- Bitcoin pushes toward $93K as short-liquidation clusters build above.

- Bollinger Bands and reclaimed SMA show conditions for an upside expansion.

- $92K–$94K remains the critical decision zone for either a squeeze or another rejection.

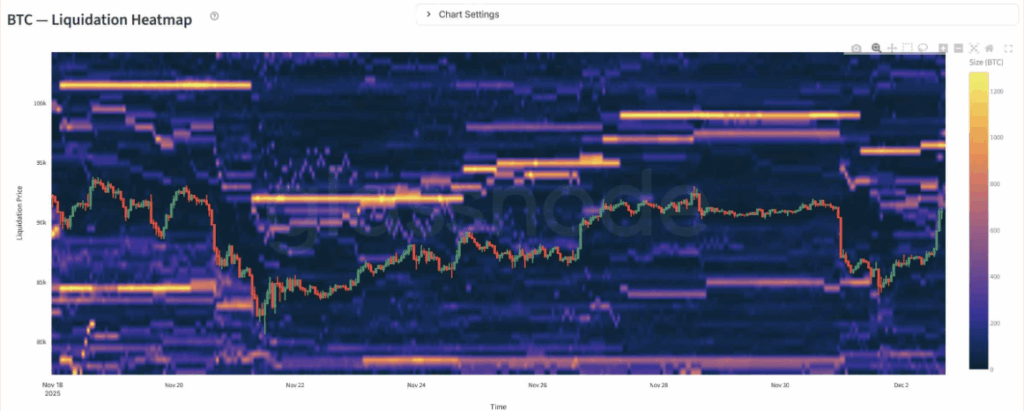

Bitcoin is making another run at the $93,000 region — its second attempt in less than a week — and this time the derivatives data is throwing off some serious volatility warnings. Glassnode’s liquidation heatmap is lighting up with dense short-liquidation clusters between $92.5K and $94K, hinting that a squeeze could erupt if BTC pushes just a bit higher.

What makes this cluster interesting is the timing. Bitcoin was sharply rejected at this exact level just days ago, and yet price is right back in the zone. That usually means traders are stacking short positions again, trying to fade the move — which, ironically, sets the stage for an even bigger breakout.

Shorts Are Fueling the Fire

Short-liquidation pockets act almost like dry tinder under a spark. Once BTC pushes into those areas, over-leveraged shorts are forced to buy back their positions, which creates fast upside momentum without requiring a flood of new buyers. It’s basically forced demand.

This mechanic has powered some of Bitcoin’s strongest, most explosive rallies in previous cycles — and the setup looks similar right now.

Technicals Are Now Aligned With a Bigger Move

Bollinger Bands on the daily chart support this view. BTC has finally reclaimed the 20-day SMA around $90.5K, a level the market struggled with for nearly two full weeks. Closing above it usually signals a short-term trend reversal.

Volatility is expanding too. After days of tight compression, the bands are widening again — a classic precursor to major directional movement. The upper Bollinger Band sits near $97.9K, meaning Bitcoin has technical room to run if momentum keeps building.

Today’s bullish candle also helped. It engulfed the entire multi-day range that price was trapped in, showing that buyers still have strength. And last week’s rebound from the lower Bollinger Band near $83K was another key moment — buyers absorbed the sell-off instantly, a reaction that aligned perfectly with long-liquidation pockets on the heatmap.

The Make-or-Break Zone: $92K–$94K

This entire push now comes down to one critical region: $92K–$94K.

This zone includes:

- Dense short-liquidation clusters

- Expanding volatility

- A reclaim of major technical levels

- Traders aggressively shorting into resistance

If Bitcoin can break decisively above $93K, the conditions favor an accelerated move — the kind of rally where price jumps thousands in minutes as forced buyers pile in.

But… there’s the other side of the coin. This exact region rejected BTC aggressively just a few days ago. If bears manage to defend it again, it would confirm that sellers still see this as a cycle-defining resistance wall.

Either way, here is where things get loud — the next move out of this zone could shape Bitcoin’s December path.