- Cardano’s full governance decentralization and new cross-chain partnerships are reshaping long-term investor expectations.

- Technical patterns show a falling wedge that could trigger a major breakout if key levels are reclaimed.

- Long-term projections stretch into multi-dollar territory, though conservative models still keep ADA under $1.20 into 2026.

The third quarter of 2025 is starting to feel like a quiet reset for Cardano, even if the price chart doesn’t show it yet. After sliding sharply from the December 2024 peak of $1.32, the network finally completed one of its most important milestones: the Plomin hard fork. Rolled out in the first quarter of the year, this upgrade pushed Cardano into full community-driven governance, something that the project has been highlighting for years. It’s a structural shift that puts ADA firmly in the category of third-generation blockchains aiming for full decentralization.

New Partnerships Expand ADA’s Utility

Beyond governance, Cardano’s ecosystem is widening faster than expected. EMURGO finalized a major partnership with Ctrl Wallet in early July, opening interoperability with more than 2,300 blockchains. It’s a big deal because it gives ADA a clearer path into cross-chain activity, a sector dominated by projects like Polkadot and Ethereum. Institutional interest is growing too. Grayscale allocated 20 percent of one of its crypto funds to ADA, and Bloomberg Intelligence recently raised the odds of a spot ADA ETF approval. Nothing is guaranteed there yet, but the momentum matters. Meanwhile, the gradual rollout of the Midnight privacy sidechain and new Bitcoin-linked DeFi tools bring fresh functionality to a network that’s often criticized for slow development.

Technical Correction Setting Up a Potential Breakout

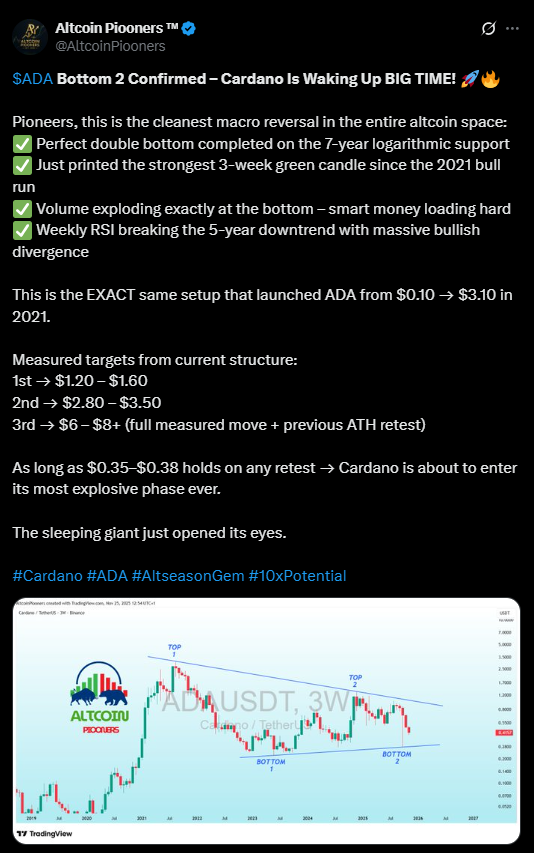

On the weekly chart, ADA has been forming a falling wedge since January 2025, a pattern known for producing strong upside reversals. Price is now testing the $0.40 zone after dropping below the psychological $0.50 level in November. Analysts see a stronger demand area between $0.27 and $0.30, and a retest later in 2025 could form the base of a larger breakout. If ADA manages to close above $1.10 on the monthly chart, the technical projection points toward a move toward $2.20 sometime in the first half of 2026. AI models collected in October show ADA drifting between $0.65 and $1.50, with an average around $1.00. Short-term sentiment is still bearish, but oversold weekly indicators and rising accumulation around $0.35 to $0.45 hint at the early stages of a bottoming process.

Long-Term Path Through 2030 and Beyond

Looking out to 2026–2030, long-term models paint a gradually bullish landscape. Price targets climb to $3.25 in 2026, $5 in 2027, and potentially $10.25 by 2030. Hitting that would put ADA above a $360 billion market cap, pushing it into the top three cryptocurrencies. This scenario assumes significant institutional adoption, a healthy global bull cycle, and major DeFi growth inside the Cardano ecosystem. More extreme forecasts stretch into the $69 range by 2040 or even $329 by 2050, but those numbers drift heavily into speculative territory. By comparison, Changelly, CoinCodex, and Binance offer much more conservative expectations, keeping ADA between $0.79 and $1.18 through 2025–2030 as macro pressure and competition from other layer-1s remain serious factors.