- BNB fell nearly 3% after breaking below key $855 support.

- Bitcoin’s sharp reversal and weakness in tech stocks fueled risk-off sentiment.

- Holding $840 is critical to avoid a deeper move lower.

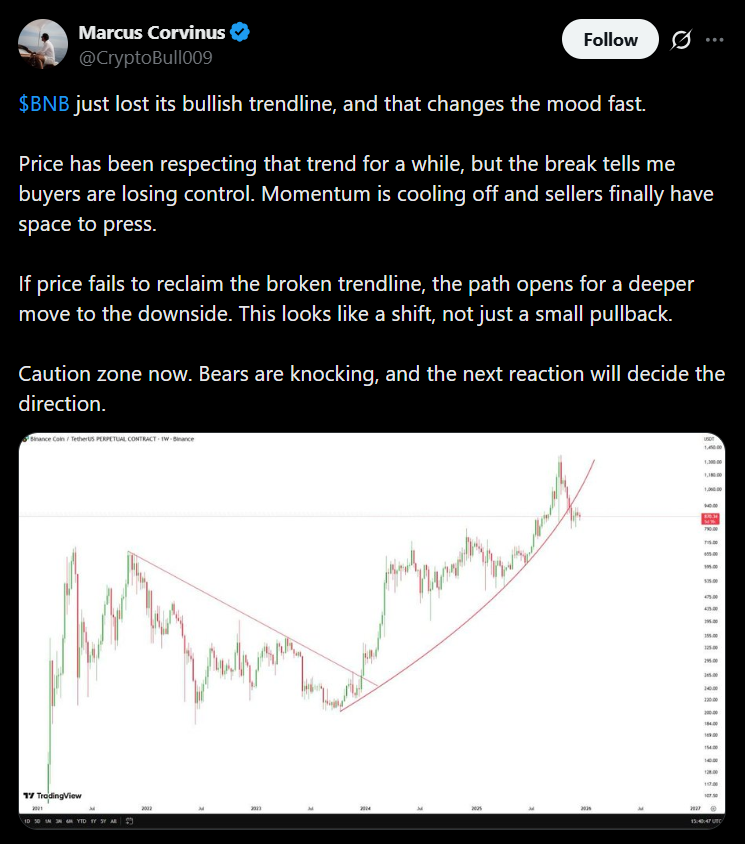

BNB slid nearly 3% over the past 24 hours, dropping to around $844 after failing to hold an earlier push higher. The token had briefly touched $872 before sellers stepped in aggressively, reversing gains as Bitcoin rolled over and U.S. tech stocks weakened. The move reflects a broader shift in market tone, with risk assets coming under renewed pressure.

Support Gives Way During U.S. Trading

For several sessions, BNB had managed to defend the $855–$857 support zone, forming a narrow consolidation range. That stability broke down during U.S. trading hours when selling pressure intensified and price slipped cleanly below support. A brief bounce toward $860 failed quickly, and BNB was pushed to session lows near $843, confirming the breakdown rather than a temporary dip.

Bitcoin and Tech Stocks Add Pressure

The selloff unfolded alongside sharp volatility in Bitcoin, which briefly surged above $90,000 before reversing hard below $86,600. At the same time, losses in AI-linked stocks such as Nvidia and Broadcom dragged the Nasdaq lower. The combination reinforced a risk-off environment, spilling into crypto markets and accelerating downside moves across major tokens.

Volume Spike Signals Forced Selling

Trading volume on BNB jumped noticeably as price fell through support, with several sharp spikes appearing on intraday charts. This pattern points toward forced selling and stop-loss triggers rather than the more controlled pullbacks seen earlier in the week. As liquidity thinned, price swings became more exaggerated, catching traders off guard.

Key Levels to Watch Next

From a technical perspective, the break below $855 has weakened BNB’s short-term structure, turning that former support into near-term resistance. Holding above $840 is now critical to avoid a deeper slide toward $830. For momentum to stabilize, BNB would need to reclaim $855 and build acceptance above it, reopening a potential path back toward $870.