- Bitcoin briefly dipped under $91K as whales entered a rare “freeze phase,” avoiding both buying and selling after weeks of losses.

- Institutions are quietly accumulating BTC in small batches while major resistance zones sit at $93K–$96K and $100K–$108K.

- Whale activity around $84K–$85K suggests bottom formation as market volatility collapses heading into December.

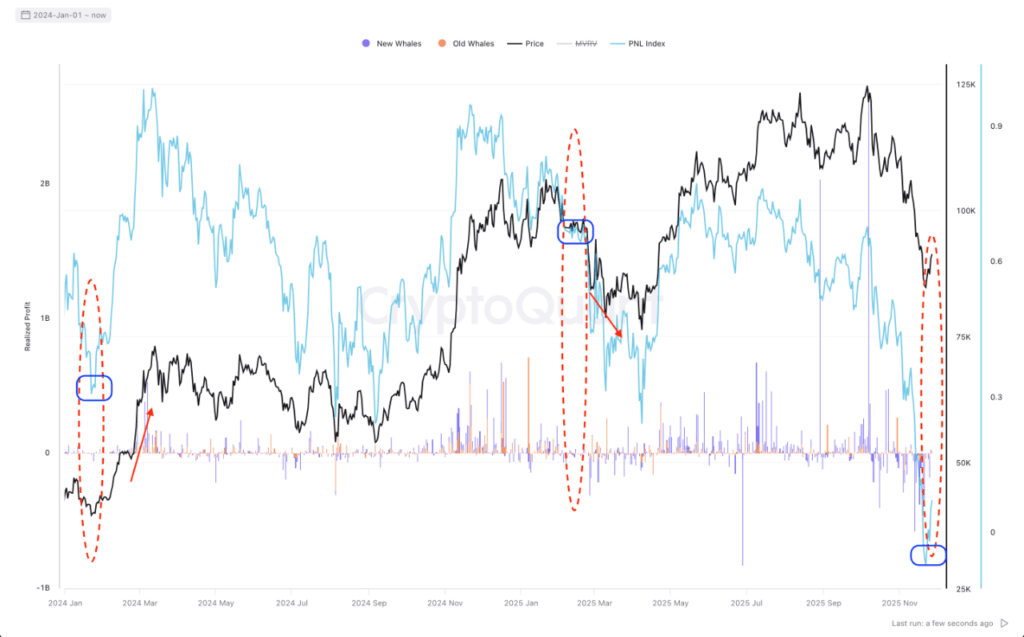

Bitcoin slid under $91,000 for a moment before clawing back toward $91,500, but the bigger story isn’t the dip itself—it’s the eerie stillness among whales. On-chain analysts at CryptoQuant say major holders have taken sizable losses in recent weeks, yet they aren’t selling or buying right now. That kind of inactivity usually shows up right before a market bottom starts brewing. BTC is still down around 18% for the month, but the quiet behavior from big players feels more like hesitation than panic, almost like they’re waiting for someone else to make the first move.

Institutions Are Accumulating, But Slowly

Fund-flow data shows that institutions are buying, just not aggressively. They’re picking up BTC in small, careful batches—accumulation without conviction, at least not yet. Even so, Bitcoin’s market cap staying above $1.8 trillion suggests someone big is quietly absorbing supply and forming a potential floor. The next trouble zones are stacked between $93K–$96K and $100K–$108K, according to Glassnode heatmaps. Those ranges are crowded with traders who have historically pushed back on rallies and sell-offs, creating thick resistance bands that BTC has struggled to break cleanly.

Whale Activity Hints at Deep Bottom Formation

Analyst Murphy pointed out a massive cluster—nearly 950,000 BTC—sitting in the $84K–$85K region. After accounting for Coinbase’s internal transfer spike, about 400,000 BTC of that appears to be real turnover, likely from major players stepping in during the drop. That kind of quiet but heavy accumulation is usually a bottom-building sign, even if the headlines don’t make it look bullish. While whales aren’t active right now, their earlier buys near the lows show they weren’t ignoring the volatility; they were catching discounted supply.

Market Tightens Heading Into December

Matrixport notes that volatility has fallen off a cliff and sentiment is looking bruised, but BTC is still trading beneath historical ceiling levels—levels it has struggled to reclaim in prior cycles.

The market structure is getting tighter: selling pressure is fading, institutional nibbling is growing, and whales are in a holding pattern. It feels like the market is waiting for a spark—a macro trigger, ETF flows, or even a liquidity squeeze—to decide whether the next move is another leg down or the start of a new rally.