- FTX made payments totaling $3.2 billion to its founder Sam Bankman-Fried and other key employees

- Most of the payments came from Bankman-Fried’s trading firm Alameda Research

- Current FTX CEO John J. Ray III said that the company’s failure attributes to incompetence and lack of control

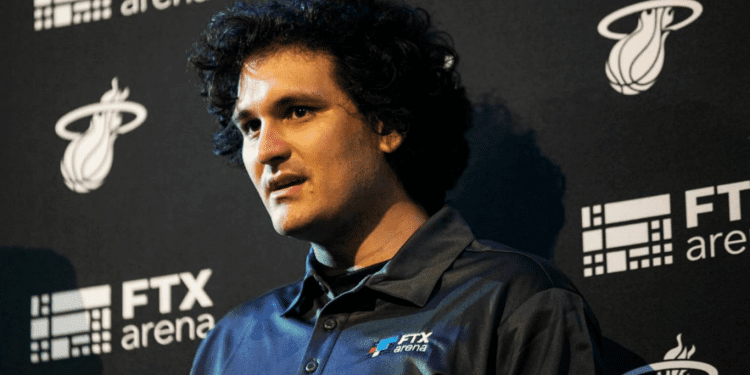

FTX, a bankrupt cryptocurrency exchange, made payments totaling $3.2 billion to its founder Sam Bankman-Fried and other key employees, including Director of Engineering Nishad Singh, who received about $587 million, according to documents filed on Wednesday. Most of the payments came from Bankman-Fried’s trading firm Alameda Research, whose precarious finances set the downfall of FTX in November.

The amount listed does not include $240 million spent on luxury real estate in the Bahamas nor any directly made political or charitable donations. Upon becoming FTX’s new CEO, John J. Ray III described the firm’s collapse as an example of a failure due to a lack of control and an “absence of trustworthy financial information.”

On February 28, Singh was charged with fraud and conspiracy. He pleaded guilty and looked for a plea deal with prosecutors in January.

PRNewsWire reported on the earnings and said, “Although some of the property purchased with the proceeds of these transfers is already in the control of the FTX Debtors or governmental authorities with whom the FTX Debtors are cooperating, the amount and timing of eventual

monetary recoveries cannot be predicted at this time. The FTX Debtors are investigating causes of action against the recipients of these transfers and their subsequent transferees.”

FTX’s downfall is a moral lesson for cryptocurrency firms and their customer service, emphasizing the importance of thorough research, financial management, and transparency.

As John J. Ray III noted in his letter announcing FTX’s fall, “this is a lesson for all companies on how not to operate.” Nevertheless, Bankman-Fried and other vital employees have turned their misfortune into gain, walking away with significant wealth even after their company’s collapse. In an ever-changing digital economy, awareness of opportunities and risks pays off.

FTX from Stardom to Ashes

FTX was a crypto trading platform that provided traders with access to advanced tools and features to make fast and informed decisions. It offered margin trading, derivatives, index products, spot trading, OTC, futures, options, and leveraged tokens. It supported several major cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, and the opportunity for users to buy stocks. With its user-friendly interface and low-cost structure, FTX quickly became one of the most popular cryptocurrency exchanges in the world.

However, that success was short-lived when in November 2022, a CoinDesk report showed that FTX’s sister company, Alameda Research, was using customer funds for trades. When Bankman-Fried denied it, Binance CEO Changpeng Zhao challenged him to show FTX’s liquidity.

With nothing to show, Zhao, announced that Binance would liquidate all its holdings of FTT tokens, the native token of FTX. It became a domino effect from there as customers wanted out.

That same month, Bankman-Fried filed for Chapter 11 bankruptcy and stepped down as CEO. The fallout of the exchange is now known as one of the worst stories in financial history.