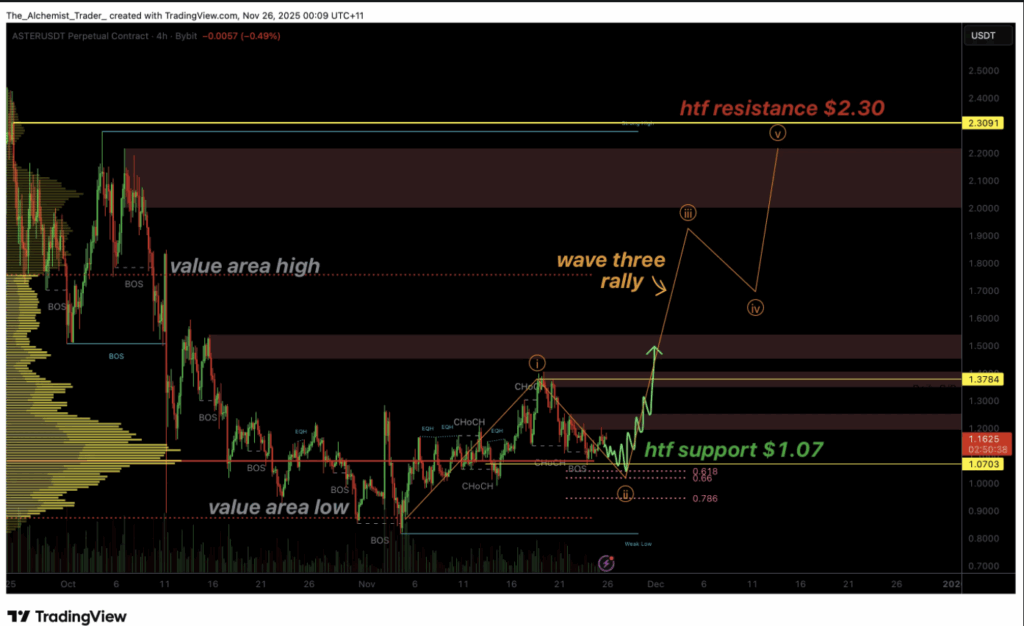

- Aster trades directly on a multi-confluence support zone involving the 0.618 Fib, POC, and daily HTF support.

- A higher low would confirm the Elliott Wave setup and open targets toward $2.30.

- Losing the current support invalidates the structure and delays any bullish continuation.

Aster’s price has slid right into one of its most important support zones, and the market’s starting to show the first hints that something bigger might be forming beneath the surface. Selling pressure has slowed across several time frames, and recent volume spikes around these lows suggest traders are quietly stepping back in. With broader altcoins showing early recovery signs too, the stage feels like it’s shifting — not aggressively, but you can see the change if you squint a bit.

Technical confluences stack up at the current level

Right now Aster is sitting on a support cluster that lines up the 0.618 Fibonacci retracement, the point of control, and a major daily high-time-frame support. Historically, when these three stack together, Aster tends to pivot in a big way. Toss in the fact that on-chain data recently dismissed the $35M ASTER transfer rumors tied to Changpeng Zhao — a story that had rattled some investors — and sentiment has started smoothing out again.

The first real structural shift appeared when price bounced sharply from the value-area low and pushed through the immediate market structure, forming a new swing high. This sort of move is classic “Wave 1 behavior” in Elliott Wave terms — the kind of spark that usually kicks off a larger cycle.

Higher low needed to confirm the setup

For the Elliott Wave pattern to stay valid, Aster now needs to form a higher low right inside this support range. If it does, that would confirm the Wave 2 retracement and open the door for a Wave 3 expansion — typically the strongest, most impulsive leg of the entire cycle. A Wave 3 move for Aster would target the value-area high first before stretching toward the key $2.30 resistance. That level has stopped several rallies in the past and would likely become the first big battleground if momentum accelerates.

Some analysts also pointed out that the renewed attention around Aster may reflect how influential profiles — like CZ — still shape visibility and narrative flow even when not directly involved. The spotlight alone, in moments like this, can add fuel to early structural shifts.

What to expect next as Aster tests its foundation

If Aster holds this zone and prints that higher low, a Wave-3-style breakout toward $2.30 comes into play. But if the support fails — meaning price closes decisively below it — the entire Elliott structure gets invalidated and any bullish continuation gets pushed further down the road. For now, Aster is sitting right on the edge, and the next few candles might decide whether this becomes another reset… or the start of its next expansion phase. Here is where patience pays off more than prediction.