- LINK is down 55% from its April high, but institutional signals — including Grayscale’s praise and ETF buzz — hint at a possible major reversal.

- Exchange reserves just hit a two-year low, showing investors pulling LINK off centralized platforms and reducing sell pressure.

- Whale wallets, however, dumped 31M LINK recently, creating mixed sentiment and raising questions about what big holders might be anticipating.

Chainlink has been on a rough slide lately, the kind that makes long-time holders stare at the chart a little too long. After touching almost $30 back in April, LINK has shed around 55% of its value, drifting lower month after month. But the funny thing is… several signs are starting to stack up that maybe, just maybe, this drop is running out of steam—and the next move could actually be up, not down.

It almost feels like the market forgot what Chainlink actually is. And then Grayscale showed up to remind everyone.

Grayscale Lights the Spark Again

Just a few days ago, Grayscale called Chainlink “the critical connective tissue between crypto and traditional finance,” which—coming from the biggest digital asset manager—carries some weight. Instead of just labeling it an oracle network, Grayscale said Chainlink is really more like modular middleware, giving on-chain systems a safe way to tap into off-chain data, talk to other chains, and meet compliance rules without breaking everything.

They even went as far as calling LINK “the largest asset in the Utilities & Services Crypto Sector,” which, yeah, is the kind of language that tends to wake up institutions.

And here’s the kicker: this isn’t the first time Grayscale has pumped the tires of a project and something crazy happened right after. In early October, they praised Zcash and reopened their Zcash Trust to accredited investors. Within weeks, ZEC exploded—up more than 600%—and suddenly everyone was Googling whether they missed the bottom.

Does that mean LINK will repeat the same pattern? Not guaranteed, but the setup rhymes.

A LINK Spot ETF? That’s Where Things Get Interesting

The potential catalyst sitting in the background is the rumored launch of America’s first spot LINK ETF. Think of it like this: investors get exposure to LINK without touching private keys, cold wallets, or anything remotely complicated. And that kind of “easy button” usually brings in big money that avoids holding raw assets.

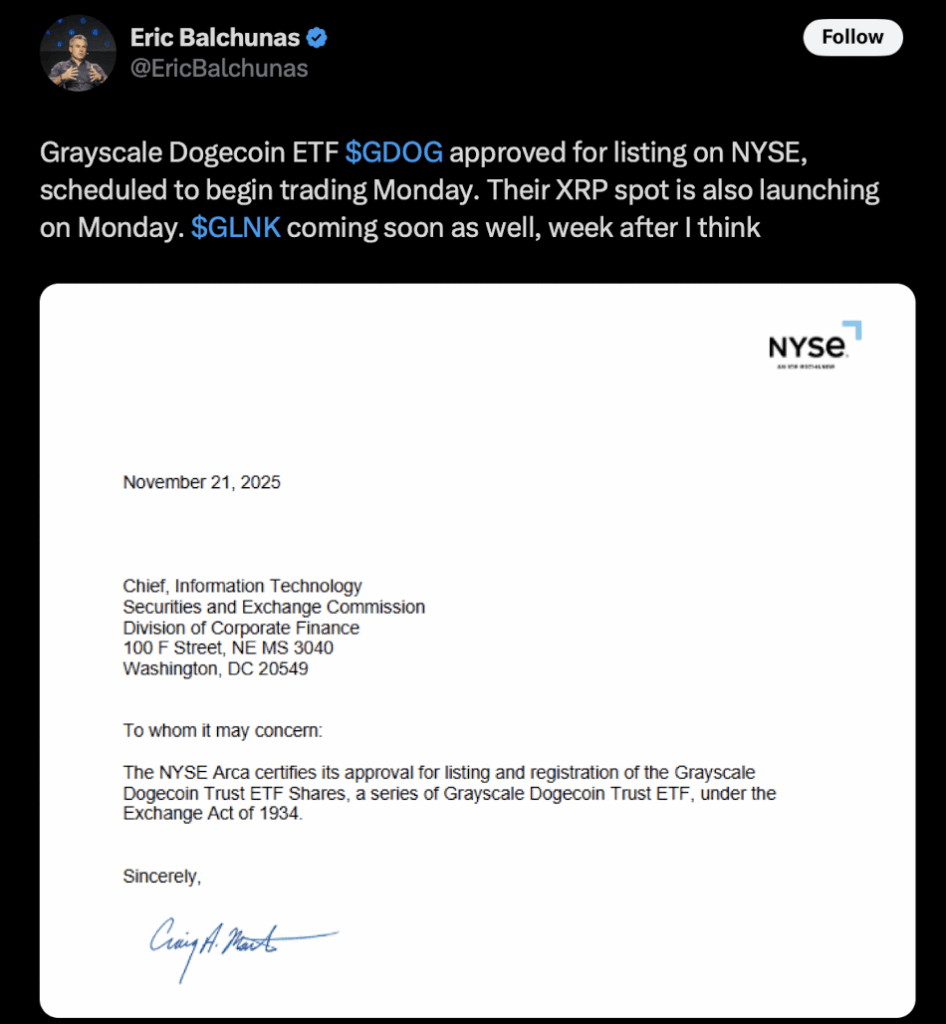

Bloomberg analyst Eric Balchunas even suggested this ETF could land before the end of November, which—if true—lines up almost too neatly with the timing of Grayscale’s recent messaging.

But traders, as always, should stay aware of the classic trap: the sell-the-news moment. Just look at what happened with the first spot XRP ETF. Canary Capital launched it, the hype exploded, and then XRP immediately tanked. Not all of that drop was caused by the ETF itself, but the pattern is familiar enough to keep in mind.

Exchange Reserves Hit a Two-Year Low

Another major piece of the puzzle dropped today: LINK reserves on centralized exchanges sank to 128.4 million tokens, the lowest level since mid-2022. Usually that means one thing—investors are pulling their coins off exchanges, opting for self-custody. And when tokens leave exchanges, selling pressure drops too. Less supply = less panic selling. Sometimes it precedes reversals.

So far so bullish, right?

Well… not everything is green.

Whales Are Dumping — And That’s the Part Nobody Likes

Even though many metrics point toward recovery, whale behavior tells a slightly different story. Ali Martinez reported that large holders have sold or shuffled around over 31 million LINK in just three weeks. That’s nearly $400 millionworth of supply suddenly on the move.

Their collective holdings dropped to 158.5 million LINK—around 22% of the circulating supply. When whales dump that aggressively, two things usually happen:

- Smaller traders panic and follow.

- People wonder what the whales know that the rest of us don’t.

And both outcomes can suppress price action, even if underlying fundamentals look strong.