- Analysts argue centralized exchanges are becoming “average at everything,” while small teams on Solana build focused on-chain tools for trading, transfers, and capital access that could eventually feel smoother than CEXs.

- Vibhu suggests Solana itself could act as a long-term “exchange layer,” with banks and fintechs like SoFi funneling users straight into SPL-USDC and wallets like Meridian or Solflare instead of classic exchange dashboards.

- Rising Bitcoin outflows from exchanges and growing interest in self-custody support the shift toward on-chain systems, though some still believe simple, familiar exchange UIs will keep CEXs relevant for mainstream retail users.

Solana news stirred up a whole new debate this week after fresh comments suggested that centralized crypto exchanges could slowly fade over the next decade. The idea isn’t brand-new, but the way analysts framed it this time—mixing retail habits, Bitcoin liquidity shifts, and the rise of onchain tools—set off a deeper conversation than usual.

Exchanges Under Pressure as Onchain Teams Build Faster, Simpler Tools

The conversation kicked off when analyst Vibhu argued that exchanges today try to do everything but don’t really excel at any single piece. He described them as platforms that bundle every part of the trading stack—funding, swaps, interfaces, custody—but deliver something just “okay” across the board.

Meanwhile, much smaller teams are building hyper-focused onchain tools that target only one thing: trading, capital movement, or simplified transfers.

Because these teams commit to one purpose instead of ten, Vibhu says they move faster, innovate quicker, and produce cleaner user experiences. Once these tools mature, he believes users will naturally piece them together, getting a smoother flow than what exchanges provide today.

One chart he posted summarized the idea bluntly: exchanges are basically stitched-together middlemen, and the next generation doesn’t need them as much.

Still, another analyst pushed back, arguing retail users simply prefer something familiar. “People like simple UIs,” he said. Even if onchain tools are technically better, he believes exchanges will always serve as the starting point for beginners and casual users. And exchanges can still list new onchain products, keeping them useful rather than obsolete.

Solana Positioned as a Long-Term “Exchange Layer”

Vibhu took it a step further and pointed at Solana itself as a future exchange-like base layer.

Thanks to its speed and near-zero fees, he said Solana could eventually replace the need for a full centralized exchange. He explained that a user could move money from Cash App, Revolut, SoFi, or even Fidelity straight into SPL-USDC. From there, users can send it into any Solana wallet and start trading or exploring DeFi without ever touching a traditional exchange.

Apps like Meridian and Solflare already support this type of direct flow, making the process feel “more normal” even for beginners.

He emphasized that banks still matter in this shift. Most people trust their checking account more than any crypto platform. If a known bank—he used SoFi as an example—lets people plug directly into Solana markets, then the chain itself starts behaving like the exchange layer.

That idea suggests a future where exchanges aren’t central hubs. Instead, the chain becomes the “home base,” and simple fiat bridges do the onboarding.

Bitcoin Outflows Add Another Layer to the Debate

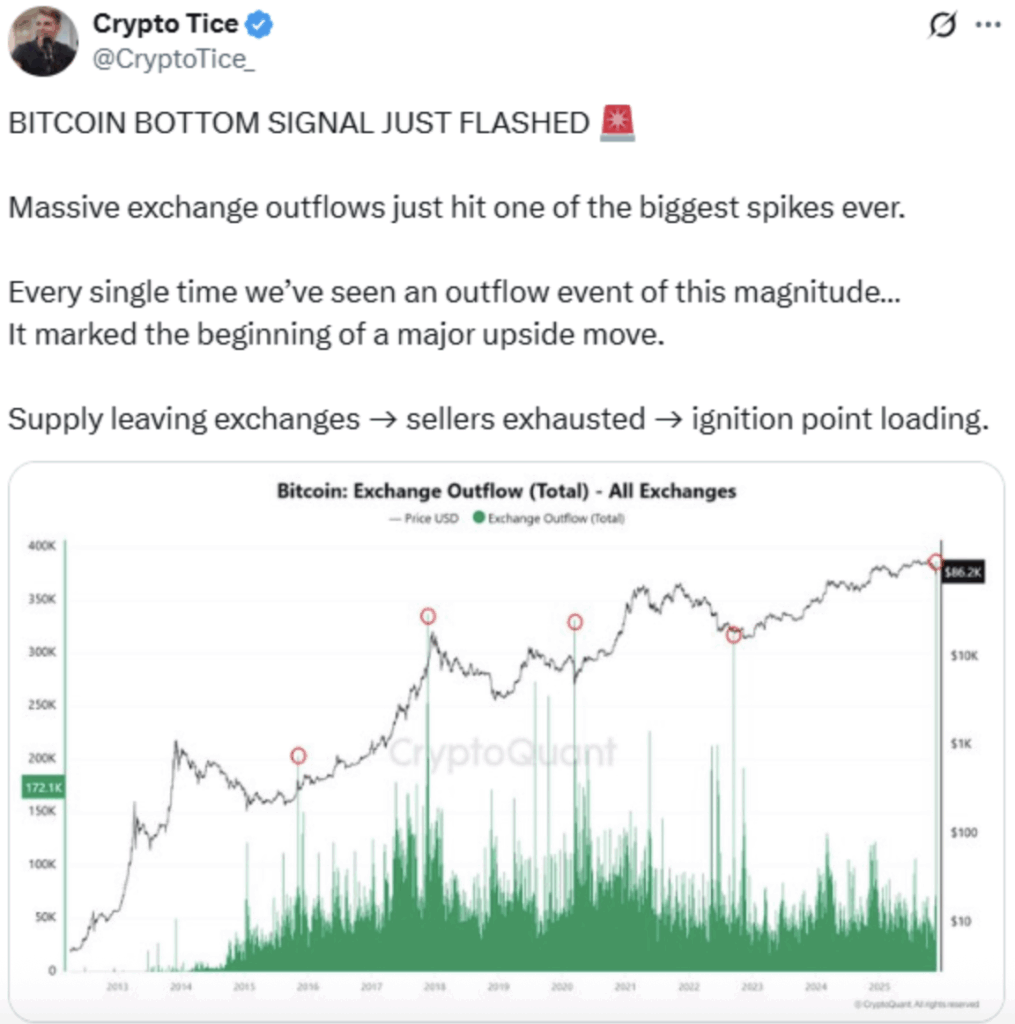

Solana news also connected to another big trend in the market: heavy Bitcoin outflows from exchanges. Analyst Crypto Tice highlighted a chart showing large BTC leaving trading platforms. Historically, similar outflows appeared near bottoms or early uptrends.

The logic is simple: coins that leave exchanges are usually not for sale. Less supply = less selling pressure.

And if large holders keep migrating toward self-custody and onchain tools, it reinforces the argument that exchange dependence is shrinking, not growing.

Some believe this is exactly why ecosystems like Solana will thrive—fast blockchains that feel like “internet-native exchanges.”

Others argue that no matter how strong onchain tools become, most users will still return to centralized platforms because they’re familiar, regulated, and don’t require people to manage their own keys.

Either way, the next decade is clearly shaping up to be a tug-of-war between onchain autonomy and traditional convenience. And right now, Solana sits right in the middle of that conversation.