- PENGU falls 12% as heavy outflows accelerate selling pressure.

- Indicators like SAR and MFI confirm fading momentum and bearish control.

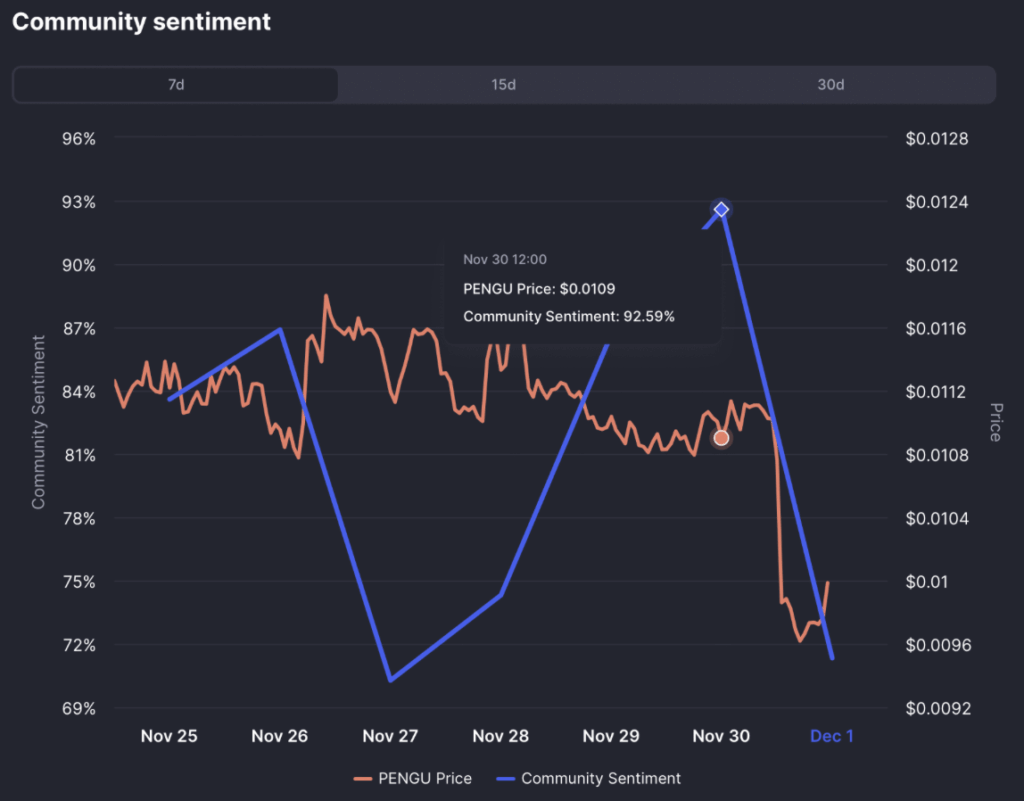

- Sentiment drops from 90% to 72% bullish, with $6.5M exiting derivatives positions.

PENGU, once one of the louder memecoins on the charts, has been leaking capital for days — and the sell pressure finally tipped it over the edge again in the last 24 hours. Outflows dragged the price down another 12%, leaving Pudgy Penguins [PENGU] trading around $0.0097 at the time of writing. And it’s not just PENGU feeling the sting. The entire memecoin sector is getting crushed, posting an average decline of 27% in a single day. Capital is fleeing the sector, and PENGU is sitting right in the center of the storm.

PENGU Gets Rejected at Resistance, Again

The latest drop came right after PENGU tapped into a well-known resistance wall — the same one that has smacked the token down multiple times before. Each touch tends to trigger sell-offs, and this time wasn’t any different. Liquidity in that zone is thick, and sellers clearly used it to unload bags.

The last time PENGU hit this exact resistance, it suffered a brutal 53% crash before finding a local bottom. The average of the last three reactions is a bit gentler — around 31.7% declines — but today’s rejection still fits the pattern.

A breakout above this descending resistance usually sparks bigger rallies, but… this wasn’t one of those moments. Instead, PENGU is likely preparing to search for the nearest support before attempting anything meaningful on the upside.

Momentum Drains Out as Indicators Flip Clearly Bearish

Momentum isn’t doing PENGU any favors right now. Both the Parabolic SAR and the Money Flow Index (MFI)confirm that bullish strength has evaporated.

- The Parabolic SAR dots are above price, which is basically a flashing red sign that selling pressure is dominant and further decline is very possible.

- The MFI sits in the 30–50 zone, which is considered bearish territory. It signals outflows, weak demand, and low buying interest overall.

However — barely noticeable, but still present — the MFI is inching upward. That means some capital is flowing back in, though not nearly enough to offset the heavy selling that triggered this entire downturn.

Community Sentiment Drops Sharply as Traders Pull Back

The PENGU community isn’t as loud as it was weeks ago. According to CoinMarketCap’s sentiment data, bullish confidence has fallen from over 90% to 72% as of Nov. 30. That’s still a majority, but the drop is steep and signals shifting expectations from thousands of investors — more than 375,000 responses were counted.

Meanwhile, the derivatives market added more fuel to the decline. About $6.5 million left open positions as traders backed away from risk. Combined with a weakening funding rate, the exodus suggests the market expects more downside pressure in the near term.

Outlook

PENGU is stuck between heavy selling, weak momentum, and fading community optimism. Until it finds support — and holds it — the path of least resistance remains downward. If sentiment shifts again or the MFI continues pushing upward, a relief bounce could form, but right now sellers are still firmly in control.

Here is where the market waits to see if PENGU can stabilize… or sink further.