- AAVE jumped nearly 9% after the Fed rate cut, with traders reacting strongly to the upcoming V4 upgrade.

- Derivatives activity rebounded fast, as Open Interest rose by $34M and leverage returned to the market.

- On-chain activity and protocol fees increased alongside price, pointing to real usage behind the move.

AAVE has quietly turned into one of the clearer winners following the Federal Reserve’s latest rate cut. While much of the market reacted cautiously, Aave’s token pushed higher, climbing about 9% on the day and trading near $205 at press time. The timing wasn’t random. Attention quickly shifted to Aave’s upcoming V4 upgrade, and traders seemed to like what they saw.

At the center of the update is a redesigned liquidation engine, built to improve capital efficiency while tightening risk controls across the protocol. It’s a technical change, sure, but one with real consequences. And judging by how the market reacted, that message landed almost immediately.

Liquidation Engine Triggers a Return of Leverage

Following the V4 announcement, derivatives traders moved fast. After a relatively quiet stretch earlier in the week, positioning began to expand again. CoinGlass data shows Open Interest jumped by roughly $34 million in the past 24 hours, a noticeable shift from the flat behavior seen before.

That rise points to growing leveraged participation, likely from larger traders willing to lean into the upgrade narrative. Still, higher Open Interest cuts both ways. While it supports momentum on the way up, it also makes price more sensitive to sharp moves if sentiment flips. Volatility risk hasn’t disappeared — it’s just changed shape.

On-Chain Activity Starts to Catch Up

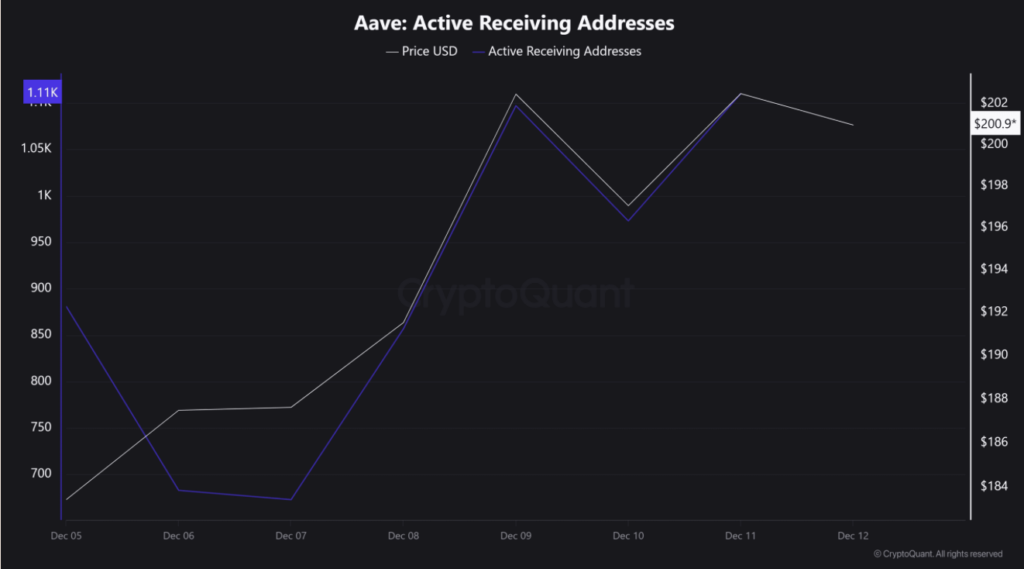

The rally didn’t stay confined to price and derivatives. On-chain metrics picked up as well. According to CryptoQuant, Active Receiving Addresses nearly doubled after December 7, climbing to around 1.2K at press time.

That kind of move suggests broader participation, not just a handful of whales shuffling tokens. More wallets getting involved usually signals growing engagement across the network.

At the same time, Aave’s protocol revenue ticked higher. Token Terminal data shows weekly fees increased by about $0.3 million, bringing total fees to roughly $15.47 million. That revenue comes from lending interest and liquidation activity, tying the price move back to real usage on the protocol.

In other words, this wasn’t just a speculative pop. Network fundamentals moved with it.

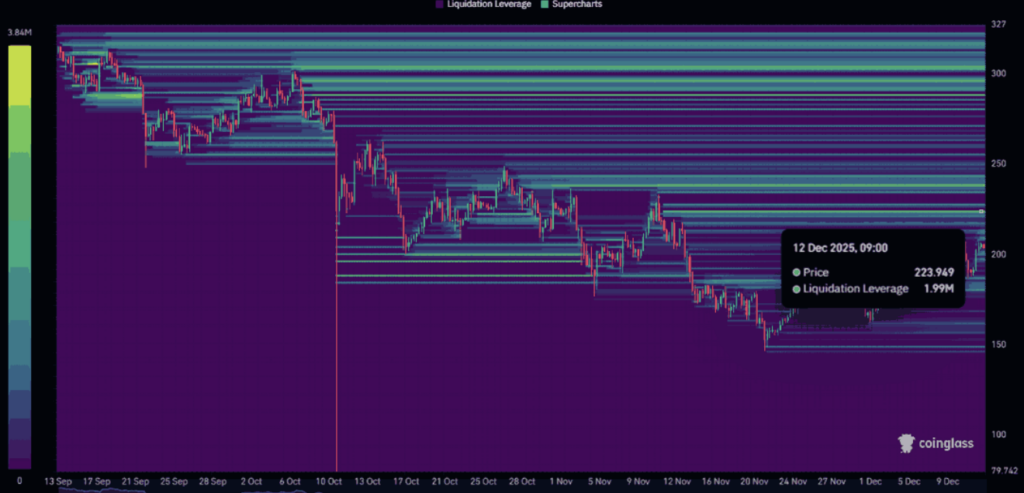

Liquidity Cluster Sets the Next Area to Watch

Even with the strong bounce, derivatives data shows a clear area of interest above current price. CoinGlass’ liquidation heatmap highlights a $1.99 million liquidity cluster around $223. If bullish momentum continues and broader market conditions cooperate, that zone could act like a short-term magnet.

But there’s a flip side. With leverage building again, any failure to hold key levels could lead to sharper pullbacks. The same derivatives positioning that fuels upside can unwind quickly if confidence wavers.

For now, AAVE looks energized. Rate cuts helped, the V4 upgrade added a narrative traders could latch onto, and on-chain data confirms rising activity. Whether this move extends further will depend on how well the protocol — and the market — handle the extra leverage now back in play.