- Pump.fun has transferred $480M in USDC to Kraken since November 15, including another $75M on November 27, reigniting fears of treasury dumping.

- PUMP has plunged nearly 40% this month as insider allocations, lawsuits, and large treasury movements continue to erode market confidence.

- Analysts expect further weakness into December, citing extreme volatility and an Extreme Fear sentiment score of 15.

Pump.fun sent yet another huge batch of USDC—about $75 million—over to Kraken on November 27, continuing a string of oversized transactions that’s been freaking out the community for almost two weeks. Blockchain sleuth EmberCN reported that total transfers have now hit roughly $480 million since November 15, all sourced from the project’s original ICO treasury. And just like the earlier movements, this one followed the same odd pattern: once the funds reached Kraken, nearly the same amount flowed out toward Circle. It’s not the first time this sequence happened either—on November 24, $405 million moved in, and around $466 million quickly went out, which sparked chatter about USDC redemptions.

Team Denies Dumping Allegations

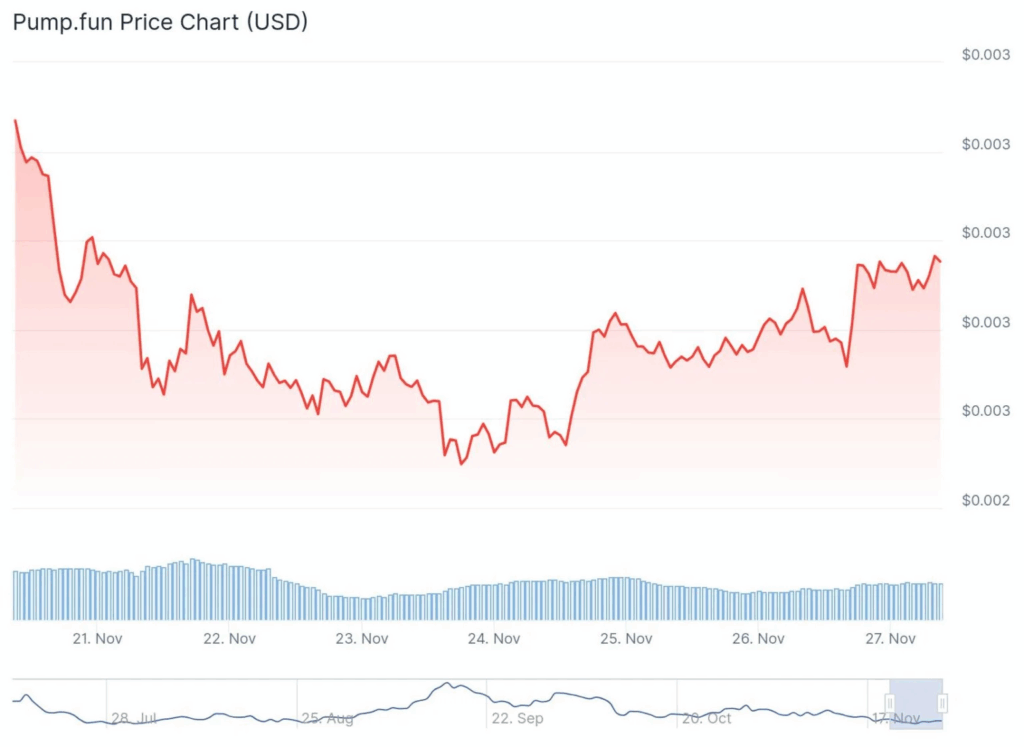

Co-founder Sapijiju pushed back against the rumors, saying the team isn’t dumping tokens or cashing out, and instead described the transfers as “routine treasury management.” He emphasized that Pump.fun has never worked directly with Circle and that the treasury is simply reorganizing ICO funds across wallets for operations and future development. Still, the timing and scale of these transfers have left traders uneasy, especially as PUMP has cratered nearly 40% in the last month and sits around $0.00294, far below its August peak near $0.009.

Token Distribution and Revenues Draw Criticism

Pump.fun has taken heat for its token structure since launch. The private round handed 18% of the 1 trillion PUMP supply to early investors at $0.004, raising an estimated $720 million. Analysts noted insiders and early buyers controlled more than half the supply once trading opened, which many community members argue created a lopsided and unfair market from day one. Despite generating over $910 million in revenue since launch, monthly income has slipped sharply—from $136 million at peak to about $38 million recently. The platform also sold around $757 million worth of SOL tokens between May 2024 and August 2025, adding to concerns that treasury actions, paired with insider allocations, may have weighed heavily on price performance.

Legal Pressure and Market Sentiment Darken Outlook

Pump.fun is also dealing with class-action lawsuits in New York, accusing the team of unregistered token sales and misleading profit expectations. The legal cloud, combined with massive ongoing treasury movements, has fueled an extremely bearish mood.

Analysts from Coincodex project more downside into December, flagging PUMP’s volatility and an “Extreme Fear” score of 15 on the Fear & Greed Index. Even the September launch of Project Ascend—meant to improve fee structures and creator incentives—hasn’t been enough to offset sentiment. And with the latest $75 million transfer tied once again to ICO wallets, traders worry volatility could worsen before it gets better.