- Chainlink’s spot ETF launched with $41M in inflows and $13M trading volume on day one.

- Institutions are signaling interest in regulated altcoin exposure beyond BTC and ETH.

- While not a blockbuster, LINK’s ETF already holds $64M in assets and validates demand for long-tail crypto ETFs.

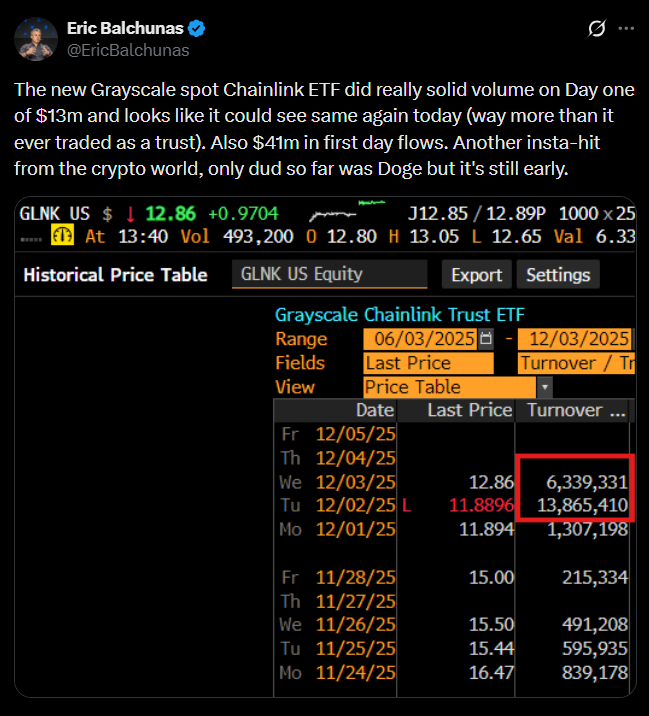

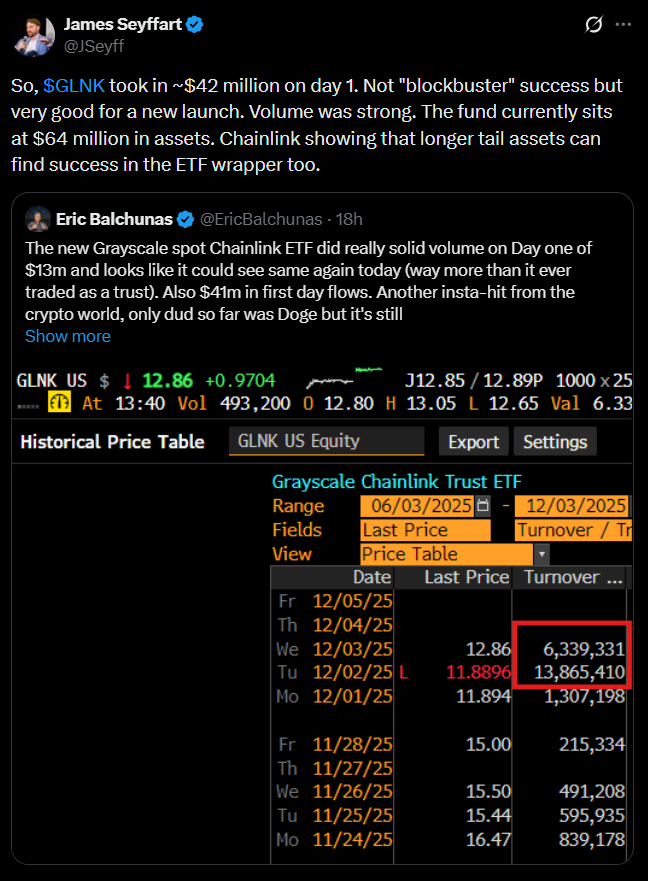

Grayscale’s launch of the first U.S. spot Chainlink (LINK) ETF has landed with a stronger-than-expected impact, pulling in $41 million in net inflows on its first day and delivering $13 million in trading volume despite a shaky crypto market. Bloomberg ETF analyst Eric Balchunas called the debut “solid,” noting that nearly every crypto ETF launch this year has performed well, with Dogecoin being the lone laggard so far.

Demand Shows Institutions Want Regulated Altcoin Exposure

The early flows confirm a clear trend: institutional investors want altcoin exposure, but only through regulated, compliant, ETF-wrapped products that can be integrated into fund mandates, pensions, and treasury strategies.

In fact, Chainlink’s ETF outperformed other recent altcoin debuts:

• Solana ETF: $8.2M first-day volume

• XRP ETF: $243M first-day inflows (the strongest altcoin ETF launch of the year)

While LINK’s debut doesn’t match XRP’s blockbuster start, it signals that demand is growing for ETFs tied to altcoins with strong fundamentals, real utility, and active developer ecosystems.

Not a Blockbuster — But Still a Clear Success

ETF analyst James Seyffart noted that LINK’s first day wasn’t a “blockbuster,” but emphasized that the ETF already holds $64 million in assets, including an $18 million seed investment. He highlighted the significance of a long-tail asset like Chainlink seeing success in the ETF wrapper — an important benchmark for future altcoin products.

Despite the ETF launch, LINK’s price action remains overshadowed by broader market weakness. The token is up 9.8% this week, but still down 39% year-over-year, according to Cointelegraph data.

Why Chainlink Attracts Institutional Interest

Chainlink isn’t just another altcoin — it’s one of the most widely integrated backend networks in crypto. Its decentralized oracle feeds and cross-chain interoperability services power:

• Smart contract automation

• Tokenized real-world asset systems

• DeFi platforms needing secure external data

• Institutional blockchain infrastructure

This gives LINK a utility profile that aligns closely with what traditional finance looks for when exploring blockchain integrations.

A Milestone for “Long-Tail” Crypto ETFs

Chainlink’s ETF debut adds fresh momentum to the idea that ETFs for long-tail assets — not just BTC or ETH — can find meaningful market traction. As regulated on-chain products expand, more altcoins with real-world utility could see ETF listings in 2025–2026.

If demand continues, the Chainlink ETF’s early success may mark a turning point for altcoin adoption through traditional financial rails.