- Arthur Hayes warns Tether’s growing exposure to Bitcoin and gold could create liquidity risk during a sharp market drop.

- Analysts argue Tether is financially stronger than critics claim, with $181B in assets and nearly $10B in annual profit.

- Tether operates more like a fractional-reserve system, but with far higher liquidity ratios than traditional banks.

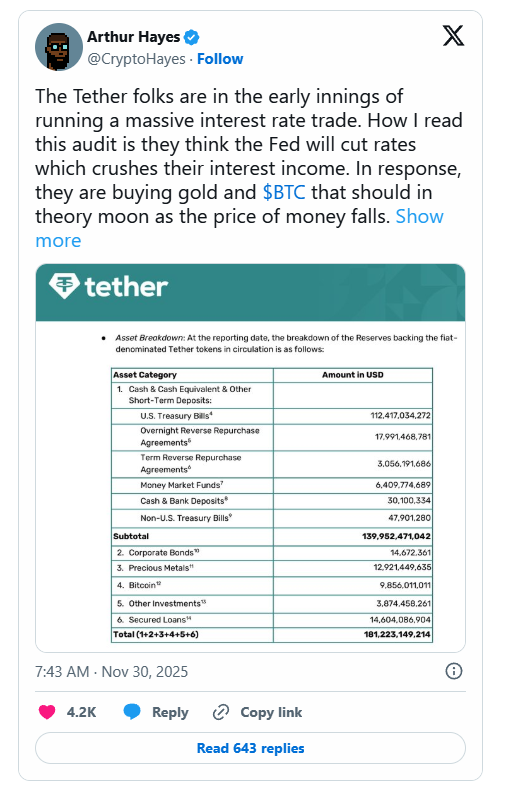

BitMEX co-founder Arthur Hayes stirred up a fresh wave of worry this week after claiming that Tether — the world’s biggest stablecoin issuer — is taking on serious risk during the coming Federal Reserve rate-cut cycle. He pointed to Tether’s growing exposure to Bitcoin and gold, arguing that a sudden pullback in those assets could squeeze its liquidity and trigger fear around USDT’s backing. But the crypto community, analysts, and even former Wall Street researchers pushed back fast, saying Tether is not only solvent, but probably stronger than most banks operating today.

Hayes Raises the Red Flag on Tether’s Reserves

Hayes claims the shift in Tether’s latest report is the real danger: instead of keeping everything in cash-like reserves, the company has been leaning further into BTC, gold, and other investments. Tether holds around $181 billion in total assets, with $174 billion in liabilities — solvent on paper, but not 100% liquid at any given moment. According to Hayes, if Bitcoin or gold suddenly tanked, that could drag down Tether’s equity cushion and spark panic selling. S&P Global echoed something similar earlier this year, slapping Tether with a “weak” stability rating partly because its reserve mix isn’t purely defensive.

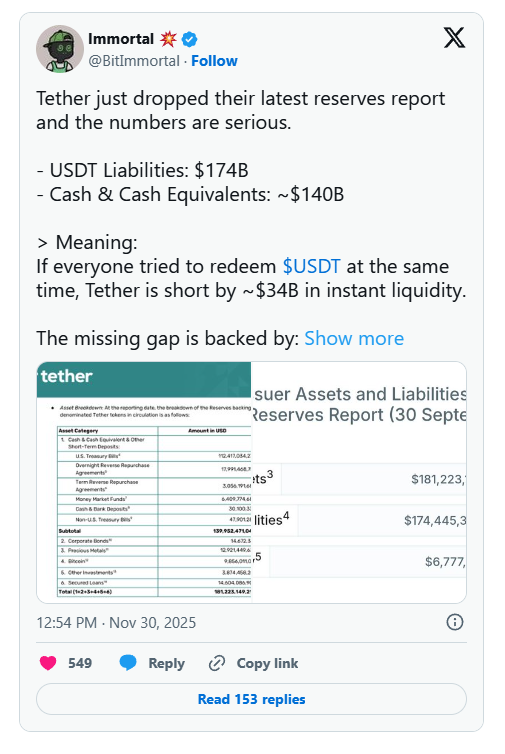

Tether, for its part, brushed off the S&P framework as outdated and pointed to its enormous daily settlement flows as proof that the system works. Analyst BitImmortal broke the reserves down even further: $140 billion is fully liquid (cash and equivalents), but roughly $34 billion sits in Bitcoin, gold, secured loans, and other mixed investments. Structurally, that looks more like a fractional-reserve model — the same model banks use — rather than a fully liquid vault. Everything functions smoothly when redemptions are normal, but an extreme panic could put stress on how quickly Tether can unwind the non-cash chunk.

Analysts Argue Tether Is Stronger Than Critics Think

Former Citi Research crypto lead Joseph stepped in to counter Hayes, saying the reserve report isn’t even the full picture. He explained that the disclosure only covers the matched reserves for USDT, not Tether’s complete corporate balance sheet. The company also holds separate equity — including mining operations, private investments, and possibly more BTC — which doesn’t appear in the same filing but still contributes to the company’s financial safety net.

Joseph also argued that Tether is insanely profitable. With over $120 billion in Treasuries earning around 4% since 2023, and almost no operational overhead, Tether is generating close to $10 billion per year in profit. That puts its equity valuation deep into the tens of billions, meaning Tether has far more flexibility than critics assume. In a liquidity crunch, selling equity or tapping corporate reserves could solve the problem long before USDT holders feel any shock.

A Liquidity Debate, Not a Solvency One

Joseph finished by comparing Tether to the traditional banking system: banks typically hold only 5–15% of deposits in liquid reserves, far less than Tether’s ratio. The difference, he said, is that banks have a central-bank backstop, while Tether doesn’t. That lack of a lender of last resort doesn’t automatically mean instability — it simply means Tether has to manage its structure differently. And so far, it has done that while expanding supply, increasing buffers, and staying massively profitable.

The bottom line? Hayes is warning about liquidity speed, not whether Tether is actually underwater. Analysts believe Tether is far stronger than the fear narrative suggests — but the debate over how “safe” a stablecoin truly can be isn’t going away anytime soon.