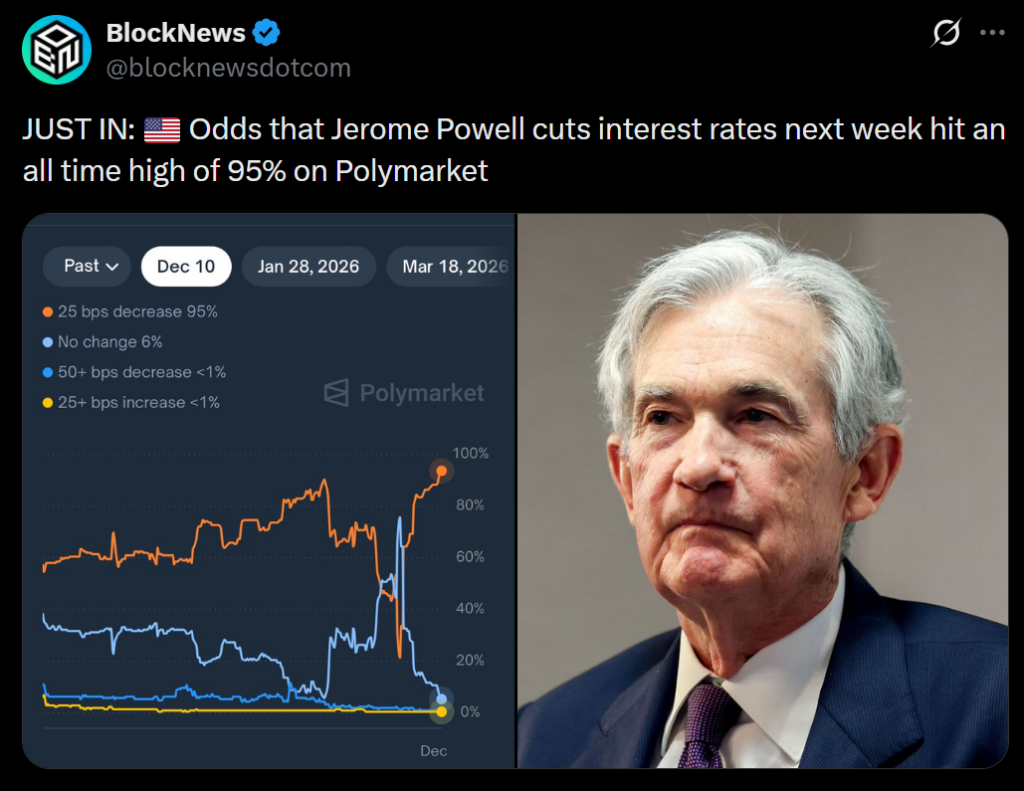

- A Fed rate cut next week is highly likely, with debate between 25 or 50 basis points.

- Trump is expected to name a new Fed chair soon, with Kevin Hassett seen as the frontrunner.

- Powell and Trump remain at odds, increasing pressure on the Fed during a sensitive economic moment.

The Federal Reserve is heading into one of its most-watched meetings of the year next week, and all signs are pointing toward another rate cut — unless Chair Jerome Powell decides the latest batch of economic data gives him an excuse to slow things down again. Former White House Economic Advisor Steve Moore didn’t mince words this week, saying there’s a “high probability” the Fed eases policy again. The only debate, he added, is whether it’ll be a modest 25-basis-point trim or a more aggressive 50-point move.

Markets Already Bracing for a Cut

Moore, speaking with The National News Desk, said the markets seem fully prepared for a cut. “I think the markets do expect that rate cut to come,” he said, hinting that investors have already priced in a softer policy stance. With inflation cooling and growth wobbling a bit at the edges, the Fed is under pressure to keep financial conditions supportive heading into 2026 — especially with political noise building around the central bank.

Trump Eyes Powell’s Replacement

Complicating the moment is the growing tension between Powell and President Donald Trump, who has openly criticized Powell for months, urging him to slash rates faster. Trump is expected to announce his nominee for the next Fed chair early next year, and the shortlist is already stirring plenty of speculation. Steve Moore pointed out that Trump has strongly hinted at Kevin Hassett — currently serving as director of the National Council — as a leading contender, alongside Treasury Secretary Scott Bessent.

“There’s a lot of high intrigue,” Moore said, adding that Hassett would be a “very fine economist” and likely an “excellent choice.” If Hassett gets the nod, Powell could be out before summer, marking a dramatic shift at the nation’s most powerful financial institution.

Rate Cuts, Politics, and a Heated Fed Transition

Moore said there’s “no love loss” between Trump and Powell, describing their relationship as long-standing friction. “Trump is eager to get him out and get someone in who he feels will help grow this economy. And Trump would like more rate cuts,” he said.

Even so, Moore stressed what the Fed must keep front and center — inflation. Despite political pressure, he said the U.S. has managed “pretty modest inflation” this year, giving the central bank some room to maneuver without losing credibility.

A High-Stakes Decision Coming Next Week

With the Fed’s December meeting just days away, the stakes are unusually high. A cut seems likely, a leadership change is looming, and political pressure is heavier than at any point in Powell’s tenure. Whether the Fed goes 25 or 50 points may set the tone for the first half of 2026 — and possibly for Powell’s final chapter at the central bank.