- The Canary Litecoin ETF has recorded five straight days of zero inflows, highlighting a major lack of investor interest since launch.

- Litecoin’s biggest corporate holder, Lite Strategy, is sitting on over $20M in unrealized losses, mirroring the weak institutional demand.

- While new ETF filings from Grayscale, CoinShares, and REX-Osprey could revive interest, the current stagnation shows Litecoin is losing ground to XRP and Solana in this cycle.

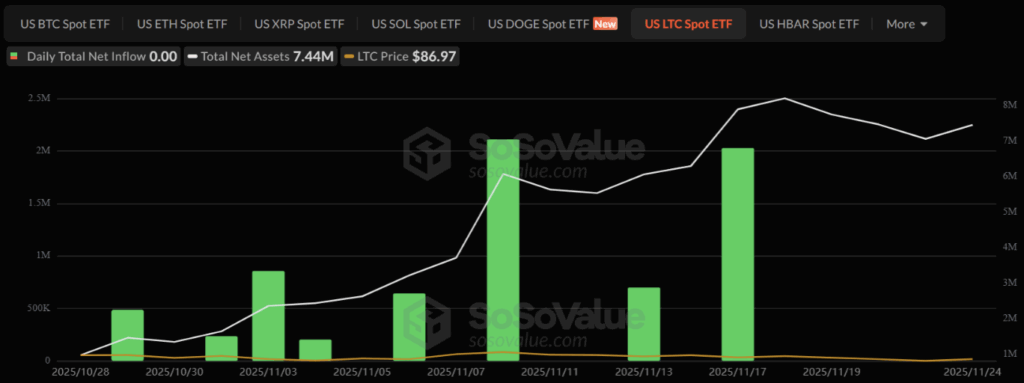

Litecoin’s only U.S. spot ETF is barely moving the needle right now, and honestly, the numbers look rough. The Canary Litecoin ETF hasn’t pulled in a single dollar of net inflow for five straight trading days, basically sitting still since its October 2025 launch. Compared with the avalanche of money pouring into newer XRP and Solana funds, this one looks like it’s stuck in neutral… maybe even rolling backwards a bit.

The ETF’s stats tell the story pretty clearly. As of Nov. 25, LTCC is holding just $7.44 million in net assets and has collected only $7.26 million in net inflows since day one. Daily trading value is also thin, barely scraping $747,600. With LTC trading around $84.94 — way down from earlier highs — it’s no surprise investors haven’t rushed toward institutional Litecoin products.

Meanwhile, other crypto ETFs are exploding with demand. XRP ETFs hit $164 million in a single day, and both XRP and Solana funds have crossed half a billion dollars in net inflows without logging a single outflow yet. The contrast is pretty brutal, and it’s becoming clearer that sentiment around Litecoin has cooled dramatically while capital moves toward trendier assets.

The Corporate Picture Isn’t Pretty Either

Litecoin’s biggest corporate holder isn’t having a great time, either. Lite Strategy (formerly MEI Pharma) owns 929,548 LTC — a big slice of the supply — worth about $79 million now. Problem is, they paid $100 million for that bag.

That’s a $20.67 million unrealized loss. More than 20% underwater.

The company remade itself into a crypto treasury play, even bringing Litecoin creator Charlie Lee onto the board. But unless LTC turns itself around, the pivot hasn’t paid off. Lite Strategy’s stock is sitting at $1.83 with a market cap lower than its Litecoin stash, which is… kinda wild.

Could New ETFs Actually Turn Things Around?

Some investors are hoping that more competition in the Litecoin ETF market might breathe life into demand. And yes, a few new players are waiting on approval — Grayscale, CoinShares, and REX-Osprey all have Litecoin ETFs in the pipeline.

Grayscale alone manages over $160 million in its existing Litecoin Trust, so a conversion to a spot ETF could add real legitimacy. CoinShares brings even more traditional-investor reach. More ETF options usually mean more liquidity and better price efficiency.

But there’s a catch: none of that guarantees people will actually want Litecoin exposure. Canary’s zero-inflow streak hints that institutional demand just isn’t there yet.

Mixed Sentiment: Bulls Dream Big, Institutions Shrug

Despite the weak ETF performance and heavy corporate losses, some traders still see a big upside. A few technical analysts continue projecting four-digit Litecoin targets — $1,000 or even $2,000 — based on old Elliott Wave logic and long-term cycle patterns.

That optimism contrasts sharply with the reality in front of us: slow ETF growth, waning institutional confidence, and big holders struggling with losses. Litecoin sits in a strange spot — loyal community, steady network usage, but fighting for relevance in a market full of faster, flashier, and more liquid assets.

For now, the Canary ETF’s flatline reflects the market’s priorities. Investors are choosing Solana for speed, XRP for settlement, and Bitcoin for safety. Litecoin… hasn’t found its narrative this cycle. Maybe that changes if the new ETFs launch successfully, but for now, the demand just isn’t there.