- TAO flow introduces strict zero-emission rules for subnets that fail to maintain positive inflow, eliminating dilution and pushing the ecosystem toward a more competitive, performance-driven structure.

- The new system cannot be manipulated by whales or liquidity tricks—only sustainable activity and real AI value generation determine subnet survival.

- While the transition is uncomfortable, analysts argue TAO flow may become Bittensor’s biggest long-term advantage by rewarding builders who deliver real utility instead of hype.

Right now, TAO flow is probably the hottest topic inside the Bittensor ecosystem—especially across the AI-crypto community, where every change gets dissected like it’s world-changing. And honestly, this one kind of is. The new system has reshaped how the network behaves so sharply that many holders are scrambling to really understand what it means.

Two separate threads—one from Tao Ouτsider, another from Andy ττ—have helped unpack the idea. But they also sparked more questions. Together, their explanations reveal the real tension behind TAO flow: it’s strict, unforgiving, and brutally honest about which subnets deserve to live. And strangely, that harshness might turn out to be Bittensor’s most powerful advantage.

TAO Price Was Never Supposed to Be the Center of the Story

People love talking about the TAO price—the swings, the hype, the volatility. But the truth is, Bittensor wasn’t built to be a price-driven project. The protocol rewards useful AI outputs, not speculation. The old emission model tried to reflect that through price signals, but it left room for manipulation, hype spikes, and structural imbalances.

TAO flow is the attempt to fix that.

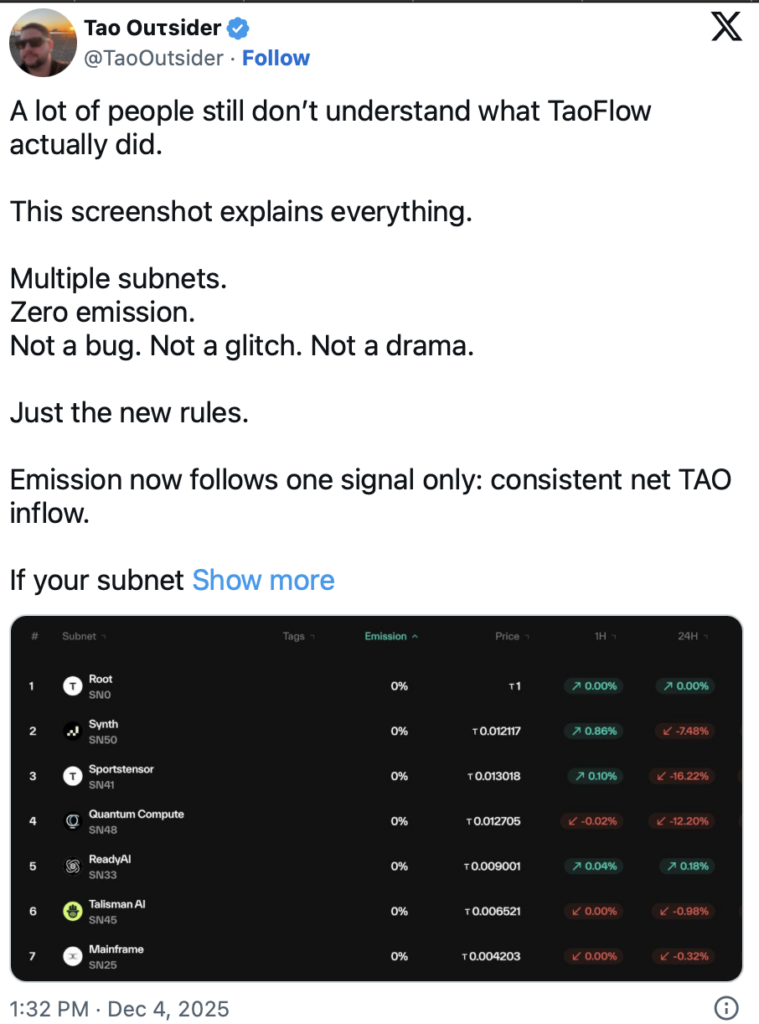

As Tao Ouτsider explained, old rules don’t apply anymore:

- Subnets now operate under one universal rule: maintain positive net TAO inflow

- Subnets with zero inflow earn zero emissions

- Weak momentum? They’re cut instantly—no grace period

This may sound harsh, but it solves a long-standing issue: weak subnets leaking value from the system. With TAO capped at 21 million supply, every token printed matters. About 10.4M is circulating today. Eliminating emissions to underperforming subnets reduces dilution and strengthens long-term scarcity.

TAO flow isn’t punishment—it’s cleanup.

A Sharper, More Competitive Economy Emerges

TAO flow doesn’t just change incentives—it rewires the entire economy.

Subnets are forced to compete again. Some sit in zero emission right now, but that doesn’t automatically mean failure. Many are real teams with good products, just caught in a rough patch. They can still rebound, attract stake, and climb back into emission territory.

This makes Bittensor feel more alive—more like a competitive marketplace and less like a leaderboard where early entrants stay ahead forever.

Andy ττ took it further by clearing up a huge misconception:

TAO flow cannot be manipulated by whales or liquidity tricks.

- High price doesn’t save a subnet with no participation

- Low price doesn’t kill a subnet with strong inflow

- Flow is based on sustainable activity, not hype

The protocol rewards what actually matters: real usage and real contributions.

TAO Flow May Be the Stress Test the Ecosystem Needed

Many teams fear the new system. Subnet death. Inconsistent rewards. Volatility. The usual list. But Andy ττ argues that most of these fears miss the bigger picture.

TAO flow eliminates old advantages where subnets survived off hype or momentum without delivering value. Now, performance is the only metric. If inflow is stable? You survive. If not? You’re cut.

Kurtosis rising shows subnets separating into winners and losers. That separation feels uncomfortable—but it’s also necessary. Networks can’t grow by rewarding the middle forever.

Tao Ouτsider summed it up perfectly:

“Winners earn flow. Losers lose. Build something people want or watch your emission stay at zero.”

It’s blunt. But it’s the closest thing to a mission statement you’ll ever get.

Could TAO Flow Become Bittensor’s Biggest Strength?

This shift feels messy right now, especially for teams pushed into zero emission. Communities are confused, builders are stressed, and subnets are being forced to rethink everything—from incentives to product direction.

But that’s also what growth looks like.

A network that punishes stagnation and rewards real contribution becomes stronger long-term. TAO’s future depends on builders who create value, not momentum chasers looking for easy emissions. TAO flow isn’t a bug or a flaw—it’s Bittensor evolving into what it always claimed to be.

A true, competitive economy for machine intelligence.