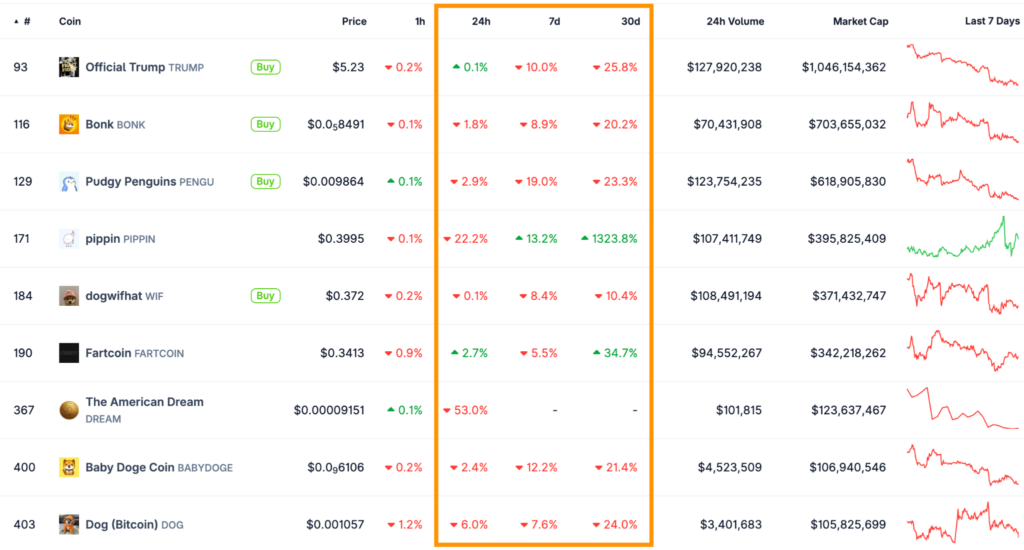

Memecoin Collapse Weighs on the Ecosystem

The slump in Solana’s TVL closely mirrors what’s happening in its once-booming memecoin sector. Most Solana-based memecoins are now posting double-digit losses on both weekly and monthly timeframes, with many down 10% to 25% from recent highs.

DEX activity tied to memecoins has collapsed as well. Weekly memecoin trading volume on Solana has plunged by roughly 95%, falling to about $2.7 billion from a peak near $56 billion recorded in January. That collapse in speculative activity has removed a major source of demand that previously helped support the network and SOL’s price.

Bear Pennant Signals Further Downside

From a technical perspective, SOL remains under pressure. Chart data shows the token trading below a bear pennant formation, a continuation pattern that often appears after a sharp decline followed by brief consolidation. The recent break below the pennant’s support near $135 opened the door for another leg lower.

The measured target of the pattern sits around $86, representing a potential 32% drop from current levels. Before reaching that zone, SOL could find interim support near the 200-week EMA around $118, where buyers may attempt a defense. Still, several traders warn that a move into the $90–$100 range is increasingly plausible if current conditions persist.