- GLNK becomes the first U.S. spot Chainlink ETF, offering regulated exposure for institutions.

- Staking inside the ETF boosts yield potential but brings added regulatory complexity.

- Chainlink’s expanding integrations and real-world partnerships strengthen long-term demand.

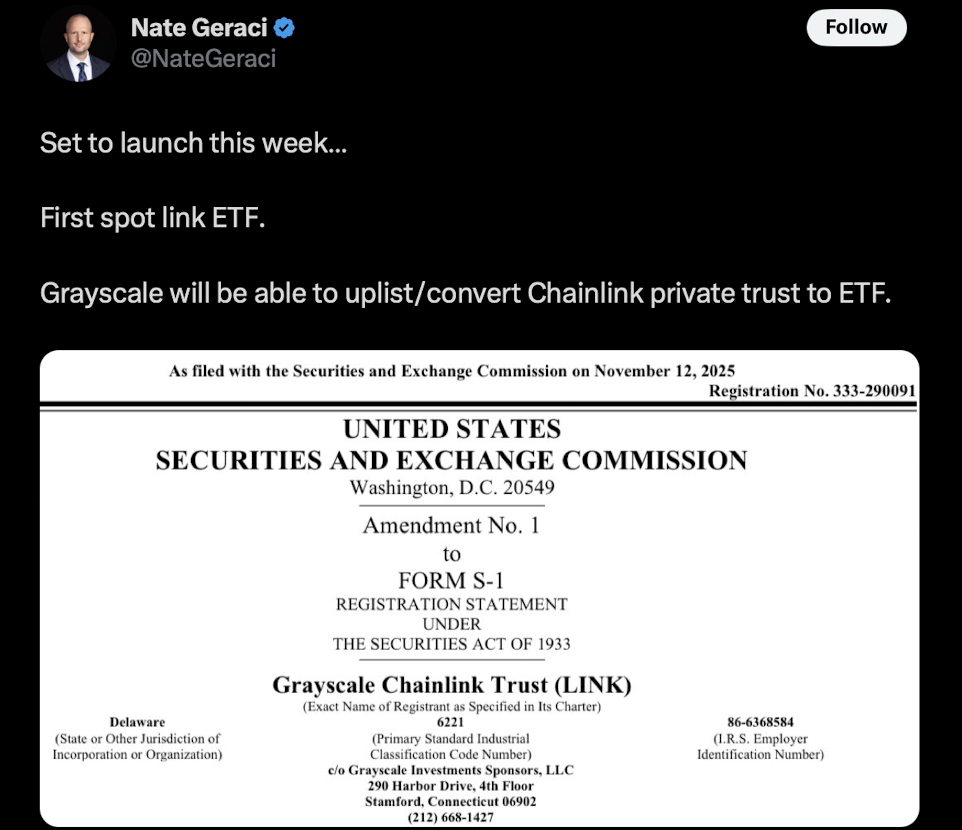

Grayscale has finally secured approval to launch the first-ever U.S. spot Chainlink ETF, ticker GLNK, and it’s set to hit NYSE Arca on December 2, 2025. The listing basically gives institutional investors a regulated doorway into Chainlink (LINK) without having to deal with private keys, cold wallets, or any of the usual crypto–handling headaches. The SEC signed off after reviewing Grayscale’s S-1 filing from late September, which formally converted the old Chainlink Trust into an ETF. It’s a move that feels overdue considering how much infrastructure Chainlink already supports across Web3 and traditional finance.

A Safer, Simpler Route for Institutions Entering Crypto

Big institutions have always been skittish about touching crypto directly — mostly because of compliance rules, custodial risks, and the fear of waking up to headlines about “misplaced wallet keys.” GLNK solves that problem by wrapping LINK exposure inside a structure they already understand. Traditional liquidity, transparency, public reporting… all the familiar stuff. According to CryptoRank, this lets major asset managers participate in the tokenized economy in a way that fits neatly into existing frameworks, without needing to manage messy multi-chain setups or self-custody logistics. It’s crypto, but with training wheels — and that’s exactly what institutions want.

Staking Inside the ETF Adds a Twist — and Some Friction

One of the things making GLNK stand out is the staking feature baked directly into the ETF. That means the fund can actually generate yield from LINK holdings, which is a pretty big deal for long-term portfolios hungry for extra return in low-interest environments. But of course, this comes with its own regulatory tension. The SEC is still figuring out where staking fits inside investment products, and Grayscale pushing ahead sets this ETF apart from Bitwise’s CLNK, which launched earlier on the DTCC registry but without staking. GLNK’s structure is a little more daring — and a little more complicated.

Chainlink’s Expanding Role in Tokenized Finance

Chainlink’s entire reason for existing is to act as the data bridge for smart contracts — providing off-chain information to on-chain systems in a secure, decentralized way. That function has become essential for everything from financial instruments to supply chains and tokenized asset platforms. Partnerships with firms like S&P Global and FTSE Russell have boosted Chainlink’s credibility with traditional finance, and Grayscale researchers Zach Pandl and Michael Zhao even described LINK as the largest crypto asset that isn’t a Layer-1. Its importance keeps growing as more institutions experiment with blockchain infrastructure.

Chainlink’s CCIP (Cross-Chain Interoperability Protocol) is also gaining momentum across Asia and in private corporate networks like World Liberty Financial. These integrations help connect fragmented networks, letting tokens and data move more easily across them — something enterprises have been wanting for years.

More ETF Launches Signal Grayscale’s Bigger Push

GLNK is actually Grayscale’s third new listing in just two weeks, following fresh ETFs tied to XRP and Dogecoin. It’s clear the company is rolling out a broader strategy: give institutions regulated access to decentralized infrastructure, layer by layer. Meanwhile, interest in Chainlink itself has been climbing. CaliberCos recently became one of the first U.S. companies to hold LINK in its corporate treasury — and earn staking rewards on it, which is pretty telling.

As tokenized finance grows and more traditional markets start tapping blockchain rails, the Chainlink ETF could open the door for a wave of similar products focused on decentralized networks used in settlement, compliance, identity, and next-gen securities. Here is where institutions may finally start dipping more than just a toe into crypto’s infrastructure layer.