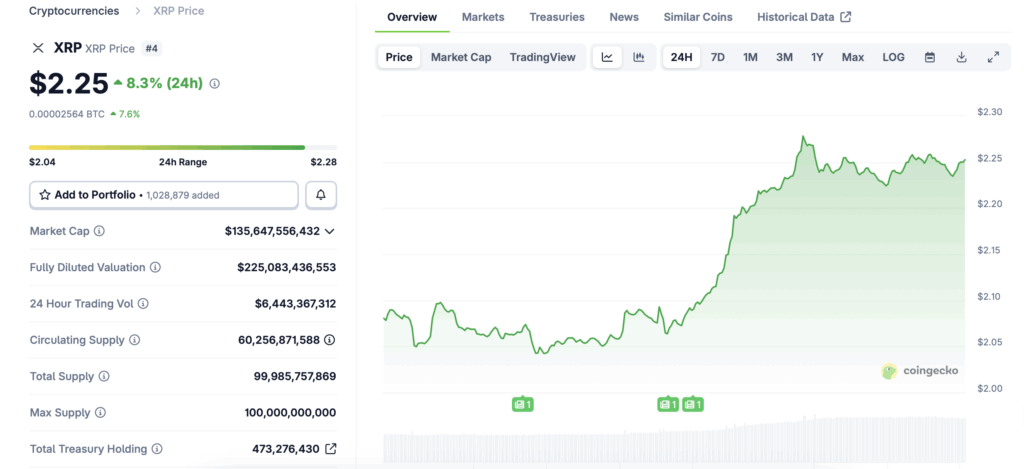

- XRP spiked over 9% to around $2.27 after Franklin Templeton and Grayscale launched spot XRP ETFs, joining Bitwise and Canary in offering regulated exposure.

- Ripple’s 2025 SEC settlement cleared long-standing legal uncertainty, opening the door for major institutions to treat XRP as a serious settlement and bridge asset.

- With rising futures open interest, multiple ETFs, and growing focus on cross-border payments and tokenized settlement, XRP is increasingly positioned as core infrastructure rather than just another altcoin.

XRP exploded nearly 10% to hit $2.27 after Franklin Templeton and Grayscale kicked off trading for their new spot XRP ETFs on Monday. The $1.69 trillion asset manager now joins Bitwise and Canary Capital in rolling out regulated XRP investment products — and they didn’t hold back, calling XRP “foundational” for global settlement rails.

For a crypto community that spent years waiting for clarity, this wave of ETFs feels like a line in the sand. With Ripple’s SEC battle finally wrapped up earlier this year, the door for institutional money is swinging wide open.

Wave of Wall Street ETFs Signals a New Phase for XRP

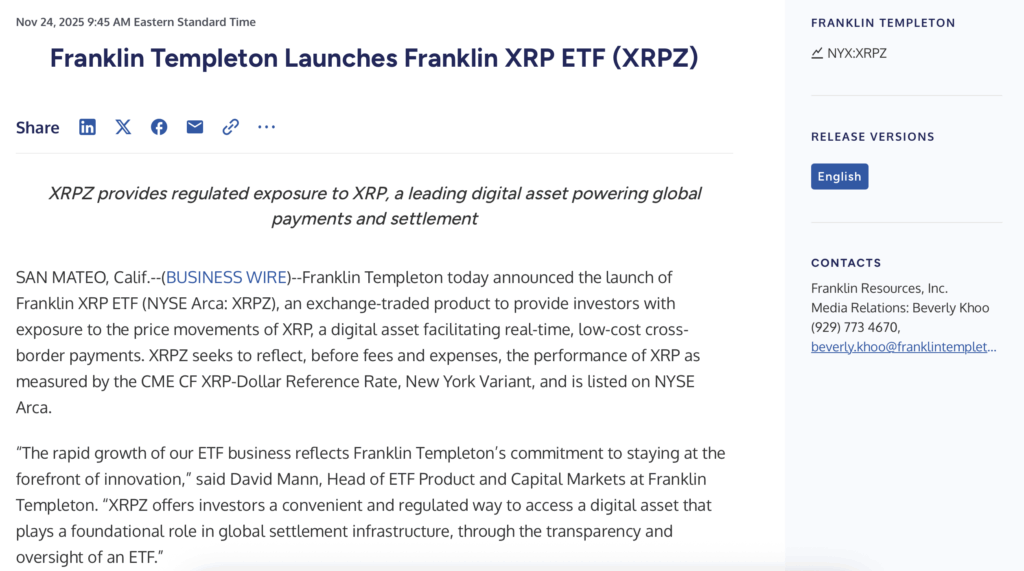

Franklin Templeton launched the Franklin XRP ETF (XRPZ) on NYSE Arca, structured as a grantor trust that tracks the CME CF XRP-Dollar Reference Rate. Coinbase Custody handles the crypto storage, and BNY Mellon oversees administration. Basically: a clean, regulated wrapper for investors who don’t want to touch the asset directly.

“XRPZ gives investors a regulated way to tap into a digital asset that’s playing a critical role in global settlement infrastructure,” said David Mann from Franklin Templeton.

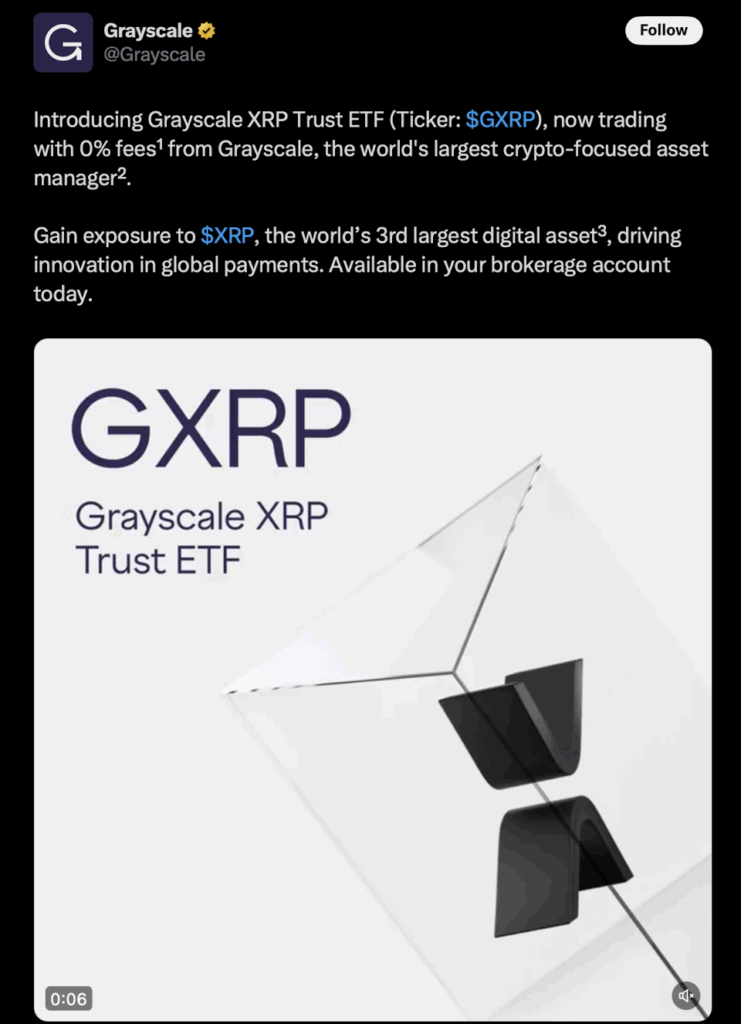

Grayscale stepped in with its own product, GXRP, offering a zero-fee launch period — a bold move that’s already catching attention.

Bitwise got there first, dropping its spot XRP ETF a week earlier and pulling in $100 million right out the gate. Several ETF launches back-to-back suggests these firms were waiting for one thing: regulatory green lights.

Ripple’s Settlement Finally Clears the Path

Ripple’s $125 million settlement with the SEC in May 2025 removed the final cloud hanging over XRP. The deal resolved all claims without Ripple admitting wrongdoing. The SEC confirmed that $50 million was paid directly, and the rest released from escrow — enough clarity for Wall Street to move without hesitation.

Franklin Templeton’s entry is the biggest credibility stamp so far. With their size, oversight, and custodians, the institutional world now has a fully compliant way to get exposure to XRP — something that was impossible just a year ago.

Still, ETF filings warn about volatility, regulatory unknowns outside the U.S., and the fact that these products are not diversified. You’re buying XRP, period, nothing else in the basket.

Technical Strengths Make XRP Attractive to Institutions

XRP runs on the XRP Ledger — a fast, low-fee, energy-efficient blockchain built for settlement, not speculation. XRPL handles transactions in around 3 to 5 seconds and has already processed more than 3.3 billion transfers.

Compared to Bitcoin, which mostly functions as a store of value, XRP’s infrastructure is designed for banks, fintechs, and cross-border payment corridors. That’s one of the big reasons Grayscale and Franklin Templeton keep emphasizing XRP’s role as a currency bridge.

Open interest in XRP futures has also climbed, hinting at a surge of institutional and retail participation. It’s not just ETF hype — traders are positioning for a bigger move.

Global Payment Narratives Add Fuel

Some analysts have pointed out that XRP could play a role in emerging payment corridors — especially across Asia, Africa, and the Middle East.

Black Swan Capitalist even suggested China has indirect exposure to XRP via the BRICS New Development Bank and major Japanese fintech SBI Holdings. While China isn’t adopting XRP directly, geopolitical interest in cross-border digital settlement keeps creeping into the conversation.

BRICS recommendations from April 2025 included calls to support new digital payment systems. They didn’t mention XRP explicitly, but the overlap with XRP’s use case is hard to ignore.

Meanwhile, the European Central Bank continues exploring cross-border digital payments, discussing “Project Nexus” earlier this year, which aims to link fragmented regional systems.

All these threads — from Wall Street ETFs to global settlement initiatives — point in the same direction: XRP is becoming increasingly relevant in the world’s shift toward faster, interoperable money.